Hedge Fund Due Diligence_4

Post on: 19 Май, 2015 No Comment

Hedge Fund Due Diligence in the New Normal: Insights from a Japanese Plan Sponsor Forum

Article Main Body

In November 2012, PIMCO held a forum for Japanese corporate plan sponsors in Tokyo. Bruce Brittain, a member of PIMCO’s Solutions Group, presented to the group on the state of the hedge fund industry, addressed specific concerns of plan sponsors and introduced the firm’s approach to helping clients conduct better due diligence on their hedge fund managers. The following article is adapted from his presentation.

Japanese corporate plan sponsors have increasingly turned to hedge funds in search of equity-like returns with less volatility than traditional stock investments. Indeed, a recent Greenwich Associates Japan survey indicates 75% of Japanese plan sponsors already invest on average more than 15% of the value of their portfolios in alternative investments, mostly in hedge funds, which account for nearly 10% of portfolio value.

While the same survey indicated plan sponsors intend to increase their investments in hedge funds – and do so by reducing commitments to domestic and international equity – we at PIMCO have heard questions and concerns from these important investors that will play a large part in determining their future allocations to hedge funds.

Among them:

- Why are many hedge funds failing to meet their stated return objectives?

- Why have returns correlated with equities especially in crises?

- What do these correlations say about systemic risk posed by and to hedge funds?

- Why do liquidity terms in many hedge funds extend beyond the liquidity of the underlying instruments and of the strategies employed?

- Can disclosure be improved and complex strategies better explained?

- How are hedge fund opportunities changing?

In addition to doubting that hedge funds can produce elevated returns in light of such growth, these questions show that Japanese plan sponsors are concerned about whether hedge funds can achieve their objectives at all – after all, many hedge funds posted losses during the financial crisis, and their correlations with risk assets such as equities and credit-sensitive securities were also high during the worst of the crisis. How can expectations of such robust growth be reconciled with such dramatic underperformance?

New Normal expectations

First, we would like to suggest that growth of hedge fund commitments may overstate the growth in demand for scarce manager alpha: Growing demand for equity hedge funds may be a better indication of where investors believe good equity ideas can be captured as much as a conviction in the skills of some managers. Indeed, equity investors appear to be pursuing a barbell strategy, shifting capital both to purely passive strategies on the one hand and to active equity management on the other. These investors appear to be acting on the conviction that skillful traditional equity managers who underperform in “style-box-oriented mandates” may be able to outperform in unconstrained, hedge fund investing styles, as PIMCO’s Andy Pyne wrote in a Viewpoint article, “Equity Investing: From Style Box to Global Unconstrained,” May 2012.

Regardless, we are optimistic that this New Normal world of slowing and shifting growth offers attractive opportunities, but we would encourage investors to take a more restrained view of possible hedge fund returns. We also believe it’s worth commenting on how the crisis has empowered investors to change their approach to their managers and the consequences of increasingly sophisticated techniques of manager due diligence.

The hedge fund opportunity set has changed meaningfully since the global financial crisis. Standbys of the pre-crisis world, such as merger and convertible arbitrage, seem less promising – if only because there are few mergers to arbitrage and few convertible bonds to hedge. In the current environment, more likely sources of opportunity are in global macro, relative value, opportunistic, volatility and credit-oriented styles in addition to some more complex equity styles. Here are some of the important factors molding the opportunity set:

- Economic policymakers have become substantially more active in markets. The crisis conditions of 2008–2009 evoked a dramatic policy response, and persistent slow global growth has sustained policy activism. Broadly speaking, this policy activism has repressed interest rates globally, suppressed the volatility of financial instruments – particularly interest rates at the short end of government bond yield curves – and, in most cases, dramatically increased the volume of government borrowing. Policy-induced shifts in important market prices and in the volatility of markets should create opportunities for hedge fund managers attuned to macroeconomic developments

While investors believe that the hedge fund opportunity set is robust, realists are also reducing their expectations for the absolute level of long-term hedge fund returns. Most believe that hedge fund investments can outperform traditional investments by some considerable margin. But most of us also accept that bond returns are unlikely to exceed 3% and equity returns are unlikely to exceed mid-single digits over a secular investment horizon of three to five years. Realistic capital market expectations will ultimately lower the absolute return threshold that investors can demand and expect from skilled managers.

