How to Become a Investment Banker

Post on: 28 Май, 2015 No Comment

Investment Banker Roadmap

Investment Banker Job Description

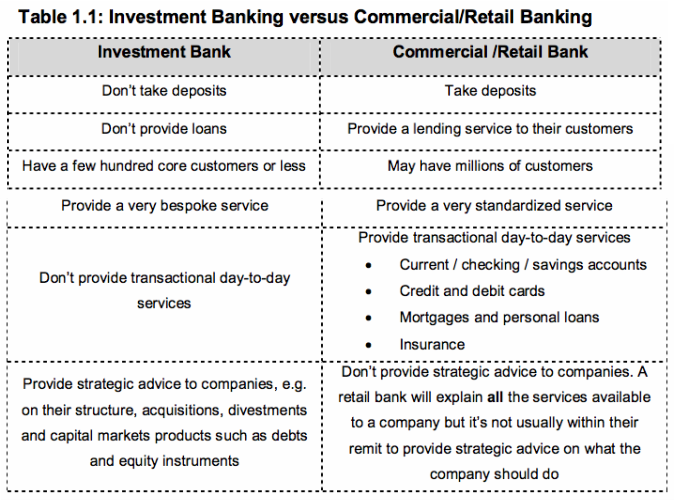

An investment banker represents a special financial institution that works with larger companies, organizations, and individuals interested in investing their money in stocks, mutual and hedge funds, bonds, assists with company mergers or acquisitions, and deal with IPOs (Initial Public Offering) for a company with a product ready to launch. Investment banks are much different from commercial banks. Their main purpose is to aid individuals and corporations in financial investments, raising capital for the budding entrepreneur or organization. Investment bankers do not receive deposits. This field is vast and multifaceted in all that you could do as an investment banker, and these are just the highlights of this profession and do not encompass all that is possible. Investment brokers connect people with a great idea with investors who are looking to make money or gain some other security out of the deal to offer a new product or service and bring it all to life. Investment bankers have many opportunities for travel, working with clients and companies all over the country, and perhaps even on the global level to pitch ideas or share investment strategies. Investment bankers may even tour other companies and facilities prior to a merger or an acquisition to determine whether the deal is beneficial for their client. You should know that while being an investment banker is rewarding and can involve travel, it does not come without paying your dues. and most investment bankers work 90-100 hours per week their first year. Investment banking can have extreme highs and lows, times where you work a great deal, and perhaps times where you are scrounging for work. Having great financial budgeting sense for your personal finances will help you through the dry times as an investment banker.

Education Requirements

Being an investment banker requires having a Masters in Business Administration. However, if youre a college graduate, you may apply to be an entry level analyst for two years to ascertain whether you would like to continue in the profession. These analysts may have to opportunity to accompany their investment banking mentor and sit in on client meetings, having the chance to observe pitches and selling ideas as the investment banker visits clients about future sales and mergers. In the United States, an advisor who provides investment banking services must be a licensed broker-dealer and subject to Securities & Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) regulation. You can see more under Certifications.

SEC Registration

As an investment banker, youll be required to register with either the Securities and Exchange Commission (SEC) or the state securities agency where you have your principle place of business. In most cases, the firm or brokerage where you go to work will guide you through the process of becoming certified and/or registered. The SEC offers a guide entitled: How To Register as an Investment Adviser. Generally, if you manage $100 million or more in client assets, youll register with the SEC, otherwise youll register with your state securities agency.

List of State Securities Divisions

Each state has its own department responsible for regulating securities. As an investment banker, you will be required to meet state regulations and register with the securities department. The links below offer the department and division for each state securities commission along with a link to their website. In addition, this list of state securities regulators also offers contact information for each department and securities division.

Investment Banker Certifications

There are many types of certifications available for investment bankers. In most cases, your employer or mentor will guide you through the exact certifications you need based on the work youll be doing and the career path youre planning. The most common certification process is through the Financial Industry Regulatory Authority (FINRA).

FINRA is the largest independent regulator for all securities firms doing business in the United States. FINRA provides qualification examinations for brokerage firms, financial branch offices, and registered securities representatives. The most common FINRA qualifications for investment bankers are:

Most positions as an investment banker require a minimum of the Series 7 qualification, in addition to education and experience requirements.

In addition to FINRA there are other certification and designations that may prove valuable in your career as an investment banker. These include:

- Certified Valuation Analyst (CVA)

- Accredited Valuation Analyst (AVA)

- Certified Forensic Financial Analyst (CFFA)

- Accredited in Business Valuation (ABV)

- Accredited Senior Appraiser (ASA)

- Accredited Member of ASA (AM)

- Certified Business Appraiser (CBA)

- Chartered Financial Analyst (CFA)

- Certified Fraud Examiner (CFE)

- Certified Merger and Acquisition Advisor (CM&AA)

- Certified Management Accountant (CMA)

- Certified Public Accountant (CPA)

- Charter Accountant (CA)

- Juris Doctor (JD)

- Certified Exit Planning Advisor (CEPA)

- Masters in Business Administration (MBA)

Experience Requirements

Experience is not necessary to start in the field as an investment banker, though many start as a investment banker analyst, as mentioned under the education section of this article. You must have an MBA to rise in this profession, and be willing to put in long hours in order to excel in this field. Lots of meetings, financial analysis, pitching ideas, phone calls, and often times working late into the night to prepare with client meetings.

Organizations

The Investment Bankers Association works with businesses and organizations that would like to go public and raise capital with other investment firms. It is possible to become a member of this organization once you are an investment banker.

In addition, the Middle Market Investment Banking Association is a professional organization devoted to the training, testing and certification of middle market investment banking professionals. They offer a Chartered Merger and Acquisition Professional (CMAP) certification for investment bankers.

Investment Banker Jobs

There are many investment banks to choose from when starting your career as an investment banker. The Wall Street Journal offers an Investment Banking Scorecard to help you identify top companies based on Mergers & Acquisitions, Debt Capital Markets, Equity Capital Markets, and Loans.

Similarly, the Bloomberg offers Global Legal Advisory Merger & Acquisitions Rankings and Global Capital Markets League Tables that also help you evaluate investment banks based on M&A, equity, debt and loans.

You may also refer to this list of investment banks. By doing a little research and talking to employees and employers, you can choose which investment bank you want to get a job at and pursue a career with that bank directly

Top investment banking companies based on M&A include:

Investment Banker Salary

According to the department of Labor and Statistics from the third Quarter 2005 through Second Quarter 2006 in selected counties across the US, the average weekly salary ranged from $4,000 to $24,000. Thats $200,000 to $1,200,000 a year, based on a 50 work week year. There has been a drop in bonuses since 2007 and even moreso since the current recession; these numbers are not yet published. In a positive light, right now is some of the best times to invest in new companies, if you follow financial advisors on Wall Street and other leading financial institutions.