How much longer can the Fed prop up stocks

Post on: 21 Апрель, 2015 No Comment

A big driver in the stock market’s multiyear bull run is the market-friendly stimulus provided by the nation’s central bank. But Wall Street wonders if the Fed can keep propping the market up forever.

Story Highlights

- Stocks sugar high from Fed stimulus remains intact as central bank pledges more stimulus Bears warn that market rally is a mirage built on smoke and mirrors that will end badly Stocks have enjoyed double-digit percentage gains after all three of the Feds stimulus programs

351 CONNECT 30 TWEET LINKEDIN 52 COMMENT EMAIL MORE

NEW YORK — Will the stock market sugar high ever wear off?

Ever since the bull market was born in March 2009, most of the credit for the stock market’s spectacular but surprising rise has gone to the Federal Reserve, whose easy-money policies have been equated to performance-enhancing drugs that Wall Street has become addicted to.

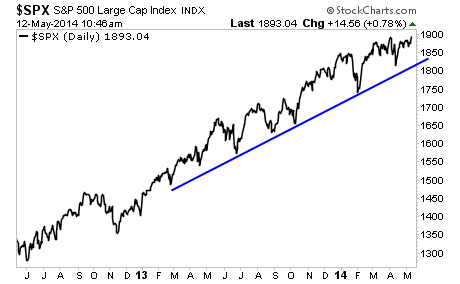

The Fed’s zero-percent-interest-rate policy, dubbed ZIRP, and its unprecedented bond-buying program, known as quantitative easing, or QE, is often cited as the major engine behind the market’s 136% rise the past four years and its fast-and-furious 12% gain so far in 2013.

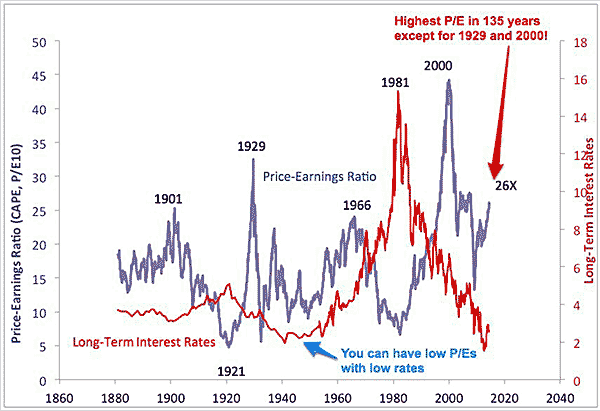

The Fed’s policy playbook has driven interest rates and borrowing costs to record lows, which has spurred risk-taking, allowed consumers to get their finances back on track and enabled Corporate America to keep churning out profits. Super-low interest rates on cash and bonds have also made the stock market, which now sports a fatter dividend yield than the 10-year U.S. Treasury note, a far more attractive investment alternative relative to fixed income.

To get any kind of return and build wealth you have to take risk, and the risky investment people know best is stocks, says Bill Hornbarger, chief investment strategist at Moneta Group.

But how long can the Fed prop up the stock market? Likely for a good time longer. The Fed said Wednesday it would continue on its current path of buying $85 billion in Treasuries and mortgage-backed bonds each month until the unemployment situation improves substantially. For the first time the Fed also said it could increase the pace of bond purchases if inflation remains tame and the job and economic recovery sputters.

The Fed’s fresh language and signs of another economic soft patch have shifted the debate from when will the Fed take its foot off the stimulus pedal to maybe they will do more if needed. The Fed’s strategy coincides with similar easy-money policies from central bankers in Europe and Japan.

The stock market is likely to continue to push higher or at least find a floor under it, Hornbarger says, as long as the Fed keeps rates at 0%, the economy keeps growing and companies continue to eke out earnings growth.

Perversely, due to the Fed’s all-in mentality, stocks could also get a boost if economic data turn down, adds Nicholas Sargen, an investment strategist at Fort Washington Advisors. If we get bad news on the economy, investors will say, ‘Hey, the Fed is in play even longer,’ he says.

What worries Sargen, however, is that the Fed is increasingly cited by investors as the only reason why they’re buying. It could set the market up for disappointment, he says, adding that he would like to see stocks rise because of improving business fundamentals, such as stronger sales.

The market’s rise is all due to the Fed’s smoke and mirrors, warns Richard Suttmeier, chief market strategist at ValuEngine.com. ‘It’s a mirage. It will end. You just don’t know when. Fed sentiment will turn, he says, when companies start falling short on earnings projections on a consistent basis, signaling that the Fed’s policies are not helping the economy heal fast enough.

351 CONNECT 30 TWEET LINKEDIN 52 COMMENT EMAIL MORE