Hedging Bond Risk With Inverse ETFs

Post on: 14 Июль, 2015 No Comment

Bond investors may be exposed to more risk than they realize and they may not know what to do about it. Here we discuss a strategy that may help cushion a bond portfolio if rising rates drive down bond prices:

First, let’s take a look at the historical landscape for U.S. bonds.

What’s Next for Bonds?

Bonds are often viewed as a critical component of a diversified asset allocation strategy, potentially providing a steady income stream and stability to a portfolio.

Bonds performed well for more than 30 years. The 10-year U.S. Treasury Bond returned approximately 8.8% annually from 1981 to 2013—outperforming the S&P 500’s annualized return of 8.2% (calculated using price returns). But bond prices don’t always go up.

Rates Up, Bonds Down

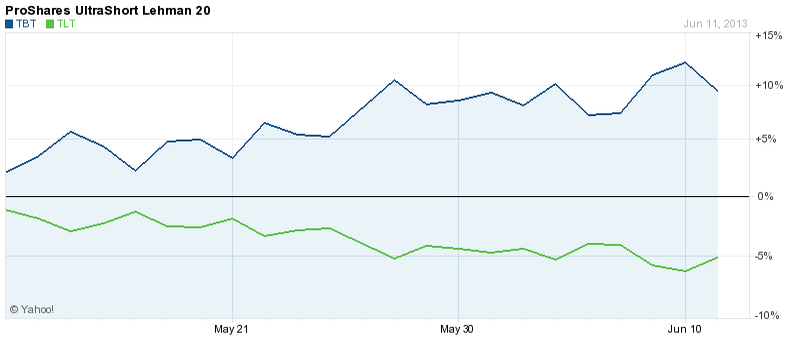

Bond prices and yields generally move opposite each other. As shown above, bond yields fell to historically low levels as bond prices climbed. Experts have raised concerns about the sustainability of low interest rates. If rates increase, bond yields are likely to rise, triggering potentially significant losses in bond portfolios.

Measuring the Impact

An increase in interest rates will generally drive down the price of a bond. To quantify the potential impact of rising rates on your portfolio, it is helpful to look at duration.

Duration is a measure of the sensitivity of the value of a bond (or bond portfolio) to a change in interest rates and the yields of securities with similar characteristics. Higher duration generally means greater sensitivity.

- As a hypothetical example, the 30-year U.S. Treasury Bond, with a duration of 18, will be about twice as sensitive to a change in yield as the 10-year U.S. Treasury Bond, which has a duration

of 9.

Even a small shift in yields could trigger a substantial change in the value of your bond portfolio.

How sensitive might your portfolio be to changes in yields? The table below shows what could happen to the value of bond portfolios of varied durations given a range of changes in yields, all other things being equal.