How Leverage Works

Post on: 16 Март, 2015 No Comment

Leverage is both the joy and scourge of traders in equal measure, and can single-handedly make or break your trading success. For the most part, millionaire traders have got there as a result of leverage, and without this often invaluable tool they would probably still be toiling to build up their trading capital and, bluntly, nowhere near as successful. Indeed, many of today’s most popular trading forms, such as spread betting and CFD trading rely on leverage to a massive extent, and attract new aspiring traders in their tens of thousands each year. But what exactly is leverage, how does it work, and what role can leverage play in your trading activities?

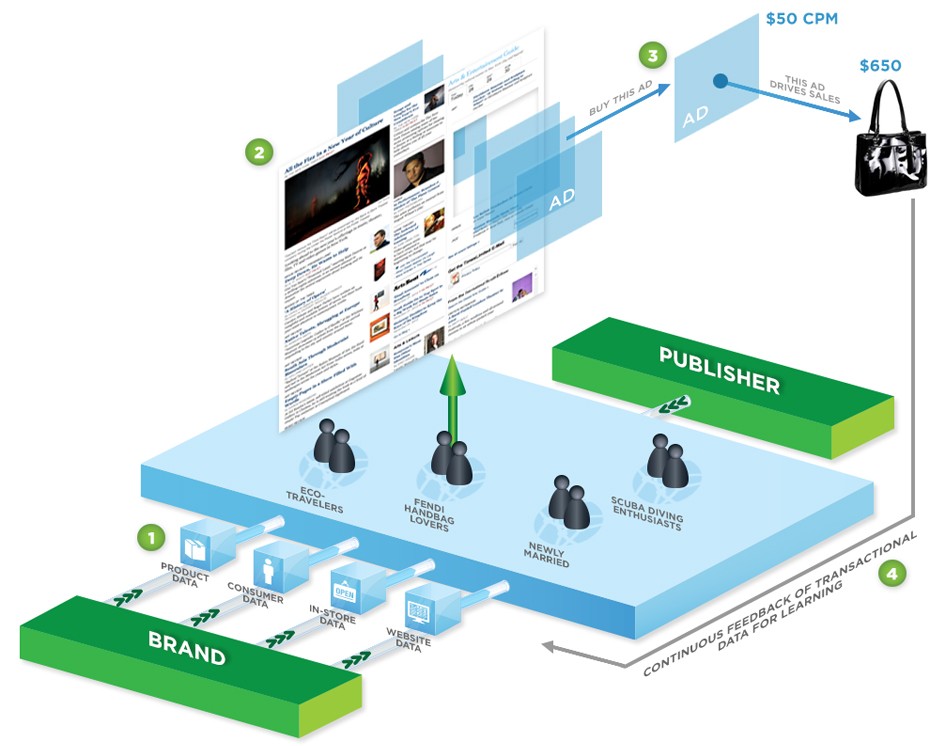

Leverage is essentially loan finance permitted on a given transaction to allow a trader to ‘gear up’ his exposure, without having to invest 100% of the trade value. The broker usually allows a trader to open a position at a much higher value than his current trading account balance, often requiring as little as 5% in margin deposit to allow an individual transaction to proceed. In effect, this allows the trader to earn off the back of 100% of a transaction, at a personal up-front cost of just 5%, (or whatever the agreed margin rate may be).

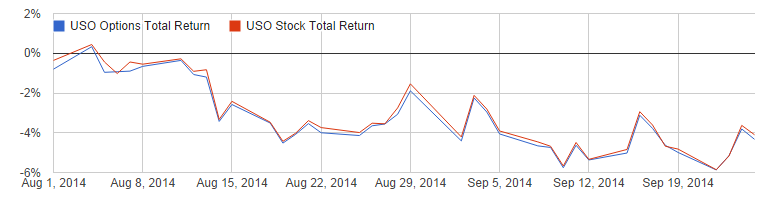

However, while leverage can have a dramatically positive effect on your trading, it nevertheless presents a range of risks and dangers, and is all too often the ruin of even experienced traders. Leverage can work both for you and against you in equal measure, and the higher earnings of leverage wouldn’t be possible without a corresponding leveraged risk profile.

In addition to paying financing costs, a negative leveraged position must be paid up, and will solicit the margin call to the extent that your account is unable to pay. For this crucial reason, respecting the threats posed by leverage and monitoring your risk exposure throughout your trading activity is an essential strategy to mitigating losses on wayward trades.

CFDs themselves are margined products, and more often than not are traded with the benefit of leverage, supplied by the broker to the trader to finance particular trades. Just like any other form of loan finance, leverage attracts financing costs in the form of interest, which takes account of the risk of default and builds in a profit margin for the broker in respect of the service (i.e. the leverage) offered.

This obviously makes for a factor that must be considered in attempting to calculate the whether or not a position is likely to yield a profit, and spiralling costs of leverage finance can at times make certain positions unviable.

Leverage can be a double-edged sword, and has the effect of amplifying trading positions across the board to maximise earnings and, unfortunately, losses. As a trader, it’s not advisable to stay clear of leveraging positions if you’re looking to build your portfolio quickly, but it is important to remember to give due consideration to the risks and the pitfalls associated with leveraged trading, to make sure you don’t become another trading statistic.