How to build a safety net for your stock portfolio

Post on: 26 Апрель, 2015 No Comment

By Matt Krantz, USA TODAY

You don’t plan for your house to burn down, but you have homeowners insurance. And you carry auto insurance, even if you’re a safe driver. But if you’re like most investors, your portfolio is completely exposed to peril.

Now, investors are beginning to wonder if they need to protect their portfolios just as they safeguard their other assets. After suffering two vicious market declines during the past 10 years, the idea of sitting idly by as stocks fall 20%, 30%, 40% or more again isn’t easy to tolerate.

Finding ways to protect a portfolio has been a hot topic with investors, says Brian Overby, options analyst at online brokerage TradeKing. Right now is when investors should be looking.

That might seem especially appropriate considering stocks are in the September-October stretch, historically two of the market’s worst months.

If you’re an investor and wish to stay in the market, but don’t want to see your financial house burn down, there are several strategies you might consider, listed in order of sophistication:

Diversification

The easiest way to protect yourself is owning different assets that don’t move in lockstep. Start by reducing your exposure to stocks and increasing your bond holdings, an easy and quick way to reduce downside risk, says Bryan Olson of Charles Schwab .

If you’d like to do more, consider adding some international stocks, bonds and real-estate investment trust stocks. That would spread your risk and reduce anxiety during downturns in any one sector, he says.

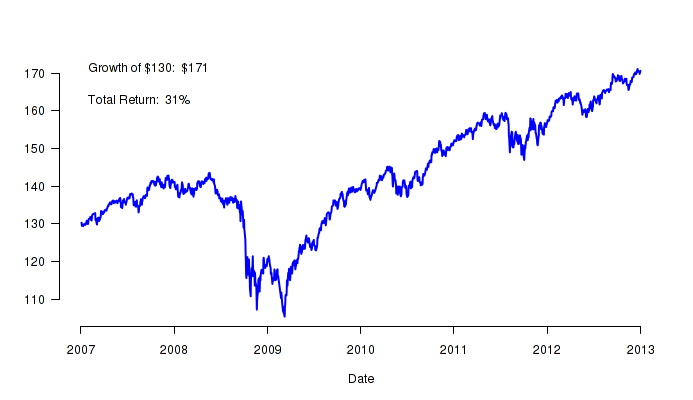

A portfolio 30% in bonds, 14% in international stocks, 7% in real-estate and 7% in emerging markets stocks, and the balance in U.S. stocks, generated long-term returns almost identical to the Standard & Poor’s 500 index with 21% less risk, says Index Funds Advisors.

Stop limit orders

Most brokerages let you set parameters for buying and selling stocks that, if used correctly, can help protect your portfolio. One of the best options for investors is called a stop limit order. With a stop limit order, you tell your brokerage to sell a stock once it falls to a certain level. For instance, you might stipulate to sell the stock if it falls more than 10% below what you paid for it.

Investors should consider setting a stop limit at each stocks’ average price for the previous 200 days, also known as the 200-day moving average, says Ken Winans of Winans International. When stocks fall below that average, it often signals even more pain to come. You can get the 200-day moving average of nearly every stock in the stock quote pages at USATODAY.com.

Protective puts

If you’re looking for something that’s more like traditional insurance, you’ll need to delve a bit into the world of financial derivatives, including options. A type of option, called a protective put, acts very much like insurance that you’d have on your car or house.

Imagine you have 100 shares of an exchange traded fund that mirrors the S&P 500 and currently trades for $106. To protect yourself from a drop, you can buy a put option that gives you the right to sell the ETF at a set price that’s below the current stock price. For instance, you could buy a put letting you sell that ETF for $100 a share anytime before the contract expires in October. Even if the ETF fell to $75, you could still get $100.

As with any insurance, there’s a cost. You would pay the current price of the option, which, for example, is $2.23. So you’d pay $2.23 per share or $223 for the insurance protection on the 100 shares of the ETF. Then add another roughly $5 for the commission to buy the put. Still, if that ETF fell to $75 a share, paying $228 for a put would cut your loss on the 100 shares to $600 plus the cost of the option, rather than $3,100.

Protective puts are best for insurance for up to about 90 days, says TradeKing’s Overby. Any longer than that and puts alone are too expensive.

Collars

If you want to protect your portfolio for longer than 90 days, you’ll need to get more sophisticated. That’s where collars come in, which allow you to insure your stock against a loss, but in a way that cuts the cost.

With a collar you buy the protective put, but at the same time you also sell a call option. The call option requires you to sell the stock if it rises by a set amount. You give up some potential upside, but you are paid by the person who buys the call. The amount you collect from selling the call helps to pay for the protective put. Remember that a collar protects your portfolio from a crash, but you also risk losing out on upside if the stock soars.

Whether you decide to protect your portfolio with simple diversification or a more sophisticated collar, if you’re nervous it’s best to at least do something.

In sports and in military operations, there’s always an offensive and defensive strategy, Winans says. Most investors don’t have a defensive strategy. We have grown lazy as investors.

Financial markets reporter Matt Krantz answered your portfolio questions from 1-2 p.m. ET on Friday, Sept. 10.