How Are HighYield Bonds Hurt by Falling Oil Prices

Post on: 26 Май, 2015 No Comment

Key Points

- As oil prices have fallen recently, so have prices of high-yield bonds. While the sell-off in the high-yield bond market has a number of causes, the recent drop in oil prices has played a role. Despite the recent drop in high-yield bond prices, and accompanying higher yields, we’re still cautious on high-yield bonds.

As oil prices have fallen recently, so have prices of high-yield bonds. Are these events connected?

The answer is yes. While the sell-off in the high-yield bond market has a number of causes, such as rich valuations and declining demand from individual investors, we think the recent drop in oil prices has played a role as well.

Lower oil prices tend to hurt energy companies, which can in turn exert a drag on the overall high-yield market because of their sizable share of the market. Despite the recent drop in high-yield bond prices—and accompanying higher yields—we’re still cautious on high-yield bonds. We believe any further declines in oil prices could continue to put pressure on the high-yield market.

Energy companies have increased their debt

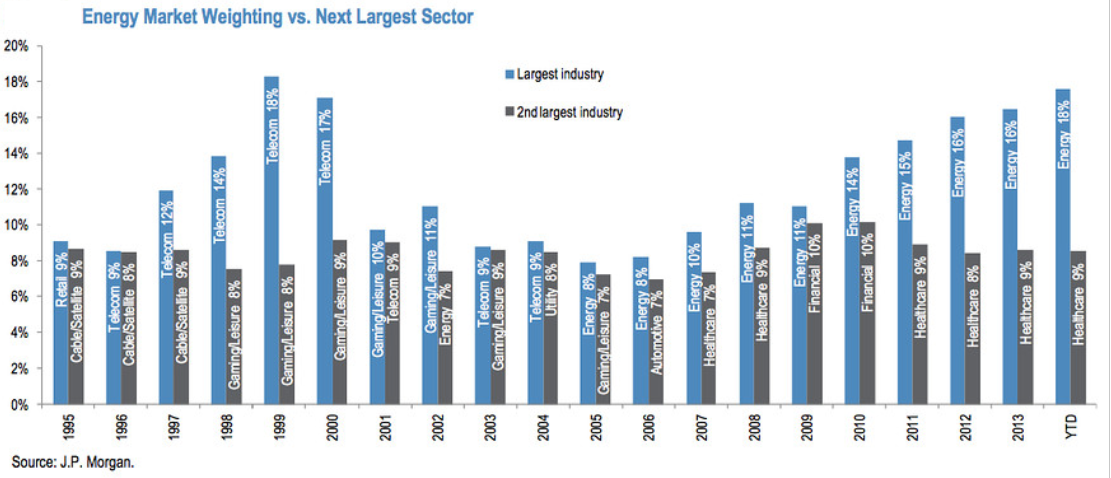

Oil prices can have a broad impact on the high-yield bond market because energy corporations have been increasing their share of the high-yield bond market. Today, energy companies make up more than 15% of the Barclays U.S. Corporate High-Yield Bond Index. 1 That’s up from less than 5% of the index at the end of 2005—and the chart below shows that the share has been steadily increasing over the past decade.

Energy companies make up a rising share of the high-yield bond market

Source: Barclays U.S. Corporate High Yield Bond Index. Columns represent the weight of the energy sector in the index. All columns represent year-end values, except 2014, which is as of October 17, 2014.

In fact, the energy sector now has the second-largest weighting in the high-yield bond index, trailing only the communications sector, which accounts for more than 18% of the index. At the end of 2005, the energy sector was only the seventh-largest weight in the index.

Total crude oil production is expected to average 9.5 million barrels per day in 2015, the highest amount since 1970, up from an average of 7.4 million barrels per day in 2013, 2 according to the U.S. Energy Information Administration (EIA). With that expected increase in production, energy corporations have been borrowing money to expand their facilities and boost their output.

