How capital gains and losses are taxed

Post on: 16 Март, 2015 No Comment

Heres how individuals treat gains and losses from dispositions of capital assets.

by Nicholas Fiore, J.D.

While most taxpayers dont think about it, almost everything they own and use for personal or investment purposes is considered a capital asset. When any of these capital assets are sold (or exchanged), the difference between the assets basis and the amount it is sold for is a capital gain or loss. Generally, the basis of an asset is its cost, i.e. the amount paid for it when it was purchased. If a taxpayer sells (or exchanges) the asset for more than its basis, he or she has a capital gain; similarly, if the asset is sold for less than its basis, the taxpayer has a capital loss. Losses on the sale of investment property may be deducted, but losses from the sale of personal-use property are not deductible.

Capital assets

Under Sec. 1221(a), a capital asset is property held by a taxpayer (whether or not connected to a trade or business)with certain exceptions.

Certain types of property are not considered capital assets:

- Inventory, stock in trade, or other property held primarily for sale to customers in the ordinary course of a taxpayers trade or business (Sec. 1221(a)(1)).

- Accounts or notes receivable acquired in the ordinary course of a trade or business for services rendered or from the sale of property (Sec. 1221(a)(4)).

- Depreciable property (and amortizable intangibles) used in a taxpayers trade or business (Sec. 1221(a)(2)).

- Real property used in a taxpayers trade or business (Sec. 1221(a)(2)).

- Certain copyrights and literary, musical, or artistic compositions, and letters or similar property (Sec. 1221(a)(3)).

- U.S. government publications taxpayers received from the government free of charge or below the price sold to the public (Sec. 1221(a)(5)).

- Commodities derivative financial instruments held by commodities dealers, subject to certain exceptions (Sec. 1221(a)(6)).

- Any hedging transaction clearly identified as such before the close of the day on which it was acquired, originated, or entered into (Sec. 1221(a)(7)).

- Supplies a taxpayer regularly used or consumed in the ordinary course of his or her trade or business (Sec. 1221(a)(8)).

Sale or exchange

Under Sec. 1222, the disposition of a capital asset must be the result of a sale or exchange. A sale is a transfer of property for money or a mortgage, note, or other promise to pay money. For tax purposes, the sale or exchange occurs when the benefits and burdens of ownership are transferred. For intangible property, for a sale of the property to have occurred, the taxpayer must have parted with all substantial rights with respect to the property.

An exchange is a transfer of property for other property or services (Regs. Sec. 1.1002-1(d)).

Holding period

Capital gains and losses must be classified as long-term or short-term. If an asset is held for more than one year before it is disposed of, the taxpayers capital gain or loss is long-term. If the asset is held one year or less, any capital gain or loss is short-term. To determine how long the asset is considered held, the period begins the day after the day it is acquired and ends on the day the taxpayer disposes of the asset.

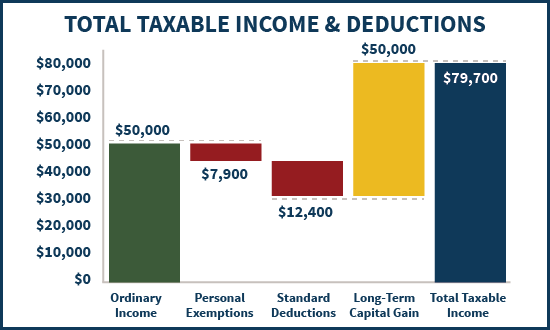

Reporting capital gains and deductible capital losses

As noted, a capital gain is the difference between the taxpayers basis in the property and the amount received when the asset is sold. Capital gains and deductible capital losses are reported on Schedule D, Capital Gains and Losses. of Form 1040, U.S. Individual Income Tax Return. and on Form 8949, Sales and Other Dispositions of Capital Assets.

The tax rates that apply to net capital gains depend on the individual taxpayers income. While the top long-term capital gains rate rose from 15% to 20% beginning in 2013, a zero or 15% rate applies to most taxpayers. (A 25% or 28% tax rate may also apply to special types of net capital gains (see Exceptions below).)

Net capital gains. If a taxpayer has a net capital gain, that gain is usually taxed at a lower tax rate than ordinary income tax rates. A net capital gain is the amount by which a taxpayers net long-term capital gain for the year is more than his or her net short-term capital loss for the year. The term net long-term capital gain means long-term capital gains reduced by long-term capital losses (including any unused long-term capital losses carried over from previous years). For most taxpayers, net capital gain is taxed at rates no higher than 15%. For taxpayers in the 10% or 15% regular income tax brackets, some (or all) net capital gain may be taxed at 0% (i.e. no tax is due on these gains).

Net investment income tax . Beginning in 2013, taxpayers may be subject to a net investment income tax. The tax applies at a 3.8% rate to certain net investment income for individuals (and estates and trusts, but they are not addressed in this article) with income above the statutory thresholds set by the Health Care and Education Reconciliation Act, P.L. 111-152 ($200,000 for single taxpayers; $250,000 for married taxpayers filing jointly or qualifying widow(er); and $125,000 for married taxpayers filing separately).

Exceptions. In some situations, capital gains are taxed at rates higher than the regular capital gain rates (Sec. 1(h)(4)):

- The taxable part of a gain from selling Sec. 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (like coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured Sec. 1250 gain from selling Sec. 1250 real property is taxed at a maximum 25% rate.

In addition, net short-term capital gains are subject to tax at the taxpayers ordinary income tax rate.

Net capital losses. If a taxpayers capital losses exceed his or her capital gains, the amount of the excess loss that can be claimed is the lesser of $3,000 ($1,500 for married taxpayers filing separately) or the taxpayers total net loss (as shown on line 16 of Schedule D).

If a taxpayer has a net capital loss greater than the amount that can be claimed in a given tax year, the portion of the loss not claimed may be carried forward to future years and claimed on future tax returns. To determine the amount that can be carried forward, a taxpayer may use the Capital Loss Carryover Worksheet found in either Publication 550, Investment Income and Expenses. or in the Instructions to Schedule D. This carryover never expires.

Rate this article 5 (excellent) to 1 (poor). Send your responses here .