Hedge Fund Operational Due Diligence What Managers Need to Know

Post on: 16 Март, 2015 No Comment

By Kaleigh Brousseau,

Thursday, November 11th, 2010

The information below was derived from the expert panelists who spoke at Eze Castle Integrations November 10, 2010 event in New York City, Hedge Funds: Examining Operational Risk and Due Diligence .

The subject of hedge fund operational due diligence is one that has risen to the forefront for both hedge fund managers and investors in recent years. Prior to the economic downfall in 2008 and high-profile investment scandals made infamous by Bernard Madoff and others, hedge fund due diligence was viewed as an unnecessary assignment.

Historically, there has been a general lack of transparency within the hedge fund industry; larger funds, particularly, used to balk at investor inquiries. They figured there would never be a shortage of investors, so there wasnt a need to spend extra time satisfying their needs.

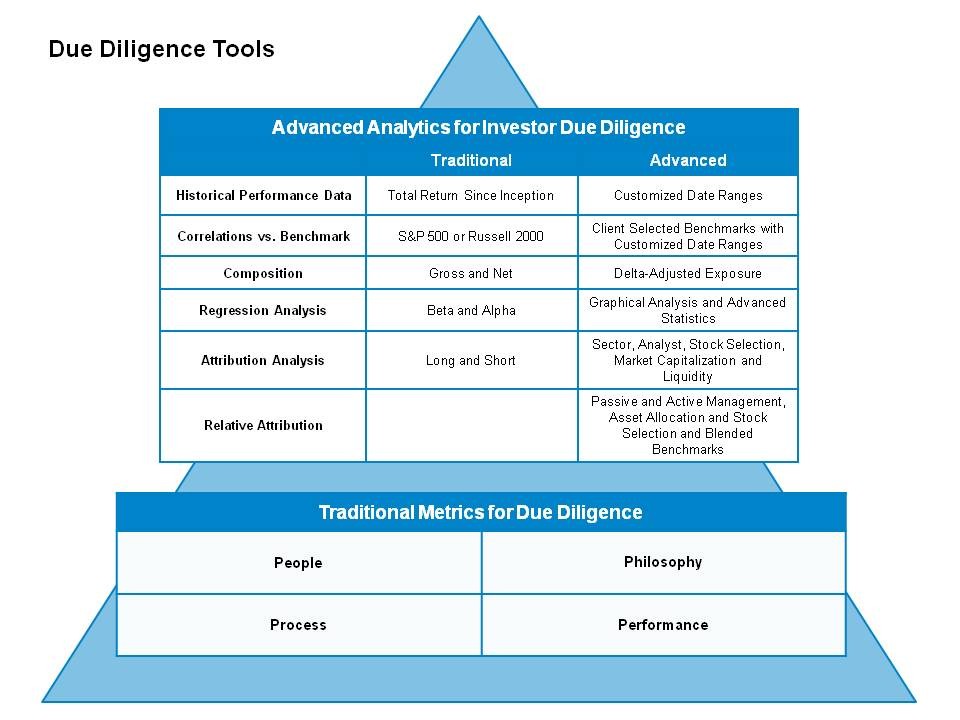

Due diligence, as a process, did not gain significant importance until recently. In the past, the responsibilities associated with hedge fund due diligence would often fall under the role of a CFO, CCO or other executive someone who had very little time to devote specifically to due diligence. But as the hedge fund industry has evolved over the last several years, so has the need and desire for operational due diligence.

So what exactly has changed?

It seems that both hedge funds managers and investors are now taking due diligence seriously, and making conscious steps to maintain open communication and increase information-sharing. According to experts in the industry, there has been a significant increase in the number of due diligence inquiries by hedge fund investors, and the questions they are asking are much more relevant and involved. Hedge funds are engaged in due diligence sessions on a regular basis. Many funds now have personnel on staff solely devoted to due diligence; others are hiring consultants to ensure theyre covering their bases.

Operational excellence has become one of the most important factors to hedge fund investors today as they determine where to allocate their money. They want more information, more transparency and more assurances that hedge funds have done their own due diligence in assembling and managing their businesses.

Here are a few questions hedge funds should be prepared for from potential investors:

Who has the power to move money?

What is your valuation policy?

How often do you test your disaster recovery system . Can you walk me through the procedures?

What redundancies do you have in place in the event of an outage or disaster?

What service providers are you engaged with and how do you determine their quality of service?

For more insight into what questions investors are looking for answers to, view the Managed Funds Associations Model Due Diligence Questionnaire for Hedge Fund Investors .

Technology Considerations for Hedge Fund Due Diligence

Investors need to understand why hedge funds have made each of their operational choices, including when it comes to technology. Small-scale disasters, such as the New York City blackout in 2003, and larger incidents like the Madoff scandal have initiated a real shift in the hedge fund industry and highlighted the need for hedge funds to have robust technology solutions in place and systems and procedures to keep them operational.

Investors have become much more aware of technology and how important a role it plays in the day-to-day operations of a hedge fund. During the due diligence process, they often ask to see systems at work, the processes through which data is transmitted and stored, and how testing procedures work. There is a major focus on four critical areas of technology:

Data Protection/Disaster Recovery

Communications (Voice, Internet, FIX connectivity, market data)

Applications (order management systems, portfolio management systems, accounting applications, customer relationship management systems, etc.)

Business Continuity Planning

Hedge funds should be prepared to recover from both short- and long-term disasters and be prepared to outline their processes and procedures (in writing!) to investors.

Due Diligence Recommendations for Hedge Fund Managers

Below are some actionable recommendations for hedge fund managers preparing for the operational due diligence process:

Know your investors. Understand what their goals are. If you dont know what they are, ask them!

Educate your investors. Explain the designs and processes of your operations, particularly when it comes to your technology.

Outline your technology budget. If you do not have an in-house IT staff, you can ask your technology service provider to do this for you.

Document everything. Written results are the best way to impress investors.

Be transparent. You will score points with investors if you are up front about everything and dont attempt to hide anything.

Complete a DDQ. A due diligence questionnaire is a great exercise for funds to complete. You can also compile a comprehensive presentation or simply have an open question and answer session with your potential investors.

Try a mock due diligence review. Hire a consultant to help you with this it is the single easiest way to prepare for a real investor review.

Communicate with your service providers. Dont be afraid to call them if you need clarification on their systems/processes/documentation/etc. Ask your technology provider to create a technology blueprint for you.

Test, test, test. Test your disaster recovery system frequently (at least quarterly), and show the results to investors.

Make operational excellence a priority. Investors want to see that funds are serious and that they value operations and technology as vital aspects to their businesses.

Whats Next for Hedge Fund Due Diligence?

Hedge fund due diligence is not one questionnaire or one presentation. It does not begin when an investor comes in for a meeting and end when they walk out the door. Due diligence is an ongoing process that can continue to improve and evolve as investors and fund managers open the lines of communication and maintain an open dialogue. Hedge funds should continue to take the time to understand where the real risks are within their businesses and work to instill confidence with their investors. Disaster recovery and business continuity planning should be viewed as a full business exercise, not solely a technology one.

Hedge fund operational due diligence is an opportunity and a marketing exercise one that funds should undertake with educated personnel and a willingness to be open and transparent. Whether youre a small start-up fund or a large existing presence in the industry, your goals remain the same: Protect your business. Invest in operations and technology that will keep you functional and efficient. And be open and communicative with your investors. Your due diligence test begins today.

Keep Reading.

Hedge Fund Due Diligence Guide: Top 10 List