How Conservative Traders Can Benefit From Volatility In A Market Decline

Post on: 2 Июнь, 2015 No Comment

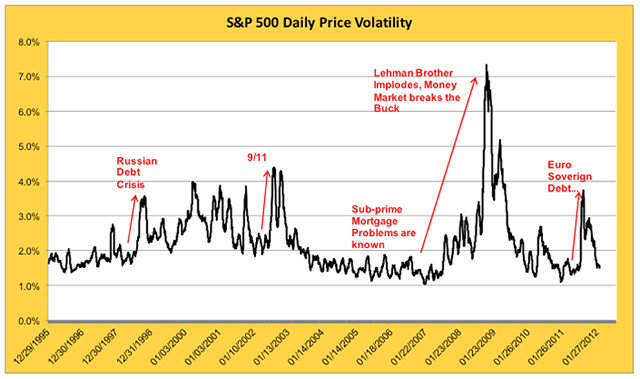

The idea of trading volatility is appealing to many investors. Because volatility rises when prices fall, volatility seems like it should be a hedge against stock market losses. In this way, volatility could act like insurance and deliver profits when stocks deliver losses.

Unfortunately, volatility tends to make quick spikes, and that behavior makes it difficult to profit from the rise in volatility that accompanies market declines. Traders would have to react quickly in market declines buying volatility after it starts to rise and selling volatility after the peak is reached. This would normally require a day trading strategy, and most individual traders cannot watch the markets all day, every day to benefit from relatively rare volatility spikes.

It is also difficult to trade volatility directly. There are a number of ETNs that track volatility, but they all have significant tracking errors and do not move as much as the CBOE Volatility Index (VIX). An ETN is similar to an ETF except that ETNs hold derivatives rather than individual stocks, bonds or physical metals like ETFs do. This makes an ETN riskier than an ETF because the derivatives carry a number of risks related to the creditworthiness of the ETN issuer and the counterparty to the trade.

Even though its tough to trade volatility directly, there are still ways for investors to benefit from the increased volatility seen during market declines. One strategy is to sell put options on a regular basis. When volatility goes up, option sellers receive higher prices for their trades. This strategy requires some effort to understand, but it can help deliver steady gains and reduce the pain of a market decline.

A put option allows the buyer to sell 100 shares of a stock or ETF at a certain price (called the strike price) at any time before the put expires. The put seller receives a payment upfront (known as a premium) for taking on the obligation to buy the stock or ETF at the strike price should it fall below that level before the option expires.

Many investors are nervous to sell puts because theyd be obligated to buy the stock or ETF for more than its market price if the put buyer chooses to exercise the option. However, there are a number of ways to manage the risk, and put selling can actually be used as a conservative income strategy.

Volatility is the largest factor determining the price of a put. Selling a put every month will generate income, and as the market falls, that income rises.

For example, if SPDR S&P 500 (NYSE: SPY) is trading near $185, a put option priced about 5% below that price (at $176) and expiring in one month might sell for about $0.40. Each put contract covers 100 shares of SPY, so selling one contract would generate $40 in income. If volatility holds steady, you could sell a contract every month and generate annual income of more than $480 a year from this trade.

However, volatility will not remain steady. Most months, you will be able to collect the $40 in income. Although it is unlikely, SPY could fall more than 5% in one month. For this example, lets assume the price falls by 10% to $166. If volatility doubled, you would be able to sell a put about 5% below that price (at $157) for about $2.20. As you can see, your income would rise dramatically along with volatility.

This strategy should only be applied to puts on very liquid stocks or ETFs like SPY. To limit the risk, you could use a stop-loss order to buy a put and close an open trade whenever it shows a loss to avoid being assigned shares. Although you would take a loss on that individual trade, you should be able to immediately sell another put to generate higher-than-average income at that time.

This is a more complex strategy, but applying it would allow an investor to earn steady income with only a small risk. Selling options would offset the losses in stocks that occur in a market decline, making it a useful hedge.

Note: Using this strategy is a great way to create income while reducing risk. And over the past year, Ive shown readers how to collect low-risk income every week by stealing thousands of dollars from Wall Street using a similar strategy. I call it the Hestla Heist.

My readers have executed dozens of these quick heists sometimes to the tune of $1,200 or more. If youre interested in learning more about these heists, and making some extra money today, I urge you to check out my presentation here.

Amber Hestla Source: ProfitableTrading