How Much Can You Withdraw In Retirement

Post on: 16 Март, 2015 No Comment

Traditional Thinking on Retirement Account Withdrawals May Be Wrong

How much can you withdraw in retirement. Howard Grey/Getty Images

How much money can you withdraw from your retirement accounts each year? There’s been a lot of work done on what is called a safe withdrawal rate which is how much you can withdraw in retirement without running the risk of using up your money too soon.

If this is the only way you are looking at how much you can spend in retirement, you’re looking at it wrong. Calculating a safe withdrawal rate is a good conceptual idea, but it does not consider strategies that increase your after-tax income, and so by simply using a withdrawal rate as a guideline you may be leaving money on the table.

How Taxes Affect How Much You Can Withdraw in Retirement

To figure out how much you can withdraw in retirement, you need to think in terms of a timeline and figure out when it makes sense to turn certain sources of income on or off. One of the biggest factors you’ll want to consider in developing this retirement withdrawal timeline is the amount of after-tax income available to you over the course of your retirement years .

For example, traditional thinking says you should delay withdrawals from your IRA accounts until you reach age 70 when you must take required minimum distributions. This traditional line of thinking is often wrong. Many couples (but not all) have the opportunity to increase the amount of after-tax income available to them by taking IRA distributions early, and delaying the start date of their Social Security benefits. Then once Social Security begins, they would reduce what they are withdrawing from retirement accounts. Following such a plan means some years you may withdraw much more from investment accounts than other years, but the end result is more after-tax income .

Before you determine how much you can withdraw in retirement, you need to create a retirement income plan, and consult with a retirement planner or tax advisor that can calculate the after-tax impact of your proposed retirement account withdrawal plan.

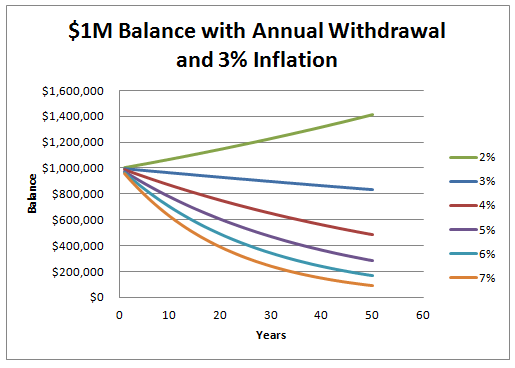

How Rate of Return Affects How Much You Can Withdraw in Retirement

You will also want to spend some time studying historical rates of return so you can understand how the rate of return on your investments will affect how much you can withdraw in retirement.

Then you can use your retirement withdrawal plan to match investments with the point in time where you will need to use them. So if it makes more sense to take income out of your IRA early, you want the amounts that you will need in the next five years to be invested in safe investments. On the other hand, if your withdrawal plan shows that it is best for you to delay IRA withdrawals until age 70 , then that money has a longer time frame to work for you and can be invested more aggressively.

This process of matching investments to when you will need them is sometimes referred to as time segmentation. and you can watch a great movie called Income for Life that explains it in additional detail.

What if You Withdraw Too Much Money?

Once your withdrawal plan is designed, it will be important to track your withdrawals against your original plan, and update your plan from year to year. Taking out too much money too soon can cause you problems later.

I have one client whose investments did very well her first few years in retirement. She insisted on taking out a lot of additional money. I cautioned her against this and told her we had tested her plan against both good and bad investment markets and by taking out these additional profits now she would be jeopardizing her future income. I explained that rates of returns in excess of 12% do not go on forever, and we needed to bank these excess returns so we could use them in years where the investments did not do as well. Nevertheless, she insisted on taking additional funds out. A few years later when the markets went down, we did not have those additional profits set aside, and her accounts are now severely depleted. Instead of having some extra fun money, she is on a strict budget.

Monitoring how much you withdraw in retirement against a long-term timeline or plan is important. You want a secure retirement income; having a plan and measuring against it will accomplish this goal while answering the question of how much you can withdraw.