How Risky Are Bonds if Interest Rates Rise

Post on: 16 Март, 2015 No Comment

October 22, 2012

By Nash Dykes

Thirty-one years ago the yield on corporate Aaa bonds reached its 100-year peak of 15.5 percent. That was in September, 1981, and rates for bonds have fallen ever since, resting near 100-year lows today. This trend can’t last forever of course, and today many bond investors are grappling with the notion of a rising interest rate environment. And because bondholders lose when rates rise, many are now wondering, how risky are bonds?

Bond coupon rates are typically set at, or close to, the prevailing market interest rates when issued. But rates and bond prices are inversely related; when interest rates rise, the value of these pre-existing bonds goes down, and when interest rates fall the value of these pre-existing bonds goes up. When rates rise, investors’ pre-existing bonds now offer a lower coupon rate than that available in the market for equivalent grade bonds. This imbalance exerts downward pressure on the market price for pre-existing bonds in order to compensate prospective buyers for earning below-market coupon rates. And given today’s extraordinarily low rate environment, current bondholders are concerned they’ll be left holding depreciating assets when rates reverse course.

20Risky%20Bonds%20Chart%201.gif /%

As indicated by the shaded blue areas in Figure 1, since 1919 investors have experienced eight different corporate Aaa rate increase periods exceeding +1.5 percent, with corresponding losses ranging from -7 percent to -24 percent. While some periods like the 1950s were marked by a slow and steady rate rise, with Aaa losses reaching-15.3 percent, other periods like the early 1980s experienced sharp increases and produced deep losses in the -24 percent range. And although the last 30 years have generally been a period of falling rates, this descent also included four Aaa rate spikes of +1.8 percent or more since 1980.

The magnitude of the findings may surprise some. While investors recognize the risk associated with high yield bonds, emerging market sovereign debt, or securitized debt (for example, large losses in 2008 will stand out for many), the risk of even high quality bonds is clearly not trivial.

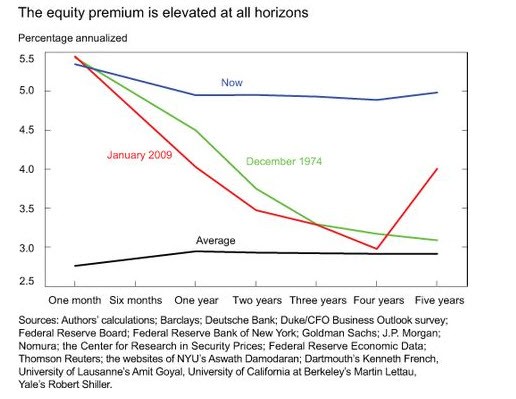

And this leads us to a second way of thinking about bonds, one based on relative risk/reward. First, let’s establish a risk/reward benchmark for public equities. The S&P 500 has historically returned about 10 percent per annum with a maximum drawdown of 83 percent during the Great Depression. In short, the S&P 500’s maximum drawdown, or risk, is about 8 times as large as its historical average annual return, or reward. That’s risky, but we knew that already.

We can compare Aaa bonds by viewing relative risk/reward in terms of drawdown to coupon rate. Using the same timeframe analyzed in Figure 1, we identified six periods when peak losses would have exceeded coupon rates for six months or more. For example, during the late 1960s bondholders would have experienced losses of -24.3 percent while earning only 5.4 percent in interest. In other words, their capital loss, or risk, was 4.5 times larger than their annual coupon payment, orreward. This ratio was equally skewed in the 1950s, while it topped out at lower—yet still highly unfavorable—ratios of between 2.0 and 2.5 times for the other identified periods.

So compared to equities, Aaa bonds are indeed less risky, but perhaps not quite as safe as some investors today assume.

Armed with the necessary understanding of what bondholder tail events have looked like in the past, we asked the question many investors are currently pondering: What would happen if rates began rising from today’s historically-low levels?

And it’s a particularly important question when starting yields are low—in other words, at times like today. The current low starting yields leave investors with little insulation in the form of coupon receipts to help offset interest rate-induced capital losses.

20risky%20bonds%20chart%202.png /%

To estimate what losses could look like, we applied the slowest, fastest, and average rate increases from the previously identified rate increase periods to today’s yield levels. These results appear in Figure 2, which shows the gradual decline in the price of a security or other investment between its high and low over a given period

Of the three scenarios analyzed, the slowest rate increase scenario, which mirrors the rate rise of the 1950s, is the most favorable. With total annual losses of just -0.03 percent, coupon receipts generally offset capital losses. Despite avoiding major losses, however, investors receive near-zero returns for almost six years. The fastest rate increase scenario, which mirrors the rate rise of 1987, produces much sharper losses, while the average scenario, representing the average rise and length of the observed historical occurrences, produces annualized losses of -7.3 percent over three years.

These results are sobering, but they’re not even a worst case scenario. For example, what would happen if interest rates rose even faster than in the past, perhaps associated with a structural inflationary shift fueled by years of quantitative easing, or a sudden loss of investor confidence? No matter the specific scenario, all results generally point to the same underlying theme – degrading risk/reward characteristics of an investment that many believe to be the safest in their portfolio.

Many investors are already painfully aware of the yield drought that has resulted from low rates. But while they may be understandably disappointed by fixed income’s return potential, investors should not conclude that the benefits they associate with fixed income are unattainable. These traits can be isolated, replicated, and diversified.

Income, for example, could be augmented with direct infrastructure investments, income-based real estate, or even some low beta equities. Portfolio diversification, and even outright capital protection, might be achieved through strategies capable of harnessing rate changes and global capital flows such as managed futures or global macro. Both have generally protected investor capital while delivering capital appreciation during times of equity market stress.

One of the benefits of these challenging times is a general change in portfolio construction toward combing investments based on their beneficial diversifying traits as opposed to their asset classification. This is a positive shift, and one that should advantage investors in reaching their goals both near and far.

Nash Dykes. CFA, is a senior associate in the Strategic Marketing Group at Welton Investment Corporation in Carmel, CA. This essay is adapted from a white paper available here .