How Does the Fed Funds Rate Affect Treasury Bills

Post on: 24 Май, 2015 No Comment

What happens to Treasury bill yields when interest rates go up? Do they react the same way as bonds?

—Mary Anile-Liberatore

Mary,

There are two important differences between how interest-rate moves — by which I mean increases or decreases in the fed funds rate by the Fed — affect Treasury bill yields, and how they affect other Treasury yields.

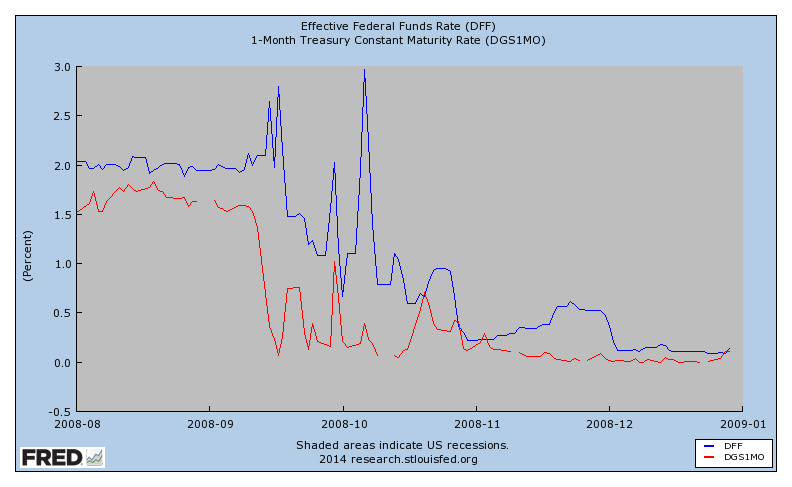

For one, bill yields are more closely influenced by the fed funds rate. You can rely on them to move up and down with the fed funds rate (or when the Fed is expected to change the rate in the near term). By contrast, the reaction of Treasury note and bond yields to changes in the fed funds rate is sometimes more complicated. This is because bills are short-term instruments, while notes and bonds are intermediate- or long-term instruments.

Second, bill yields are much more sensitive to the forces of supply and demand than note and bond yields. Bill yields can swing wildly around the fed funds rate, depending on whether the Treasury Department is issuing more or fewer bills than investors want.

The whole

Treasury

market is very sensitive to supply and demand concerns, but none more so than the bill sector, says Ken Logan, managing analyst at IFR/Thomson Financial.

Treasury bills are the shortest-term Treasury issues — they come in three-month and six-month varieties. The fed funds rate, on the other hand, is the rate at which banks lend one another excess reserves — reserves they don’t need to satisfy capital requirements — overnight.

Treasury bills are more predictably influenced by the fed funds rate than notes and bonds because Treasury bills and the fed funds rate are competing investments in the money market. The money market is the market for high-quality, short-term debt instruments. Just as individuals put uninvested cash into money market mutual funds, where they can earn interest without putting principal at risk, institutional investors for the same purpose invest directly in the money markets by buying instruments like fed funds and Treasury bills. As investments, fed funds and Treasury bills generally offer comparable yields.

Note and bond yields are less closely tied to the fed funds rate because their longer maturities (from two to 30 years) mean more can happen during their lifetime. That gives them the potential to undergo big price changes. In general, the longer the maturity of a debt security, the greater the potential price changes.