Hedge Funds The Due Diligence Process

Post on: 16 Март, 2015 No Comment

The hedge fund due diligence process begins with understanding the characteristics being considered for each portfolio. Understanding the objectives of the portfolio is the key to defining criteria for the proper hedge fund investment. This is one area where the tail should not be wagging the dog. (Learn more in Hedge Fund Due Diligence .)

Define Measurement Criteria

Criteria should be defined in both quantitative and qualitative metrics. The criteria that one can use to measure hedge funds (or any other investment, for that matter) should include: returns, volatility, liquidity terms, fund size, longevity, investment style, investment strategy, fees and asset class. The main objective to consider is whether a hedge fund meets most, if not all, of the criteria set forth in the search. An attractive hedge fund that does not meet the needs of a portfolio may be detrimental to the objectives of the overall portfolio. (Take a basic look at DD examinations in Due Diligence In 10 Easy Steps .)

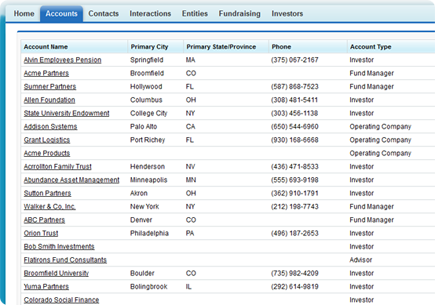

Once the criteria are clearly defined, there are a variety of databases that contain thousands of hedge fund names and performance data. Such databases include HFR, Hedgefund.net, Morningstar, and CS/Tremont. The number of hedge funds under consideration can be efficiently reduced using any number of filters available on some of the websites or through third-party providers such as Pertrac.

In addition, there are a number of hedge fund marketers that can help find suitable candidates, or they can be found within the platforms of the larger institutional brokerage firms or other industry contacts. There is no shortage of resources to find suitable hedge funds, but it is critical to understand the proper criteria to more efficiently use the resources available.

Requesting Information

The next step in the due diligence process is to contact the hedge fund manager and request information. The most common package of information sent by hedge fund managers includes a one-page summary of performance; a pitchbook (usually a PowerPoint presentation) that describes the firm, its strategy, principals, performance and terms of the investment; offering memorandum ; subscription documents; and a due diligence questionnaire (DDQ). The hedge fund may send all of these at once or on request. Initially, an analyst should make sure they receive the pitchbook, offering memo, and DDQ. These three documents should serve as a good starting point to better understand the hedge fund manager and generate additional questions that can be addressed during the conference call. (To learn more about conference calls, read Conference Call Basics .)

The preliminary analysis involves confirmation of the fund’s performance to ensure it is consistent with our expectations. We can then review the pitchbook to understand the underlying strategy that generated those returns and to help us identify hedge fund peers with similar strategies. As mentioned in an earlier section of this tutorial, many hedge fund databases characterize hedge funds into certain buckets defined by strategy and/or asset class.

Analyzing Information

The first level of analysis is to compare our hedge fund to those within the same category. The pitch book will then help further refine the strategy so we can selectively pick a more concentrated group of funds for comparison to determine how our fund performed versus other funds with similar strategies. Recall that each hedge fund has unique attributes but for the sake of comparison, we will use our judgment to define a suitable list of comparable funds.

Once we have evaluated the fund’s performance and determined that it has performed well relative to our criteria and relative to other similar funds, we can schedule a conference call with the manager to ask additional questions that have arisen during our preliminary analysis. The conference call should be held with the portfolio manager, or rather, the person making investment decisions.

Later in the due diligence process, we will address questions geared toward back-office and operations personnel. For now, we want to understand the manager’s investment methodology, his or her thought process and how well each articulates ideas. Keep in mind that a manager won’t reveal any proprietary secrets, but he or she should still be able to describe how returns are generated to a level of detail that allows us to determine whether the process makes sense, and more important, whether the process is repeatable. The conference call should last about 45 minutes to one hour. (Learn more in Evaluating A Company’s Management . Top 9 Questions Investors Should Ask Management and Why Fund Managers Risk Too Much .)

Qualitative Factors

So far we have focused on mostly quantitative factors for our analysis and although these are very important, we do not want to ignore the intangible issues related to hedge fund investing. There are too many to detail in this tutorial but should include, at a minimum: contagion risk, the risk that unrelated factors could impact the fund; geopolitical risk, particularly for funds with global mandates; manager’s education and previous experience; operations staff skills and background; staff levels and capacity for growth; and office space and working environment. (To learn more about evaluating your hedge fund, check out Taking A Look Behind Hedge Funds .)

In most cases, we cannot accurately assess some of the qualitative factors until we conduct an office visit, which should be mandatory before making an investment in any hedge fund. Even hedge funds on the platforms of the large institutional brokerages should go through the due diligence process we’ve discussed. Although the institutional brokerage has conducted their own due diligence, keep in mind that they receive a fee for selling the fund to interested investors.

Finally, we should perform a thorough background check on all of the firm’s principals to ensure they do not have any outstanding liens or issues that would affect our decision to invest money with them. A thorough background check can also provide information that allows us to assess a fund manager’s character and style of living. There are third-party service providers that conduct thorough background checks on individuals, and if you don’t have the resources to conduct public record searches yourself, this will probably be the best option.

Third-Party Service Providers

There is another aspect of due diligence that often gets little attention, and that is to make sure the third-party service providers are up to snuff. It isn’t as crucial that third-party service providers are evaluated inside and out like we would the hedge fund firm. However, while there are some high-quality service providers to the hedge fund world, there are others that do not provide the level of service required to properly manage a portfolio of hedge funds.

Third-party service providers can include auditors, accountants. NAV calculators, hedge fund marketers, attorneys, custodians, and prime brokers. to name a few. The implications of a prime broker being affected by counterparty risk and affecting a hedge fund’s investments are crucial. And a less serious impact is a delay in the NAV calculation, which prevents us from finalizing our monthly performance and, in turn, delays our reports to clients. The client won’t know or care that the delay was caused by another party and it could affect our service levels and reputation as well.

Conclusion

When performing hedge fund due diligence, it’s important to know everything that’s going on with the hedge fund and with the hedge fund management. As we saw here, due diligence is about both quantitative and qualitative aspects of the hedge fund. Thorough due diligence should be performed before an investor gets involved with any investment, especially hedge funds.