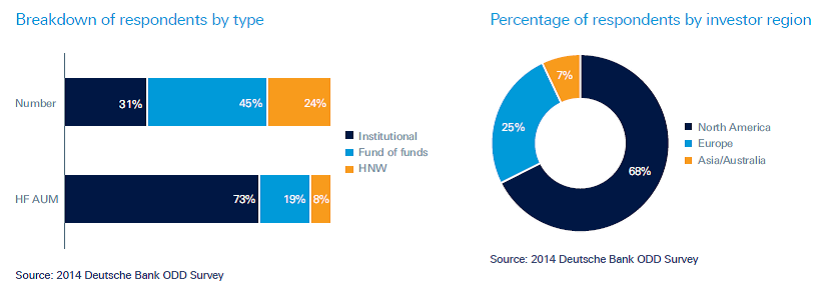

The financial crisis also has had a profound effect on the quality of due diligence procedures that investors now demand before investing in alternative strategies. Ironically, the crisis, which did so much damage to investor portfolios, has also empowered investors to assert themselves more aggressively with their managers. They have, in addition, engaged more aggressively with their gatekeepers, including funds of funds and a growing consulting community. More transparency is foremost on the list of demands, followed by better risk oversight and more thorough operational due diligence. The consequences are consolidation within the hedge fund of funds industry, strong preference for larger rather than smaller hedge fund managers, preference for managers with institutional platforms and the growth of a vibrant consulting community that offers well-researched and understandable explanations of managers’ complex investment styles. In response, many managers, particularly those with institutionally oriented platforms, have taken a more thoughtful approach to providing portfolio transparency and to offering liquidity terms aligned with the liquidity of the underlying strategy.

Post-crisis realism has also driven institutional investors to invest with fewer hedge fund managers, and most of these managers are large. These larger hedge fund complexes also tend to have greater concentrations of manager skill and more experienced researchers than was the case before the crisis. These groups monitor hedge fund portfolio risks ever more actively as managers accede to requests for greater transparency. These funds of funds can also specialize in particular niches of the market and charge lower fees. Increasingly, funds of funds complement portfolios that hedge fund investors assemble on their own.

For all of the advances that the investing community has made in understanding hedge funds, the seemingly intractable problem of hedge fund exposure to systemic risks remains. Crises of 1998 and 2007–2009 drove home the lesson that sharp reductions in market liquidity can produce disastrous effects on hedge fund investment portfolios. Market insight suggests that systemic risk expresses itself through “catalysts,” nominally excessive leverage and “crowdedness” of hedge fund trades, as noted by Amir Khandani and Andrew Lo, “What Happened to the Quants in August 2007?” The most recent and obvious example of a catalyst would of course be the collapse of the subprime mortgage market. After a catalytic event, banks and their prime brokers initially call for collateral from managers who, unable to meet calls directly from the portfolios involved, unwind more liquid strategies. Copycat positions across the industry force adverse results on other managers, initiating a spiral of further collateral calls and additional market declines.

PIMCO’s Solutions Group

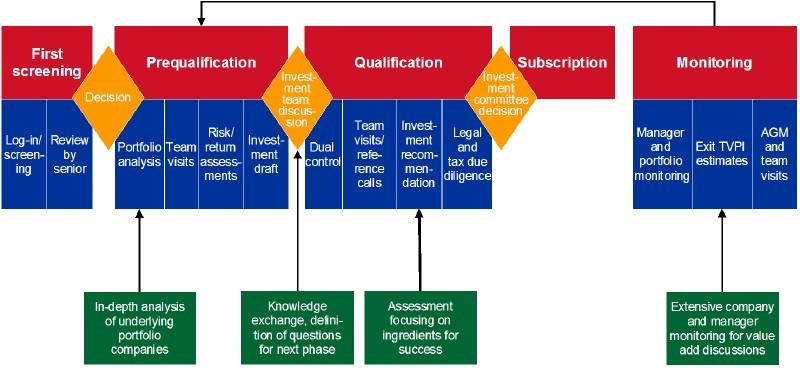

To help hedge fund investors triangulate the risks expressed in their portfolios and refine their manager due diligence, the PIMCO Solutions Group is offering an approach developed by our analytics team and drawing on resources across the firm, including more than a decade of managing hedge fund portfolios ourselves. This experience has helped us modify our analysis and make it immediately relevant to the concerns of hedge fund investors. The obvious caveats are that we don’t manage portfolios in all investment hedge fund styles and can’t undertake subjective manager due diligence on our competitors.

An example of the kind of analysis we provide can be seen in Figure 1, which ranks manager returns in a sample client portfolio by the significance of manager alpha. We focus on the significance of manager alphas, the proportion of manager returns explained by alpha and by beta, measures of risk-adjusted return and the attribution of risk-adjusted return to alpha and beta. The spirit of our analysis is to learn as much as we can about the risks in a client’s hedge fund portfolio from the time series of manager returns provided to us. Our basic analytical tool is a multivariate regression of manager returns on various betas, and we employ a broad array of statistical techniques to glean as much information as we can about the sources of manager risk and return. We don’t report actual numbers in this table but color code the actual results – green indicates the particular value of an indicator is toward the more desirable end of the range in this portfolio, red indicates the measure is toward the less desirable end. Put simply, if the movement of market betas explains all of a manager’s returns, you might want to reconsider your investment.

The object of the statistical analysis is to suggest areas for further due diligence and possible reallocations of investor capital. Why stop at suggestions for further due diligence? Because the techniques we use are best for hinting at possible weaknesses in managers’ investment processes. Identifying whether managers truly have skill is largely a matter of subjective due diligence.

The best way to select such managers, we believe, involves three steps: reviewing managers’ results, formulating questions about the persistence of alpha and the role of beta in their investment strategies, and testing these questions in a rigorous due diligence process. PIMCO’s Solutions Group aims to help interpret manager results and point our clients in the direction of more informed hedge fund investing decisions.