How to analyze your portfolio

Post on: 6 Май, 2015 No Comment

Investing in the new economy

If you’re managing your returns and your strategy, and for all of ’09 and 2010 your portfolio was way underperforming by 8 (percent) or 10 percent each year, it’s time to find out what’s going wrong and why, says financial adviser Mike Masiello, president of Masiello and Associates in Rochester, N.Y.

To assess your investments’ performance, you need to begin with your original investment plan and a process.

The keyword is the ‘process,’ says Drummond Osborn, a Certified Financial Planner at Osborn Wealth Management in LaPorte, Ind. You truly need to have a process in place for how you’re buying, how you’re re-evaluating and how to make the changes. Those three things create the process.

Ideally, investors would assess the health of their portfolios at least once a year and after significant life changes such as marriage, having kids, losing a job or coming into an inheritance.

To get to that point, you have to start at the beginning.

What’s working, what’s not

Your original investment plan is really the blueprint for assessing what’s working. If your portfolio was assembled willy-nilly, consulting a financial professional can help you put together a comprehensive investment strategy. For a start, check out Bankrate’s asset allocation calculator.

To determine if your plan is working, review your investments. These should be contained in a diversified portfolio that was constructed based on the parameters established by your risk tolerance, time horizon and goals. In simpler terms, your investment plan should be based on how much risk you’re willing to take, how long it will be until you need the money and your goals for that money.

If your investments are in accord with those three considerations, it’s time to start digging.

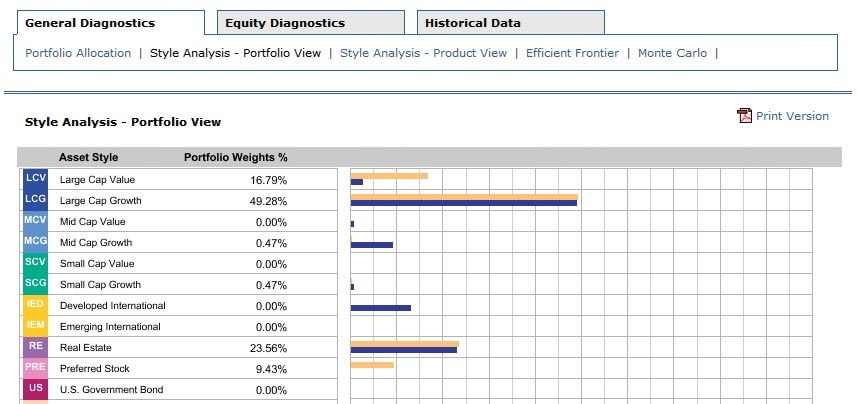

Begin by looking at your allocation and weightings.

Many investment advisers recommend rebalancing your portfolio to stay within the allocation established at the outset of your plan.

Say I’m 51, my allocation is 60 percent equities, 40 percent bonds. At the end of the year if my equity portfolio has done particularly well and it’s now 70 percent equities and 30 percent bonds, I’m going to reallocate, says Herbert Hopwood, CFP and president of Hopwood Financial Services in Great Falls, Va.

And that’s what you have to do — have that discipline, he says.

Check individual holdings

Before rebalancing, take a look at the performance of the individual investments that make up your asset allocation plan.

Investors should understand why each asset is in the portfolio and what they expect from it.

Asset classes perform differently and have varying roles within a portfolio. One sector, style or class might have a great year while other parts of the portfolio may turn in only a middling performance. Together they mitigate volatile swings in the portfolio’s value.