Hidden Risks In EmergingMarkets Debt

Post on: 27 Август, 2015 No Comment

By Patricia Oey

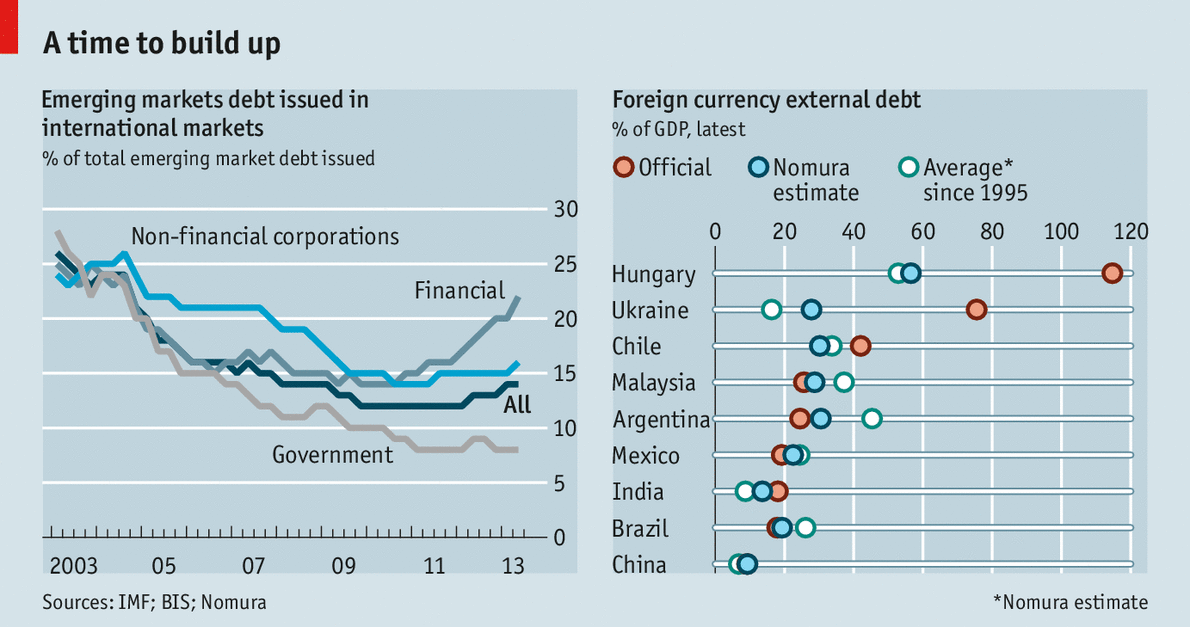

Emerging-markets bonds, along with other higher-yielding fixed-income assets such as junk bonds and bank loans, have seen a surge in flows in recent years. Investor interest has been driven in large part by persistently low yields across the developed world. Growing demand for emerging-markets bonds also reflects a confluence of other fundamental factors. Emerging sovereigns’ fundamentals have been improving, global financial markets are becoming increasingly integrated, and local-currency debt markets in many emerging nations are deepening and maturing. According to Morningstar Asset Flows data, the U.S. emerging-markets bond category had average annual inflows of slightly less than $1 billion from 2000 to 2008. This figure spiked to $28 billion in 2012. Emerging-markets debt is also increasingly finding its way into nonspecialist bond-fund managers’ portfolios, as represented by its growth as a percentage of assets in fixed-income fund categories such as world-bond funds and nontraditional bond funds.

Overcrowding?

Are emerging-debt markets able to accommodate these crowds? The International Monetary Fund’s semiannual Global Financial Stability Report highlighted a number of trends on the topic. While the growing presence of foreign investors has contributed to the development and expansion of emerging-debt markets, this has also resulted in the asset class’ greater sensitivity to changes in global risk appetite. In particular, retail investors, as well as non-emerging-markets specialists, are more susceptible to herding behavior, which can further amplify volatility during periods of sudden market shocks. Another key issue is the increasingly restrictive regulatory environment across the world, which has served to reduce liquidity and dealer inventory in global bond markets. Global banks are less active in making markets in bonds, and hedge funds are trading less. This decline in market liquidity in emerging-markets bonds might serve to exacerbate volatility during periods of stress. While the conclusions of this IMF paper focused primarily on policy recommendations, the takeaway for investors is that global portfolio fund flows are likely to add a unique dynamic and risk (in addition to credit, duration, inflation, and currency risk) to emerging-markets debt.

