How do Banks make money on Treasury Bills Auctions

Post on: 9 Август, 2015 No Comment

I’ve been buying quite a few T-bills over the last year from Fidelity and was wondering if there was any advantage of buying t-bills from Treasury Direct? It looks like on Cusip 912795Q79 that both Fidelity and Treasury Direct sale the T-bills for the same price at auction. (Fidelity $99.7826) (Treasury Direct = 99.782611)

savingcash said: horizon6,

Thanks for your reply! I also noticed that the decimal price was different. I’m not sure if Fidelity runs it out further than they show? If they do not. then it appears that a person would make .000011% more from Fidelity over Treasury Direct.

(Fidelity $99.7826)

(Treasury Direct = 99.782611)

I was thinking that the Treasury may sell Fidelity at a small discount off of the Auction price?

If both places are the same, then the only good reason that I can think of, would be that buying from the Treasury allows you to hold the T-bills with the Treasury. If Fidelity would happen to fail, then it would be easier to deal with the Treasury then have to wait in line at Fidelity.

You’re welcome.

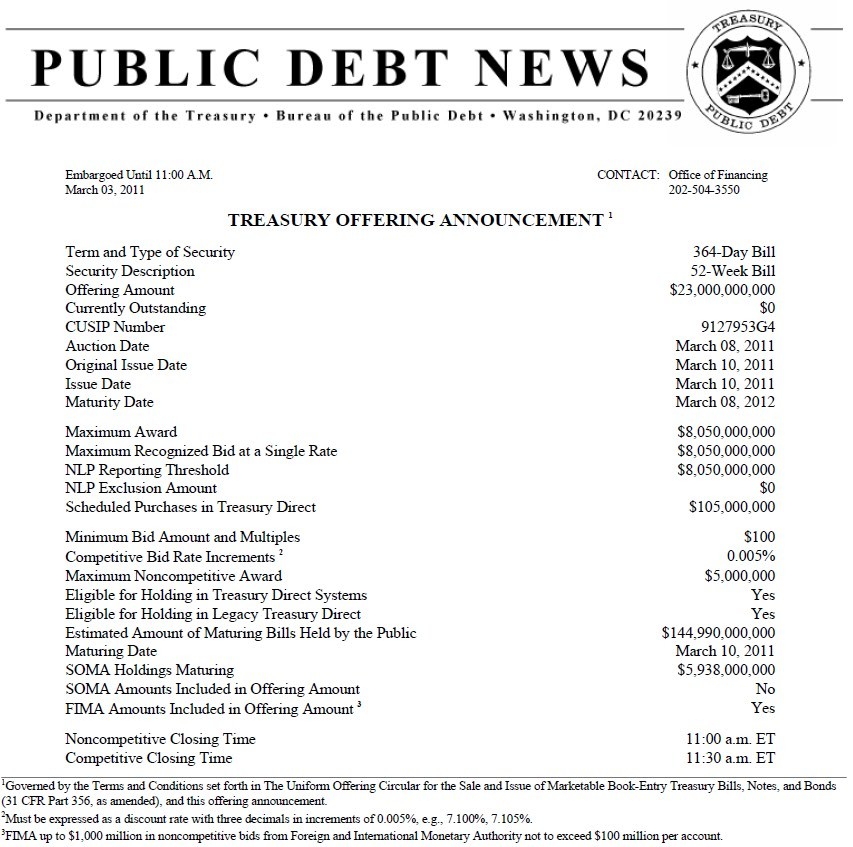

A Single-Price Auction, also known as the Dutch Auction process, allows each successful competitive bidder and each noncompetitive bidder to be awarded securities at the price equivalent to the highest accepted rate or yield. This type of auction is now used for all T-Bills, Notes, and Bonds. In the past it applied only to the 2-year and 5-year note auctions. The Federal government holds the auctions for these securities.

When the size of a pending auction is announced, retail customers have an opportunity to participate by submitting non-competitive tenders or bids. These orders are $5 million or less in size for Treasury bills, Treasury notes and coupon bonds. The remaining participants in the auction are institutional dealers who submit competitive bids to the Treasury. Institutional dealer prices will vary according to the competitive level of their bid. After all competitive bids are submitted by dealers, retail customers will receive an average price from the auction as determined from all the accepted competitive bids.

If Fidelity fails, I expect the Treasury, among others, will be very busy, as we’ve seen lately with certain other situations, and in that case individuals getting T-bills from them may be among the least of their worries.

You might also want to call Fidelity or another investment firm or bank with the good questions you’ve identified for their definitive answers.