How the Reserve Ratio Affects the Money Supply Video Lesson Transcript

Post on: 5 Август, 2015 No Comment

Instructor: Jon Nash

Jon has taught Economics and Finance and has an MBA in Finance

Where does our supply of money come from. Well, it’s in the hands of the Federal Reserve. In this lesson, discover how the central bank can dramatically alter the supply of money in the economy by changing the reserve requirements of the banks it oversees.

The Reserve Ratio

Imagine with me that you and nine other friends are all sitting at your house seated at a table playing blackjack. After talking on the phone earlier in the day, you all agreed to play blackjack for money. Specifically, each hand of blackjack will be worth $5 per person. The game starts out with all five of you placing $5 in a pile on the table. This ‘supply of money’ is the beginning of what someone will win after the first hand.

Now imagine that you’re playing the same card game with the same friends at the same table, and the only thing different is that instead of playing the game for $5 per game, you’re playing it for $10 a game instead. When you think about this game of blackjack, it’s pretty easy to see that whatever amount you and your friends decide to play for will affect the outcome of every hand you play. Playing for $10 a game will definitely create a larger supply of money in the game than $5 a game will. You have to actually play a hand in order to win the money, but whenever you do play a hand, a larger ante will lead to a larger supply of money in the game.

Changing the dollar amount of a card game is similar to the central bank changing the reserve ratio. They both lead to changes in the supply of money and affect economic output. Let’s talk about what the reserve requirement is and with the help of some examples, take a closer look at how a reserve ratio of 20% or 10%, for example, affects the money supply.

Changes in Reserve Requirement

The reserve requirement is the proportion of customers’ deposits a bank is required by the Fed to hold in reserve without loaning out. Suppose that the Federal Reserve has set the reserve ratio at 20%. That means The First National Bank of Ceelo is required to reserve 20% of every dollar that gets deposited in their bank, while the remaining 80%, which is called excess reserves, can be loaned out to borrowers. The reserve ratio could be 15% or 10%, whatever the Fed decides to set it at.

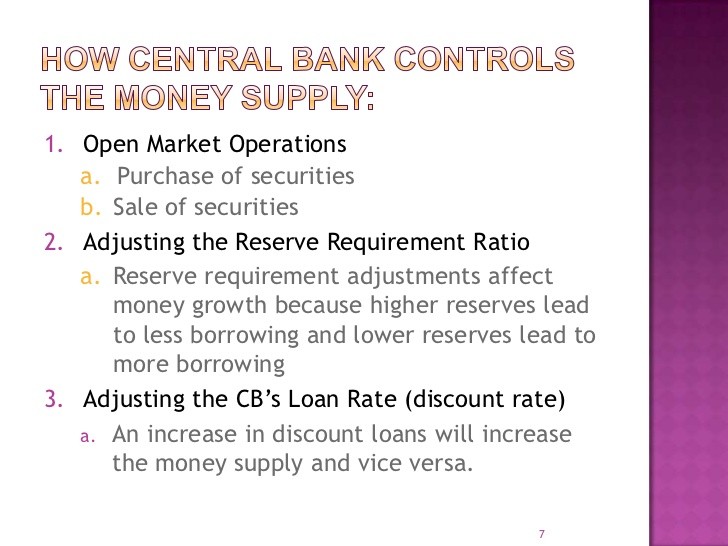

As part of its monetary policy, the Fed may decide to raise or lower the reserve requirement for all banks that it oversees, and this has a direct and immediate impact on the money supply. Here’s why: money that doesn’t have to be reserved at a bank is money that can be used to make new loans. Money that can be loaned out is money that can filter through the economy and multiply through a process of multiple deposit expansion as businesses and consumers borrow money to invest. This multiplication process is described by economists as the multiplier effect. That means changes in the reserve ratio will change the multiplier effect, and that changes the money supply.

The Money Multiplier

The formula for the money multiplier is Money Multiplier = 1 / Reserve Ratio. The money multiplier is the reciprocal of the reserve ratio. As you can see, changing the reserve ratio, which is inside of the multiplier, quickly changes the multiplier in the opposite direction. When the reserve ratio is 10%, the multiplier would 10. However, when the reserve ratio is increased to 20%, the multiplier goes down to 5, and so on and so forth. It’s an inverse relationship.

Calculating Changes in the Money Supply

It’s important to understand that when the Fed changes the reserve ratio, this doesn’t actually increase or decrease the money supply by itself. What it does is change the magnitude of the multiplier effect so that when the Fed actually changes the money supply using open market operations, the result is a larger or smaller multiple of what they started with.

Suppose the reserve requirement is currently 20%, and the Federal Reserve makes an open market purchase of $500,000 worth of US government bonds. The maximum amount the money supply could increase because of this open market purchase is $2.5 million. How did I get this? Well, let’s take a look.

First, I used the money multiplier formula and determined that the multiplier is 1/20%, which is 5. Second, I used this formula — Change in Money Supply = Change in Reserves * Money Multiplier — to calculate the maximum change in the money supply as follows: change in money supply = $500,000 * 5, or $2.5 million. So, a 20% reserve ratio multiplied a $500,000 deposit five times into a $2.5 million money supply.

Now suppose that the reserve ratio was set by the Fed at 10% instead of 20%. A $500,000 open market purchase of government bonds could lead to a maximum increase in the money supply of $5 million — twice as much as before. All we did was change the reserve ratio, which is r. and this changed the money multiplier to 10. So, here’s what the formula would look like: the maximum change in the money supply would be $500,000 x 10, which is $5 million. So, now we want to know how this affects economic output.

Effect on Interest Rates and Output

The Federal Reserve has the ability to change the reserve ratio whenever it wants, and as you can see, this small detail can have a powerful impact on the money supply, and the money supply directly affects interest rates in the economy. When the money supply increases, interest rates go down and vice versa.

Assuming that all this money gets loaned out to individuals and businesses that use it to invest and produce something, then this change in the reserve ratio will have a dramatic effect on nominal GDP. The reserve ratio is part of the Federal Reserve’s monetary policy toolbox. When they want to stimulate the economy, they can lower the reserve ratio. On the other hand, when they want to slow down the economy, they could increase the reserve ratio.