How Sukuk (Islamic Bonds) Differ from Conventional Bonds For Dummies

Post on: 22 Май, 2015 No Comment

Modern sukuk emerged to fill a gap in the global capital market. Islamic investors want to balance their equity portfolios with bond-like products. Because sukuk are asset-based securities not debt instruments they fit the bill. In other words, sukuk represent ownership in a tangible asset, usufruct of an asset, service, project, business, or joint venture.

Each sukuk has a face value (based on the value of the underlying asset), and the investor may pay that amount or (as with a conventional bond) buy it at a premium or discount.

Rewarding investors for sukuk

With sukuk, the future cash flow from the underlying asset is transferred into present cash flow. Sukuk may be issued for existing assets or for assets that will exist in the future. Investors who purchase sukuk are rewarded with a share of the profits derived from the asset. They dont earn interest payments because doing so would violate sharia.

Repurchasing sukuk at maturity

As with conventional bonds, sukuk are issued with specific maturity dates. When the maturity date arrives, the sukuk issuer buys them back (through a middleman called a S pecial P urpose V ehicle ).

However, with sukuk, the initial investment isnt guaranteed; the sukuk holder may or may not get back the entire principal (face value) amount. Thats because, unlike conventional bond holders, sukuk holders share the risk of the underlying asset. If the project or business on which sukuk are issued doesnt perform as well as expected, the sukuk investor must bear a share of the loss.

Most sharia scholars believe that having sukuk managers, partners, or agents promise to repurchase sukuk for the face value is unlawful. Instead, sukuk are generally repurchased based on the net value of the underlying assets (each share receiving its portion of that value) or at a price agreed upon at the time of the sukuk purchase.

In practice, some sukuk are issued with repurchase guarantees just as conventional bonds are. Although not all sharia scholars agree that this arrangement complies with Islamic law, a product called sukuk ijara may come with a repurchase guarantee.

Ensuring sharia compliance with sukuk

The key characteristic of sukuk the fact that they grant partial ownership in the underlying asset is considered sharia-compliant. This ruling means that Islamic investors have the right to receive a share of profits from the sukuks underlying asset.

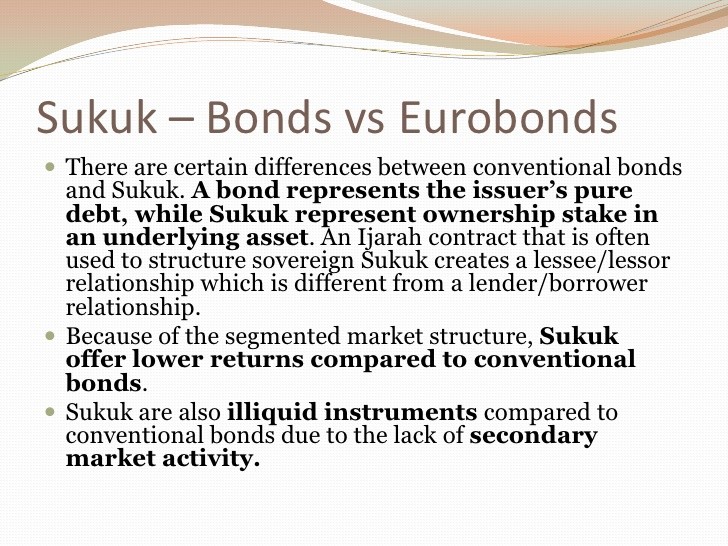

Putting bonds and sukuk side-by-side

When you have the basics about how conventional bonds and sukuk work, its time to put them next to each other. This table offers a quick look at the key ways in which these investment products compare.