Historical returns from corporate bonds

Post on: 16 Июнь, 2015 No Comment

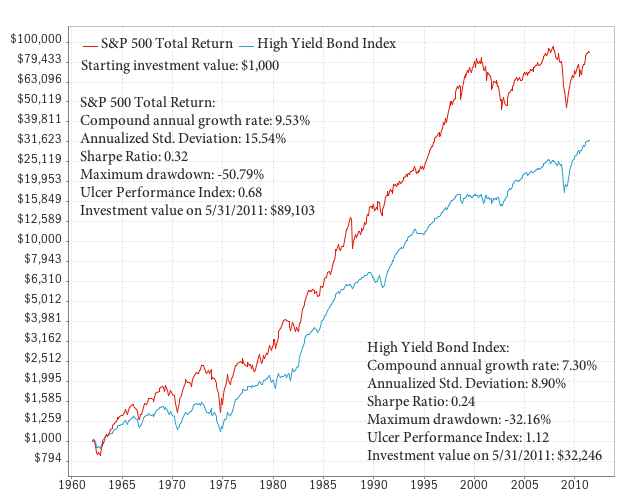

But is the theory right? How have corporate bonds done in reality?

Ive found it very hard to get figures on the long-term performance of stocks versus bonds. Perhaps the financial community would rather sell us corporate bonds than explain why we should or shouldnt buy them? (Perish the thought!)

However, the new 2009 Barclays Capital Equity Gilt Study does give the past 10 years of UK returns for corporate bonds as an asset class and the past 20 years for the US which Ill share below.

Before we get to the numbers though, lets very briefly recap on what we expect to get from holding corporate bonds versus holding equities.

Stocks vs bonds: Risk vs rewards

Corporate bondholders theoretically trade some long-term rewards for taking less risk, as discussed .

Both individual corporate bonds and shares in the same company can become worthless if the company goes bust.

Bonds are less likely to lose all of their value than shares, however, since bond holders rank ahead of shareholders in recovering any assets from a failed company.

And while both bonds and shares can stop paying coupons and dividends, share dividend cuts are more common than bond defaults, for legal as well as other reasons.

In aggregate then, the risks are less for corporate bonds than equities .

Moreover, the nature of bond investment (fixed income and eventual return of capital) mean that corporate bonds are less volatile than equities. (Risk and volatility are often confusingly entwined in investing speak!)

These factors mean that over time wed expect to see:

- Corporate bonds as a class being less volatile than equities (less risk)

- Corporate bonds delivering lower annual returns than equities (less reward)

Corporate bonds versus equities: The actual returns

Uh oh!

Despite all the theory above, corporate bonds have actually beaten equities over the past ten years, as the following numbers from the Barclays Equity Gilt Study 2009 show.

Note: All returns are real returns i.e. they have been adjusted for inflation.

UK real investment returns by asset class (% per year)

Source: Barclays Capital

Obviously the bear market of 2008 hit equities very hard much worse than corporate bonds, which also suffered steep falls due to the credit crisis.

Even over ten years, equities have posted a terrible negative real return of -1.5% per year, whereas corporate bonds have returned a positive 1.2% a year.

Of course, there have been two huge bear markets for shares in the past decade; so what about the longer term?

Unfortunately Barclays Capital has only been tracking the UK corporate bond market since 1990, but for the U.S. it has obtained 20-year data as follows:

US real investment returns by asset class (% per year)

Source: Barclays Capital

Here we see US equities edging ahead of US corporate bonds over 20 years. thanks to the bull market in shares in the 1990s offsetting the more recent bear markets.

US equities have done much worse than corporate bonds over the past decade, just like shares in the UK.

Again, its not what youd expect to see, and if Id written this article in 2007 it would have been a different story.

What can we learn from these longer-term returns?

For anyone who hadnt noticed, the figures are another reminder that stock markets have delivered terrible returns in recent years.

Corporate bonds have done much better, but I dont expect this situation to last.

Rather, I think the past couple of years have been true outliers that are playing havoc with the medium term data.

To quote the Equity Gilt Study:

Gilts [UK government bonds] were the main beneficiary of the financial turbulence of 2008.

With a real annual return of 11.7%, they were not only the best performing asset of the year, but produced the best average annual return over 20 years.

The 20-year average annual return was 5.5% for gilts and 4.6% for the FTSE All Share.

Forget about corporate bonds for a moment it is extremely rare and entirely counter-intuitive that the super-safe security of gilt investing has also delivered better long-term gains over 20 years than equities.

In fact, there have only been three previous occasions when gilts have beaten equities over a 20-year holding period 1932, 1939 and 1940.

Note that even saving cash has hammered holding shares over the past decade in the UK as well as the US. Thats very rare indeed.

My conclusion is that its a good time to buy equities, not corporate or government bonds.

Certainly corporate bonds have rallied hard since I wrote my corporate bonds article in January 2009 saying it looked like one of the rare times when it was a good idea to invest in them on a risk/reward basis.

As a result of the subsequent bond rally, well see lots of corporate bond fund advertising around over the next 12 months quoting impressive figures.

However, I wouldnt expect corporate bonds to very often beat equities over 10 years, and theres even less sense in chasing out-performance from here.

I dont know how the correction will come negative news for bonds like inflation or rising defaults, or maybe a big bull market in shares but Ill eat my hat if corporate bonds continue to beat equities over the next decade.

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.