Hedge Funds Higher Returns Or Just High Fees_1

Post on: 19 Май, 2015 No Comment

What is a hedge fund?

A hedge fund is an investment fund that uses advanced investment strategies, and invests in just about anything (for example: debt , shares , and derivatives ). It is mostly available to wealthy investors looking for higher returns than stocks and bonds. Hedge funds don’t use the traditional ‘buy, hold, sell’ strategy, but employ alternative strategies like short selling, leverage, or trading in derivatives. Hedging is a type of transaction to reduce risk by carrying out an offsetting transaction in another market. Many hedge funds use derivative products to hedge other positions. It is not protection against loss. The term hedge fund can be misleading because many hedge funds do not use hedging or offsetting transactions to reduce risk. Some even use traditional hedging transactions to expose themselves to additional risk, rather than to offset existing risk.

Hedge funds typically require higher minimum investments than regular funds. The net asset value of a hedge fund can run to billions of dollars.

Hedge funds are usually structured as open mutual fund trusts or limited partnerships and are issued by way of a private placement using a prospectus exemption , sometimes with an offering memorandum , which offers less investor information than a prospectus.

The three main categories of hedge funds are:

- Stand-alone hedge funds that depend on the investment decisions of a single fund manager

- Fund of hedge funds that invests in units of other hedge funds with multiple managers

- Principal-protected products, which are funds or other financial instruments that allow investors to participate in the returns of the underlying hedge fund, but with a guaranteed return of their original investment at maturity

What risks do they have?

Investing in hedge funds is not for everyone. Most hedge funds are not subject to specific regulation and are highly risky due to their speculative nature.

Some hedge funds reduce some of the risks by diversifying, or investing in a broad range of investments. Other higher-risk hedge funds use short selling and derivatives. One of the biggest risks is that many funds that call themselves hedge funds are simply high-risk funds that do not use any strategies to reduce risk.

The level of risk depends on the fund, the types of investments used, and the fund manager’s skill.

The following factors contribute to the risky nature of these funds:

- Lack of transparency: private entities have few public disclosure requirements

- Lack of regulation: hedge funds are subject to very little oversight by regulators

- Risky underlying investments: hedge funds can invest in risky products, such as complex derivatives , taking on their risk

- Leveraging : hedge funds often borrow money or trade on margin

- Short selling : short sellers may misjudge the price of the assets and incur a loss rather than profit

- Volatility: use of call options or put options can result in large losses

Can you sell them easily?

Every hedge fund is different. Some hedge funds have liquidity restrictions that, for various reasons, may not allow you to sell when you would want to. As a rule, hedge funds are more difficult to sell than traditional mutual funds. Some funds have a ‘lock up’ period, a set period of time when investors cannot sell or redeem shares.

What are the costs?

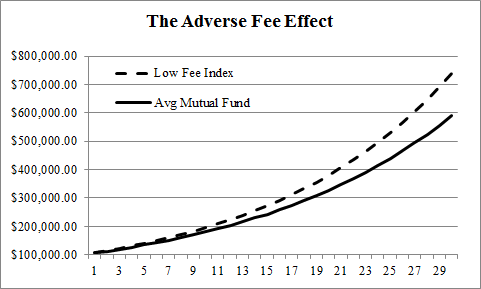

Fees are tied primarily to performance. Hedge fund managers typically charge a performance (or incentive) fee in addition to the management fee. Management fees on average are 2% of the fund’s net asset value.

The manager’s performance fee is calculated as a percentage of the fund’s profits and is typically about 20%. Some funds also charge a redemption fee if you withdraw money from the fund. Most hedge funds use the highest asset value previously seen. If the fund falls in value, a performance fee is not charged until the fund returns to the previously set high asset value.

Read the product disclosure statement to make sure you understand the fees and compensation structures, and to make sure that you are getting value for the fees you are paying.

What are the expected types of returns?

As with regular funds, hedge funds distribute their profits each year. This is normally reinvested in fund units automatically. Hedge funds do not pay interest. In addition to any distribution of profits you may receive, you will make money when you sell your fund for more than you paid.