How Do Mutual Funds Work

Post on: 5 Июль, 2015 No Comment

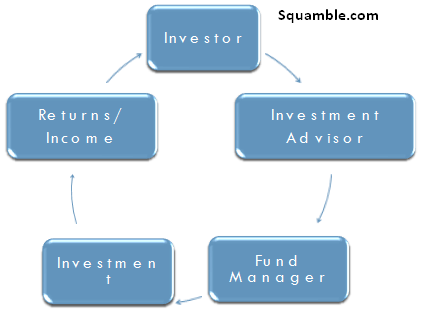

You want to invest your money, but also want to avoid the risks and hassles associated with picking individual assets. Mutual funds provide the benefits of a diversified portfolio without the time required to manage one.

If you’ve never invested in mutual funds before, we’re going to go through some of the basics that every investor should know.

What Exactly are Mutual Funds?

A mutual fund pools money from a bunch of different investors in order to invest in a large group of assets. Some mutual funds focus on a single asset class, such as stocks or bonds, while other invest in a variety.

Unlike the stock market, in which investors purchase shares from one another, mutual funds shares are purchased directly from the fund (or a broker that purchases them directly from the fund). Mutual funds will usually create new shares to be sold to new investors; there is no finite amount as with stocks. Since you purchase shares directly from the mutual fund, they are redeemable, and can be sold back to the fund at any time.

The cost of each share is calculated as the fund’s per-share Net Asset Value (NAV); funds may charge additional purchase fees, so ask about these beforehand. When you sell your shares back, the fund will pay you the per-share NAV, minus any redemption fees.

Some mutual funds offer multiple classes of shares, each of which has different fee structures. These classes will all be investing in the same portfolio of securities. You should inquire with each mutual fund as to the exact terms of each class.

Types of Mutual Funds

There are four primary types of mutual funds:

- Money Market Funds have the lowest returns because they carry the lowest risk. Money market funds are legally required to invest in high-quality, short-term investments that are issued by the U.S. government or U.S. corporations. They tend to keep their NAV around $1.00 per share.

- Bond (Fixed-Income) Funds are somewhat more risky than money market funds. They are not legally restricted to certain qualities of investments. There are many different types of bonds, so you should research each mutual fund individually in order to determine the amount of risk associated with it.

- Stock (Equity) Funds carry the greatest risk alongside the greatest potential returns. Fluctuations in the market can drastically affect the returns of equity funds. There are several types of equity funds, such as growth funds, income funds, index funds, and sector funds. Each of these groups tries to maintain a portfolio of stocks with certain characteristics.

- Hybrid Funds invest in a mix of stocks, bonds and other securities. Many hybrid funds are funds of funds; they invest in a group of other mutual funds.

Active vs. Passive

No matter which category a mutual fund happens to fall into, its fees and performance will be affected by whether it is actively or passively managed.

Passively managed funds invest according to a pre-determined strategy. They try to match the performance of a specific market index, and therefore require little investment skill. Since these funds require little management, they will carry lower fees than actively managed funds.

Actively managed funds seek to outperform market indices, and carry the potential for greater return than passively managed funds. However, they will certainly carry greater fees and risk as well.

The Benefits and Downsides to Mutual Funds

There are two primary benefits to investing in mutual funds:

- Diversification is one of the most important principles of investing. If a single company fails, and all your money was invested in that one company, then you have lost your money. However, if a single company fails out of your diversified portfolio, then you have only lost a small amount. Mutual funds provide access to a diversified portfolio, without the difficulties of having to monitor dozens of assets daily.

- Simplicity is the key role of mutual funds. Once you find a mutual fund with a good record, you have a relatively small role to play. Some people don’t like the lack of control associated with a mutual fund; you don’t know the exact make-up of the fund’s portfolio and have no control over its purchases. However, this can be a relief to investors that simply don’t have the time to track and manage a large portfolio.

The main disadvantage to mutual funds is that, because the fund is managed, fees will be incurred no matter how the fund performs. Investors have to pay sales charges, annual fees, and other expenses with no guarantee of results. That said, most any method of investment will incur fees without a guarantee of results.

How Do I Earn Money from Mutual Funds?

When you invest in a mutual fund, distributions come from three sources:

- Divided payments: When a fund receives dividends or interest on the securities in its portfolio, it distributes a proportional amount of that income to its investors.

- Capital gain: When a fund sells a security that has gone up in price, this is a capital gain. When a fund sells a security that has gone down in price, this is a capital loss. Most funds distribute any net capital gains to investors annually.

- Net Asset Value: When the NAV of a fund increases, it increases the value of your shares. This is similar to when the price of a stock increases; you don’t receive immediate distributions, but your investment’s value is greater, and you will have made money should you decide to sell it.

When purchasing shares in a mutual fund, you can choose to receive your distributions directly, or have them reinvested in the fund.