How Do You Rebalance an Investment Portfolio

Post on: 20 Май, 2015 No Comment

Posted on Jul 8, 2013

To make an investment account most effective, you cant just open it, plop in your money and forget about it.

Yes, you do want to invest for the long haul, so your money has more time to potentially grow, but, periodically, you should adjust your portfolio.

What does that mean? In short, you want to make sure your portfolio has a mix of assets which reflects the amount of financial risk you currently want to take on (more on how to figure that out in a minute).

This task is called rebalancing.

How Rebalancing Works

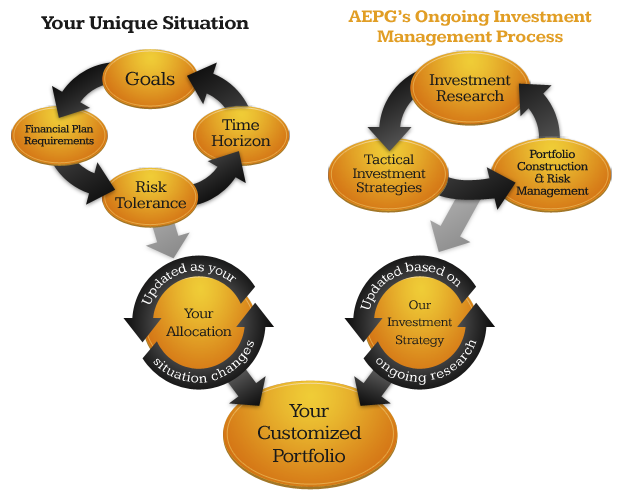

Rebalancing starts with an asset allocation—that’s the percentage of assets (for the average person, this is stocks and bonds) that make up your account. The ideal mix varies based on your age, time frame and risk tolerance .

When you rebalance, youre essentially selling some of the investments that have performed better than other holdings for the year, and buying some that have been underperforming to get your asset allocation back where you assigned it.

For instance, if you’re rebalancing a retirement account that youll need to access in 20 years, you may choose a riskier mix of stocks and bonds, since you may have time to make the money back should the market take a dive. If your goal has a shorter time horizon, such as a down payment on your dream home in eight years, you may likely invest this money very differently. In this case, you may want to take on less risk, since you wouldnt have enough time to earn the money back should the market go south.

Let’s say you’ve determined that you want to have a moderate asset allocation consisting of 60% stocks and 40% bonds. This allocation is written 60/40. After a year, you might have 66% stocks and 34% bonds, because your stocks have been more profitable than your bonds in this example. Your portfolio is now 66/34.

To rebalance, you would sell 6% of your stocks and buy 6% in bonds to bring your allocation back to 60/40. This is the basic concept behind rebalancing.

Generally, you should rebalance at least once a year. To get an idea of an appropriate mix for your own investment portfolio, a good place to start is by filling out a free risk tolerance questionnaire .

There are some exceptions, of course: If an investment holding has changed by less than 5% (meaning your 60/40 became something more like 62/38), you might want to wait before you rebalance. Thats because there are often fees to buy or sell funds that you wont want to pay for such a small adjustment. More on that, below.

If Youre Just Starting Out

If you’re unfamiliar with investing, stick to low-cost index funds and ETFs. instead of choosing managed mutual funds (which have higher fees) or individual stocks. Call and find out if your brokerage firm has a free tool to help you choose the right asset allocation for your situation. A few of the tools offered by firms include: