How Delaying Social Security Can Be The Best LongTerm Investment Or Annuity Money Can Buy

Post on: 18 Июнь, 2015 No Comment

Valuing The Trade-Off Of Delaying Social Security

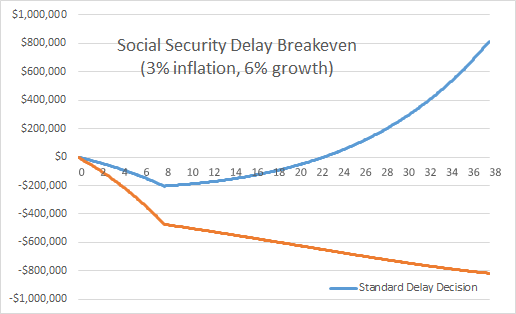

To value the trade-off of delaying Social Security — no benefits paid now, in exchange for incrementally higher benefits in the future — we must measure the economic value of the exchange. Accordingly, the chart below shows the impact over time of not receiving $750/month (increasing annually for inflation) from age 62 to 70, which then begins to be offset by the higher (inflation-adjusted) payment stream that begins at age 70 itself. Since benefits not paid from age 62 to 70 represents a foregone investment opportunity (either the money could have been invested if it wasn’t needed, or it could have been consumed and thereby allowed other assets to remain invested), we must account for not only the $750/month (at age 62) versus $1,320/month (at age 70) benefits, but also for inflation itself (assumed here to be 3%) and this time-value-of-money factor (projected at 6%, a balanced portfolio rate of return that could have been earned on the money invested or not-consumed).

As the results reveal, it can take a long time to “recover” from not receiving $750/month (and having the opportunity to invest it, or keep an equivalent amount invested by having the Social Security dollars available to spend). The “breakeven” period with these assumptions is just over 22 years; or stated another way, for the individual who chooses to delay from age 62 until age 70, it takes until beyond age 84 just to recover the economic value of having waited. Notably, though, beyond that point the benefit in favor of delaying Social Security continues to accrue, exponentially, as the compounding time value of money now works in favor of the delay decision, in addition to the fact that the higher delayed benefit is also enjoying ongoing cost-of-living adjustments.

Of course, the point to breakeven is sensitive to the return assumption used. At a greater rate of return, the breakeven takes longer; with more conservative return assumptions, the breakeven is reached more quickly (as there’s less impact to delaying Social Security if the foregone dollars are assumed to not have been able to earn much anyway). In fact, another way to look at the situation is to determine what breakeven rate of return would have been necessary at various points along the time horizon to have achieved a comparable result; in essence, this is simply an analysis of the internal rate of return on the decision to delay (and foregone payments) compared to the higher dollars ultimately received.

As these “Internal Rate of Return” (IRR) results show, delaying Social Security is a “risky” proposition, in that passing away shortly after the delay results in a total loss of foregone payments. Once benefits begin after year 8, it still takes another 8 years for the “excess” payments to make up for the years that early benefits weren’t received (i.e. the IRR crosses 0%), and then another 6 years until the IRR actually equals a 6% growth rate (8 years + 8 years + 6 years = the 22 year breakeven shown earlier at a 6% growth rate).

However, beyond that point the IRR continues to increase… on what, in the end, is a “guaranteed” rate of return backed by the Federal government. In fact, the implicit “return” of delaying Social Security is not just a nominal return, it is also a real return, since benefits are adjusted annually for inflation (which was assumed above to be 3%). Accordingly, the chart below shows how the real (inflation-adjusted) IRR trends in the later years, starting in year 17 (when it turns positive) until year 38 (when the individual would be reaching age 100).

While by definition these real returns are only available to those who live to later years at or beyond life expectancy, the results are quite significant. Those who reach age 90 (which would be the 28th year after delaying) have generated the equivalent of a 5% real rate of return in what is essentially a government-backed bond!

Comparing Social Security Delay To Alternatives

Delaying Social Security Versus Bonds

Given the charts above showing the implicit return generated by delaying Social Security, we can compare the value to other investment alternatives. For instance, the chart below shows the real IRR on delaying Social Security versus a comparable TIPS yield along the current yield curve.

As the results show, it does take until nearly year 20 before the real return of delaying Social Security is superior to the results from a TIPS yield. However, beyond that point, the economic value of delaying Social Security continues to rise dramatically, producing a real return that is multiples of a comparable risk government bond! And notably, the available return from TIPS ends beyond the 30-year market (there are no longer-dated government TIPS available today), while the value of delaying Social Security just continues to compound higher for those fortunate enough to live long enough!

Delaying Social Security Versus Immediate Annuities

Another way to compare the value of Social Security – which is ultimately a lifetime stream of payments – is to compare it to other commercially available annuities.

Accordingly, we can compare the higher payments received by delaying Social Security benefits from age 62 to 70, to the payments that would be received by accumulating those early payments and simply buying a commercially available immediate annuity at age 70. For these purposes, we assume that the inflation-adjusting Social Security payments from age 62 to 70 are accumulated in a conservative government bond fund (since the time horizon is fairly short) with a 2% growth rate. With a $750/month payment (which was $1,000 at full retirement age, reduced by 25% for starting early) the cumulative value of the benefits would be $86,587 by the start of age 70.

To compare, the chart below shows what can be purchased from a commercially available annuity for males and females at age 70 with $86,587, either on a nominal or CPI-adjusted basis. By comparison, the decision to delay Social Security over those years produces an excess payment of $722/month at age 70 (which is $1,320 with delayed retirement credits, plus 8 years of 3%-assumed cost-of-living adjustments to produce a $1,672/month nominal payment, reduced by the $950/month inflation-adjusted payment that would have been available by having started benefits immediately at age 62).

Monthly Annuitization Income of $86,587 For 70-Year-Old