How Often Should I Rebalance My Investment Portfolio Updated

Post on: 16 Март, 2015 No Comment

Heres a slightly updated and revised version of an older post I had on rebalancing a portfolio to maintain a target asset allocation.

What is Rebalancing?

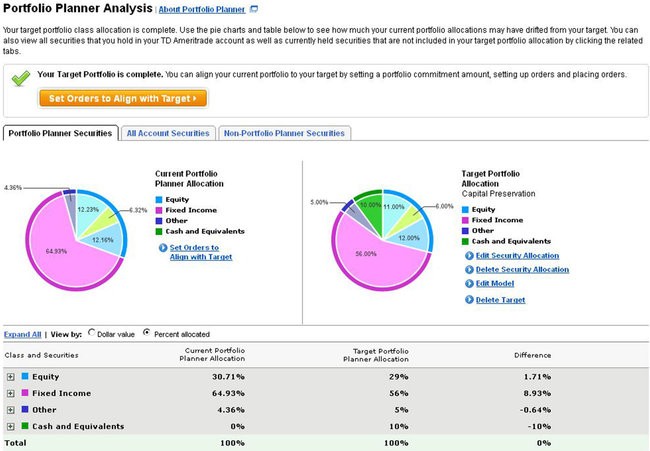

Let say you examine your risk tolerance and decide to invest in a mixture of 70% stocks and 30% bonds. As the years go by, your portfolio will drift one way or another. You may drop down to 60% stocks or rise up to 90% stocks. The act of rebalancing involves selling or buying shares in order to return to your initial stock/bond ratio of 70%/30%.

Why Rebalance?

Rebalancing is a way to maintain the risk to expected-reward ratio that you have chosen for your investments. In the example above, doing nothing may leave you with a 90% stock/10% bond portfolio, which is much more aggressive than your initial 70%/30% stock/bond mix.

In addition, rebalancing also forces you to buy temporarily under-performing assets and sell over-performing assets (buy low, sell high). This is the exact opposite behavior of what is shown by many investors, which is to buy in when something is hot and over-performing, only to sell when the same investment becomes out of style (buy high, sell low).

However, in taxable accounts, rebalancing will create capital gains/losses and therefore tax consequences. In some brokerage accounts, rebalancing will incur commission costs or trading fees. This is why, if possible, it is a good idea to redirect any new investment deposits in order to try and maintain your target ratios.

How Often Should I Rebalance?

Some people rebalance on a certain time-based schedule for example, once every 6-months, every year, or every 2 years. Others wait until certain asset classes shift a certain amount away from their desired targets before taking any action. A good source of research articles about which method is optimal can be found at the AltruistFA Reading Room. Heres a quick overreview of the articles here.

So how often is best? You may be surprised by the fact that not only is there no clear agreement on the answer to this question, but many of the articles actually contradict each other! For instance, compare this Journal of Investing article:

Over this period, regular monthly rebalancing returns dominated less active approaches. Should one infer that daily rebalancing is better still? Our data cannot say, but it seems plausible.

So, what can we conclude from all this? Monthly rebalancing is too frequent. There are small rewards to increasing ones rebalancing frequency from quarterly up to several years, but this comes at the price of increased portfolio risk.

Confused yet? I believe that this is because their results vary significantly with the time period chosen and asset classes being used in their back-tested scenarios. Then there is this paper from Financial Planning magazine, which used the 25 year period from Oct. 1977-Sept. 2002 and a 60% Stock (S&P 500 Index) and 40% Bond (Lehman Bros. Govt Index) as the starting/target allocation. Here are the results for various rebalancing frequencies:

The various rebalancing periods showed minimal performance differences, although annual rebalancing held a slight return margin and a higher risk margin.

Because the risk-adjusted performance differences among the portfolios were small, the answer to the question of when to rebalancemonthly, quarterly, semi-annually, or annuallydepends mainly on the costs to the investor of rebalancing.

Efficient Frontiers Bill Bernstein also agreed in the this last respect, stating The returns differences among various rebalancing strategies are quite small in the long run.

In the wait for a significant shift before taking action camp is author Larry Swedroe, who I think also presents a very reasonable solution. From a WSJ article :

With major holdings like U.S. stocks, foreign stocks and high-quality U.S. bonds, consider rebalancing whenever your fund holdings get five percentage points above or below your targets. suggests Larry Swedroe, research director at Buckingham Asset Management in St. Louis. For instance, if you have 40% earmarked for bonds, you would rebalance if your bonds got above 45% or fell below 35%.

Meanwhile, for smaller positions in sectors like emerging markets and real-estate investment trusts, Mr. Swedroe recommends a 25% trigger. So if you have 5% targeted for emerging-market stocks, youd rebalance if emerging markets balloon above 6.25% or fall below 3.75%. You definitely want to be rebalancing, but you dont want to be doing it too often, Mr. Swedroe says. You want to let stocks go up a bit before you sell, but not so much that you lose control of risk.

This 2008 internal working paper from Dimensional Fund Advisors provides a nice recap:

Aside from avoiding excessive trading, there are no optimal rebalancing rules that will yield the highest returns on all portfolios and in every period. The good news for investors is that without an optimal way to rebalance, the burden of producing returns through optimal rebalancing is lifted. Return generation is again the responsibility of the market, which sets prices to compensate investors for the risks they bear. The primary motivation for rebalancing should not be the pursuit of higher returns, as returns are determined through the asset allocation, not through rebalancing. The bad news, of course, is that there is no easy one-size-fits-all rebalancing solution.

Rebalancing decisions should be driven by the need to maintain an allocation with a risk and return profile appropriate for each investor. The optimal rebalancing strategy will differ for each investor, depending on their unique sensitivities to deviations from the target allocation, transaction frequency, and tax costs.

I would add that I think the most important thing is to just make sure you set up some way to rebalance that does not involve any emotions or short-term market predictions. Lots of money was moving to bonds after the last market drop, right before stocks bounced back. I think the subtitle of one of the articles above sums it up quite well Tis Better To Have Rebalanced Regularly Than Not At All. I have personally chosen to keep it simple and rebalance annually, but also try my best to direct any new investment money to maintain my target asset allocation as well.