Housing Analysis An Indepth Look at the Canadian Housing Market

Post on: 8 Апрель, 2015 No Comment

Wednesday, December 03, 2014

An In-depth Look at the Canadian Housing Market

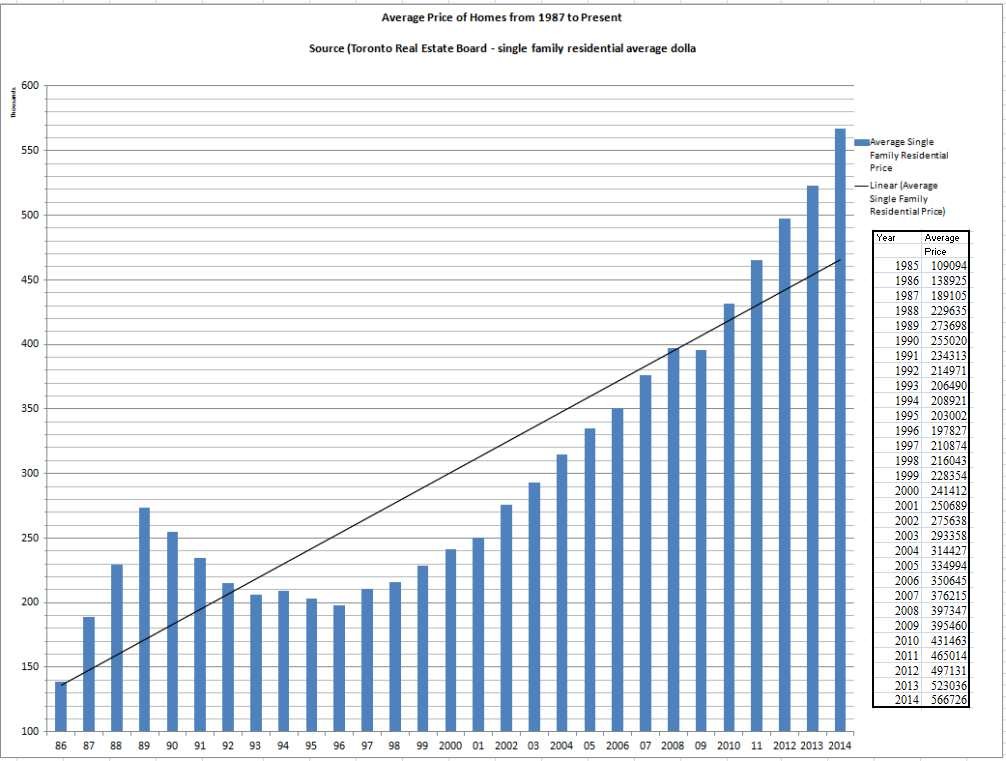

In the last couple of weeks, there has been two excellent reports published on the Canadian housing market one by the Canada Mortgage and Housing Corporation (CMHC) and the other by RBC Global Asset Management. Both are good reads for people who want to dig into the detail and get a better understanding of the many factors that drive housing prices and activity.

Both reports draw conclusions that are consistent with what the real estate industry and banks are saying there are some signs of strain in the market, but the risks are more benign than what the doomsayers like me are suggesting.

CMHCs fourth quarter assessment provides an overview of where we are today (price trends, sales to listings ratios, unabsorbed inventory levels and vacancy rates on rental units). Overall, the report concludes that the Canadian market is not overbuilt and overheated, and only moderately overpriced.

Despite the conclusion, I find the CMHC report less useful in addressing what lies ahead. It uses some sophisticated modeling to measure current valuation, but the interest rate cycle is not discussed. Given that house prices are highly geared to changes in interest rates, some sensitivity analysis would have been useful.

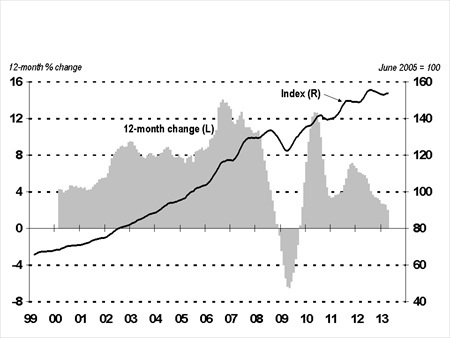

The RBC report is very thorough and attempts to address all of the doomsayers concerns. There are many interesting charts, including the scorecard below:

20housing%20scorecard.jpg /%

I find the authors conclusion (Chief Economist Eric Lascelles) to be surprising in light of this scorecard. He says, Broadly, the near-term outlook appears benign, tilting only slightly in a negative direction. Yes, the near-term is holding up OK, but theres nothing benign about his 1-5 year outlook.

I learned a lot from both reports, but they didnt change my view. There are a number of factors that werent discussed or need more emphasis:

- House prices hinge on mortgage rates that are, by any measure, well below normal levels. Basing the price of an asset on another asset that is overpriced (bonds) is a scary proposition.

- Pricing and market psychology will not be determined by the 72% of homeowners who have more than 25% equity in their house. Rather, it will be driven by the 5% who have less than 10% equity. The mistake forecasters made in the U.S. a decade ago was taking comfort from the majority instead of being wary of the weak minority.

- What is bothersome is the number of factors that are in negative territory. Its possible to explain away one or two ratios that are off trend (which Eric does well), but when theres a wall of them, it gets to be a stretch.

- Even the most positive of analysts have trouble pointing to any factors that are highly positive. The best either report can do is neutral. In my mind, its hard to make a case for investment when there are no positive indicators to offset the risks.

- Theres little recognition in either report of how good the environment has been. These are not normal times. Housing prices have had a howling tailwind at their back subsidized mortgage rates, abundant credit, a growth spurt in the buying cohort (25-34 year olds), rising home ownership and foreign buying. In a few years, well look back and marvel at how good everything was.

- And the one I feel most confident about extreme cycles dont end with benign corrections. It just doesnt happen.