Highyield bonds Back on the junk

Post on: 27 Июль, 2015 No Comment

Add this article to your reading list by clicking this button

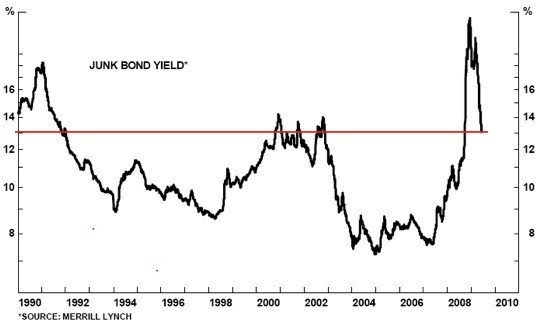

IN ONE of the most eye-popping episodes of the financial crisis, high-yield bonds—those rated “junk”, or below investment grade—traded at an average interest rate of more than 20 percentage points above Treasury bonds in late 2008 as investors dumped risky assets. The junk-bond markets subsequent rebound has been nearly as dramatic. So much so that some reckon it is ripe for another fall.

High-yield bonds returned a handsome 15% last year after a stunning 58% in 2009. The extra interest rate that investors demand to hold junk has fallen to its lowest since late 2007 (see chart). Borrowers have rushed to take advantage of strong demand: after record issuance in 2010 the pace has accelerated in the first two weeks of 2011. This is a bonanza for investment banks, which earned $5.8 billion in junk-bond fees last year, the most ever and $1.5 billion more than they made from investment-grade bonds, according to Dealogic.

Borrowers are keen to strengthen their balance-sheets while the going is good, by replacing costly debt with cheaper, longer-term paper. Last month Novelis, an aluminium company, borrowed $2.5 billion, allowing it to rejig a “tower of debt” due in 2014-15 over a much longer period, says Steve Fisher, the chief financial officer. Kenneth Trammell, his counterpart at Tenneco, which makes emission-control systems, calls a recent $500m issue a “no-brainer” that saved $9m in annual interest costs.

In this section

Bulls point to a sharp decline in distress. The global high-yield default rate, 13.1% in 2009, was just 3.1% by the end of 2010. Moodys expects it to fall further this year to 1.9%, the lowest in two decades. High-yield strategists predict that 2011 will be a solid year, with returns of 8-10%.

Optimists also point out that spreads over Treasuries, which investors care about more than absolute interest rates, are near their historical average and double their pre-crisis lows. Using a model that crunches default risk, credit availability and other measures, Martin Fridson, a veteran junk-watcher at BNP Paribas, deems the market pretty fairly valued. “Whatever the future may hold, pundits who are bearish on high yield cannot justify their stance on grounds of valuation,” he asserts. “Given where the fundamentals are, the spread is actually a touch more than it should be.”

Perhaps, but risks lurk. Investors should worry about the loosening of bond covenants (restrictions that borrowers accept on leverage and the like) over the past year—an echo of the frothy days of 2006-07. Novelis negotiated an “extremely attractive” package that gives it more flexibility in some respects than it would have had before the crisis, says Mr Fisher.

Some strategists are telling clients to shift into equities, which tend to outperform corporate debt in economic expansions, not least because acquisitive firms bid up targets share prices. And if the recovery stumbles, so might junk bonds. A deepening of the euro crisis could push high-yield default rates back above 6%, reckons Moodys. Jim Casey, co-head of leveraged finance at JPMorgan Chase, the leading underwriter, sees no bubble but admits that “the opportunities have diminished in recent months and the risks have grown.”

Some see higher interest rates and inflation as the big threats. As rates rise, older bonds with lower coupons are worth less to their holders. This should be part of every bond-buyers calculus. But wrenching rate rises can still wreak havoc. Junk bonds have historically been less sensitive to interest-rate swings than Treasuries or high-grade corporate debt, because their prices are more closely linked to the credit quality of individual issuers. Nevertheless, an inflation scare accompanied by a tightening of monetary policy is, as a banker puts it, the markets “potential nemesis”.