The Fed’s announcement regarding the tapering of its asset purchase program in May 2013 and the resulting market volatility likely prompted the IMF’s research into this topic. From early May through the end of June 2013, hard currency and local currency emerging-markets debt fell 9% and 10%, respectively, as measured by the J.P. Morgan EMBI and JP Morgan GBI EM Indexes. These sharp declines reflected the markets’ concern that a tightening of global liquidity could stem the flows into emerging markets, which in turn might further weigh on a weakening growth environment in the developing world. This shock helped expose the pockets of fragility within the emerging-markets universe—namely Indonesia, India, South Africa, Turkey, and Brazil. These countries all exhibit some combination of high inflation, weakening growth, and rising current-account deficits. They experienced sharp foreign portfolio outflows and rapidly declining currencies through the summer of 2013. But over the past nine months, the equity markets of India and Indonesia have rallied strongly, not on improving fundamentals, but on the promise of reforms by newly-elected leadership in both countries. Brazil has staged a much smaller recovery, in part due to the carry trade, as real interest rates in Brazil are currently significantly higher than those in the developed world. Extremely low rates in the developed world continue to support foreign investors’ risk appetite, which has in turn helped support these recent trends.

This complacent attitude may be masking growing risks. It is true that defaults and devastating financial crisis are much less likely than they were just 20 years ago. Thanks to low market volatility, risk appetite is high and investors continue to reach for yield. Even if the U.S. begins to raise interest rates in the coming years, it is likely that Europe and Japan will keep rates low for a longer period of time, which may help sustain the relative appeal of emerging-markets bonds. If excessive risk-taking continues to drive inflows in the coming years, investors may want to heed some of the concerns highlighted by the IMF. A major shock, such as a sudden spike in oil prices or a financial crisis in China, could prompt very large outflows that could be more damaging to the asset class than the taper tantrum of 2013.

Investment Options

At present, there are five Morningstar medalists among mutual funds in the Morningstar Category of emerging-markets bonds. Additionally, our passive strategies analysts currently cover five exchange-traded funds in this category.

Hard-currency sovereign emerging-markets bonds are simply credit products with no direct foreign currency risk, as the bonds are priced in U.S. dollars (or euros). Hard-currency debt is currently yielding around 5% (as measured by the J.P. Morgan EMBI Index), reflecting about a 260 basis points spread over U.S. Treasuries. Like the rest of the credit universe, spreads are low relative to history and have narrowed as a result of investors’ demand for higher-yielding instruments. It is also important to note that hard-currency emerging-markets bond funds may be more sensitive to rising rates as they have average durations of around seven years, which is longer than the average high-yield or intermediate-bond fund’s five years.

Spreads on local-currency sovereign debt are a bit more difficult to evaluate because yields are primarily driven by local monetary policies and yield curves. Over the past year or two, local-currency sovereign debt yields have trended higher as governments sought to address higher inflation and other imbalances in their respective economies by raising rates. While local-currency-denominated funds tend to have shorter durations of around four years and slightly higher yields relative to their hard-currency peers, investors need to consider if they are being fairly compensated for taking on foreign currency risk.

- Source: Morningstar and Company Reports

Disclosure: Morningstar, Inc. licenses its indexes to institutions for a variety of reasons, including the creation of investment products and the benchmarking of existing products. When licensing indexes for the creation or benchmarking of investment products, Morningstar receives fees that are mainly based on fund assets under management. As of Sept. 30, 2012, AlphaPro Management, BlackRock Asset Management, First Asset, First Trust, Invesco, Merrill Lynch, Northern Trust, Nuveen, and Van Eck license one or more Morningstar indexes for this purpose. These investment products are not sponsored, issued, marketed, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in any investment product based on or benchmarked against a Morningstar index.