How a Private Equity Fund Works

Post on: 20 Сентябрь, 2015 No Comment

Ever wonder how PE firms operate? Michael Collins explains

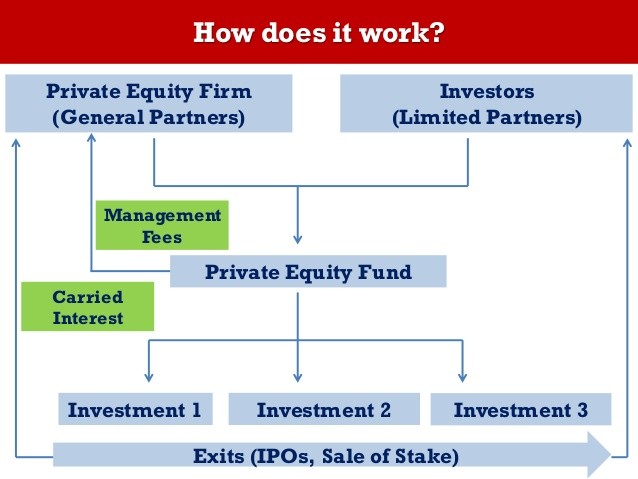

The notion of private equity (PE) buyers being active in the LBM space is well established. However, we routinely receive questions from owners of LBM businesses that are unsure of how PE funds work and how they identify and view the acquisitions they make. The most widely known proxy for a PE fund is a mutual fund. A mutual fund is a pool of capital managed by a small group of experienced investors, who typically invest in publicly traded stocks and bonds. The key difference is that most PE investments are made in privately held companies. Also, where mutual funds can hold certain investments for indefinite periods, the life of a PE fund is usually five to seven years.

There are two primary ways in which PE funds identify companies they wish to acquire. The first approach involves searching for strong companies with great growth profiles, an experienced management team and other factors. Funds using this approach are referred to as working from the bottom up. They look for great companies and then confirm that the overall industry in which those companies operate has tailwinds behind it. The second approach is a top-down methodology that first identifies industries that are poised for strong growth, based on the economic cycle. After identifying a strong industry, these groups then look for the best companies within that industry.

The best news for sellers of LBM businesses is that both of these methodologies have the potential to recommend the acquisition of LBM distributors. The building products industry is poised for a massive cyclical expansion and there are many individual companies in the LBM space that are attractive acquisition candidates. In fact, since the end of the recession, dozens of PE funds that had previously conveyed to us that they were not interested in building products have notified us of their desire to make an investment in the building products industry. Right now, most PE funds are targeting investment returns of 18 to 22 percent per year. This means that they are willing to pay somewhat higher prices for companies than has been the case in the past.

After a PE fund identifies and acquires a company, what do they do with it? Hollywood images of corporate raiders like Gordon Gekko have left many people with the completely incorrect belief that PE funds buy companies in order to break them apart, slash staff or take other undesirable steps. By and large, this is not the case. Five years after a typical company is acquired by a PE fund, it is generating greater revenues, the managers that wished to stay with the company have been able to do so and the company has likely hired many new workers. In most cases, the company will have undertaken one or more acquisitions, which leaves the company with a broader product offering, improved distribution and a generally stronger position in the market. With the exception of distressed investors, most PE funds look for companies that are in good working order and try to improve them. They do not want to take the risk of closing locations, firing workers, changing the business and hoping that the acquisition somehow still works out anyway. Given all of these characteristics, PE funds make very interesting buyers in what continues to be a hot LBM merger and acquisition environment.

Michael Collins is a contributing editor for PROSALES. mcollins@buildingia.com