HighYield Bonds High Risk NotSoHigh Reward

Post on: 24 Апрель, 2015 No Comment

With downside risk high and price gains likely to be low, we advise investors to limit exposure to high-yield bonds.

CFA. Senior Research Analyst, Fixed Income, Schwab Center for Financial Research

Key points

- Investors are putting money into high-yield bonds at almost five times the rate of 2013.

- But with yields near all-time lows, we see little room for prices to rise and plenty of downside risk for high-yield bonds.

- We recommend investors diversify into other sectors or move up in quality, depending on their risk tolerance.

Download White Paper

As the year began, bond investors were looking forward to higher yields that would allow them to generate income of 4% or more without taking on too much risk. After all, the outlook among analysts and economists was that growth would pick up and the Federal Reserve would not keep rates near zero much longer.

This anticipated end of the three-decade bull market in U.S. bonds, however, has failed to materialize so far in 2014. The economy remains sluggish and the Fed’s accommodative policies may remain in place longer than expected.

As a result, yields on most domestic fixed income asset classes remain fairly low even though they’re generally higher today than a year ago. By the end of June, no U.S. Treasury bonds yielded close to 4% (the 30-year bond, the longest Treasury maturity, yielded 3.4% at June’s close and hasn’t been above 4% since late 2011). The Barclays U.S. Aggregate Bond Index, a leading U.S. bond market benchmark, offered a yield of 2.22% at the end of the second quarter.

Still looking for yield

With relatively low rates on highly rated bonds, investors hungry for yield have flocked to high-yield bonds, which in theory compensate investors with higher yields because they have greater credit risk, or potential to default. Over the 12 months ending May 2014, while many domestic fixed income mutual fund asset classes have experienced outflows, investors have pumped money into high-yield investments, according to fund flow data tracked by Morningstar, Inc. This trend accelerated rapidly at the start of 2014investors injected $6.9 billion into high-yield funds from January to May, up from $3.4 billion during all of 2013, Morningstar data shows.

High-yield bonds now are in a precarious position. As investors have taken a shine to them, they have bid up prices close to record highs. That’s not a great place to be. Bond yields have much more room to rise than falland since prices fall when bond yields rise, there is little potential for price appreciation.

Spreads have narrowed

As yields on Treasury and high-grade corporate bonds have inched up from record lows over the past year, the yields on high-yield bonds have barely budged. As a result, the difference, or spread, between them is not as pronounced, which means there’s less of a premium for the additional risk of high-yield bonds. And overall corporate fundamentals are beginning to deteriorate. Those two trendsdeteriorating fundamentals and narrow spreadsincrease the potential for high-yield bond investments to fall in value.

Let’s first look at the spreads between different types of bonds. After hitting a 2013 low of 1.63% on May 2, 10-year Treasury yields ended 2013 at 3.03% and then settled back to about 2.5% by the end of this June. The yields on most fixed income investments are tied to Treasury yields. As result, they also have dropped from their 2013 peak, but are still well above the lows of 2013.

That is not the case with high-yield bonds. The average yield on bonds in the benchmark Barclays U.S. Corporate High Yield Bond Index hit a record low of 4.95% in May 2013. About a year later, at the end of June 2014, the yield was still at 4.91%. That means investors in high-yield bonds today would be locking in roughly the same low rates as they could have last year. By contrast, investors in investment-grade corporate bonds and Treasuries would be taking advantage of higher rates than they could have a year earlier.

At close to historic lowshovering around 5%the yield for high-yield bonds doesn’t seem like enough compensation for the accompanying risks. This is especially relevant in light of deteriorating corporate fundamentals.

Issuers have taken on more debt

At first glance, the fact that U.S. corporations have increased their cash positions significantly since the financial crisis is a positive for corporate bond investors. That is because firms with higher cash and cash-equivalent balances generally are in a good position to pay their bond interest and principal.

One reason corporate cash balances are so high, however, is that companies have been taking advantage of low interest rates to issue more debt. But Corporate America hasn’t necessarily tapped into the bond market to increase its capital spending and expand. In many cases, companies are issuing debt and keeping much of the cash on their balance sheets.

According to Federal Reserve data, the amount of cash on nonfinancial corporate balance sheets rose almost 30% to $1.47 trillion at the end of the first quarter of 2014, up from $1.13 trillion the end of 2007. But the amount of corporate bonds outstanding increased even more during the same time periodabout 77% to $6.60 trillion, up from $3.73 trillion at the end of 2007.