That boost in production may have made sense when oil prices were above $100, but recently they have fallen considerably—a decline of more than 20% —which means the earnings of many oil producers will likely be negatively affected.

Source: Federal Reserve Bank of St. Louis. Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma (DCOILWTICO). Daily data as of October 14, 2014.

The decline in oil prices isn’t the only negative factor for domestic energy companies. On average, cash flow has not kept pace with the cost of operations for most domestic oil producers. For the year ending March 31, the gap between cash from operations and uses of cash for 127 major oil and natural gas companies rose to $110 billion, a six-fold increase from the $18 billion shortfall in 2010, according to the EIA.

That shortfall has generally been met by the increase in corporate debt, as well as the sale of assets. While the sale of assets may boost the cash balance in the short-term, firms are likely giving up future cash flows from the loss of those assets.

Energy companies’ poor performance

The energy sector has been the worst-performing sector of the high-yield bond market over the past few weeks.

From August 31 through October 20, the Barclays U.S. Corporate High-Yield Bond Index has generated a total return of -1.8%. Over the same period, the energy sector of the index performed even worse, falling 4.6%. While the energy sector posted the largest drop, almost all other sectors generated negative returns as well, so even a strategy that avoided, or limited, energy issuers would have likely performed poorly.

The energy sector is dragging down the rest of the high-yield bond market

Source: Barclays, sub-sectors of the Barclays U.S. Corporate High Yield Bond Index. Total returns assume reinvestment of interest and capital gains or losses. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no indication of future results.

Can’t bond investors wary of lower oil prices just avoid the debt of energy companies? While that may be easy for investors who buy individual bonds, an investor in an index fund that tracks the high-yield bond market would likely have increased exposure to this sector. Actively managed mutual funds have the ability to underweight certain sectors and issuers, but they are still likely to have exposure.

Do high-yield bonds offer enough compensation for the risks?

Overall, we still have a cautious stance on the high-yield market in general. Although spreads and yields have risen over the past few months, we still don’t think investors are being compensated enough for the risks involved in high-yield bonds.

The average option-adjusted spread (OAS) of the Barclays U.S. Corporate High-Yield Bond Index was 4.5% on October 20, up from the post-crisis low of 3.2% on June 23. A credit spread, or yield spread, is the amount of yield a corporate bond offers relative to a Treasury bond with a comparable maturity; it can be thought of as compensation for the increased risks that corporate bonds have compared to Treasuries. Based on historical data going back to 1994, the average OAS of the index was 5.2%, so it’s currently below its long-term average.

We still think there is room for spreads to move higher. Since bond prices and yields move in opposite directions, a higher spread would negatively affect the prices of high-yield bonds. The last time high-yield bonds suffered a significant sell-off, during 2013’s taper tantrum, the average OAS of the index got as high as 5.1%, a level we think it could achieve in today’s volatile environment.

A lot of investors who have been reaching for yield may still be in high-yield bonds. While high-yield bond funds have experienced significant outflows over the past few months, the chart below shows that a lot of money is still in the market. If investors continue to head for the exits, prices could fall even further.

Recent outflows are just a fraction of the net inflows since 2009

Source: Morningstar Inc. Lines represent the cumulative net flows into mutual funds categorized by Morningstar Inc. as High Yield Bond from January 2009 through September 2014, using monthly asset flows.

Oil price declines are just one more factor that can negatively affect the high-yield bond market. We are still cautious on high-yield bonds, as the low yields don’t compensate for the increased risks, in our opinion. We still think investors who have been reaching for yield with high-yield bonds should move up in quality to investment grade corporate bonds.

I hope this enhanced your understanding of oil prices and the high-yield bond market. I welcome your feedback—clicking on the thumbs up or thumbs down icons at the bottom of the page will allow you to contribute your thoughts. (If you are logged into Schwab.com, you can include comments in the Editor’s Feedback box.)

1 As of October 17, 2014.

2 Short-term Energy and Winter Fuels Outlook, U.S. Energy Information Administration, October 7, 2014.