We don’t expect to see a sharp increase in the amount of defaults by high-yield issuers in the near future. But the increase in debt might be problematic.

Demand remains high

Another concern is that because of the strong demand for high-yield bonds, some companies have been able to tap into the market despite having questionable balance sheets. If investors weren’t so eager to find yield, we think that some issuers may have been unable to issue new debt.

That strong demand has allowed issuers within the high-yield sector to offer weaker investor protections. New-issue high-yield bonds have increasingly become covenant lite. That means the set of terms that governs what the issuing firm can or can’t do with regard to its debt has become weaker and offers investors less protection.

We think investors are also shrugging off liquidity risk, or the risk that they won’t be able to sell without taking a loss. The harder it is to sell a security or the greater the loss in value resulting from a sale, the greater the liquidity risk. High-yield bonds generally have a limited investor base because many institutional investors, among others, are prohibited from buying them. With a smaller pool of buyers, prices have the potential to drop sharply when investors head to the exits.

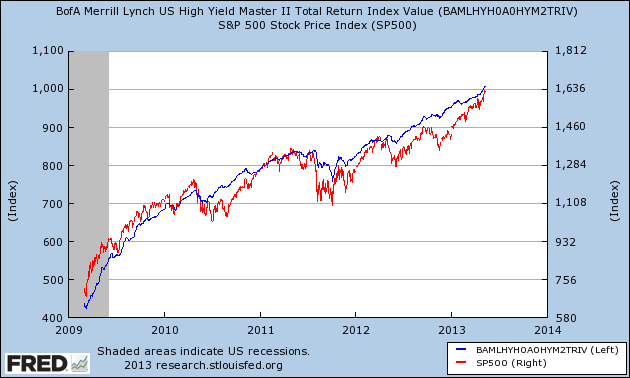

This means liquidity can play a major role in performance. We saw this in 2008, when the total return of the Barclays U.S. Corporate High Yield Bond Index was -26%.

The outperformance of lower-rated segments of the high-yield market, like those rated CCC, reveals the persistence of demand for high-yield bonds despite the risks. Total returns for CCC-rated bonds were 10.25% in the 12 months ending May 31, compared with 7.63% for B-rated bonds, data from the Barclays U.S. Corporate High Yield Bond Index shows.

If the economy, or investor sentiment, hits a speed bump or changes, there is a good chance for increased volatility—if not losses—in this market.

What should investors do now?

With little room for price appreciation in high-yield bonds, we prefer investment-grade bonds. That might mean investors are locking in lower yields, but we believe that will reduce risk.

All investors may want to reduce their exposure to high-yield bonds. Conservative investors can reduce their exposure to high-yield bonds and instead move up in quality to investment-grade corporate bonds or other broad investment-grade strategies that may mimic an aggregate bond index.

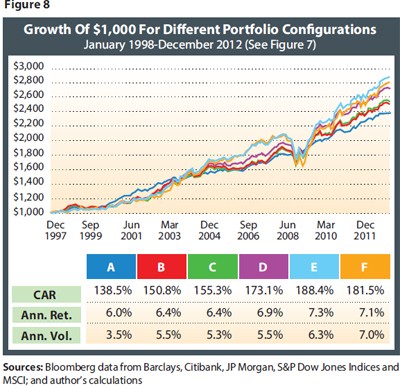

More aggressive investors might want to consider diversifying across several sectors—such as investment-grade corporate bonds, emerging market debt, and international developed market bonds. A multi-sector bond fund could provide sector diversification.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by visiting Schwab.com or calling Schwab at 800-435-4000. Please read the prospectus carefully before investing.

Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or lower than the net asset value (NAV).

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Potential share price movements of long-term bond funds cause greater risk to principal than with shorter-term funds.

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner or investment manager.

Barclays U.S. Aggregate Bond Index covers the USD-denominated, investment-grade, fixed-rate and taxable areas of the bond market.

The Barclays U.S. Corporate High-Yield Bond Index covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Diversification does not eliminate the risk of investment losses.

Lower-rated securities are subject to greater credit risk, default risk, and liquidity risk.

Past performance is no guarantee of future results.

The Schwab Center for Financial Research is a division of Charles Schwab & Co. Inc.