Hear The KaChing As The Air Leaks Out Of The Bond Bubble iShares 20 Year Treasury Bond ETF

Post on: 11 Июль, 2015 No Comment

Can you hear it? It’s in the air, it’s on the news, and it’s staring us in the face in the charts. The sound we have begun to hear, since mid-November, 2012 is the gradual leaking of the air out of the great Bond Bubble that has lasted over 30 years.

Here is what this powerful animal looked like during this period. This chart illustrates the collapse of interest rates. As interest rates move inversely to the price of a bond, bond prices soared as rates cratered during this period.

Charts courtesy of Yahoo Finance.

Interest Rate History: the Ups and Downs of it All

In the mid-1970’s, the U.S. was suffering runaway inflation that routinely increased prices in the double digit range. In some part, it was kicked off by the Arab oil embargo. OPEC decided to choke off supply to the west. Demand for oil continued to increase and as a consequence, oil and gasoline prices skyrocketed. These increases seeped into our fossil fuel-based economy and pushed the prices of everything sky-high.

Then president, Gerald Ford, tried to stop the inflation by jawboning. His administration gave out buttons for the populace to wear, proclaiming Whip Inflation Now. It was dubbed the WIN campaign; it didn’t work.

Then chairman of the Fed, Paul Volcker, took over the reins and decided the only way to wring the horrific inflation out of the economy was to remove the punch bowl. He tightened monetary policy and squeezed the money supply like a vise.

With less money available to chase the same amount of goods and services, prices started to come down. With less money in the system, the economy began to slow. A contracting economy led to less demand for money.

This reduced demand for money resulted in interest rates finally beginning their descent, from 15% on the 30 year treasury, all the way down to the recent historic low of around 2.45% reached only 7 months ago.

Fight the Fed? I don’t think so.

The old saying, Don’t fight the fed, was as true then as it is today. Long treasurys purchased at par ($100 face value per bond) anytime around 1981-1982 saw their value soar to around $180 by 2010. Those having long bonds now have seen them soar in value again from 2010 to date, as the yield has gone from the 5% neighborhood down to the low of 2.45% (bond prices move inversely to yields).

The many signals the economy has given in the past several months, trumpeting a more durable recovery has served as the starter’s pistol in the bond pits. As the economy gains strength and convinces Fed chairman Ben Bernanke that our economy has legs and can stand on its own without further government stimulus, he will gradually start to remove the punch bowl of monetary stimulus.

Once the economy kicks into high gear, demand for money will reignite as companies require funds to expand, and consumers feel more confident to borrow and spend. Workers will continue returning to the work force. adding more spending power and borrowing back into the economy.

This virtuous cycle has begun and interest rates have begun their march upward.

Note how the long bond touched the historic low of around 2.45% in August 2012 and has steadily made its way up to 3.15% today. This is a dramatic 28.6% increase in yield, with a commensurate fall in the price of bonds.

The air leaking out of the bond bubble will get louder and the pressure escaping will intensify, probably over the next 30 years as these interest rate cycles appear to trace such a path.

Buy government bonds today at your peril

At 2.45%, or even today’s 3.15%, the long bond, and every other note and bill that the US government sells today has a negative yield. When inflation at 2% is figured in, and taxes on your interest are accounted for, the interest you receive on these government securities buys you less and less. Basically, you’re giving an interest free loan to Uncle Sam and receiving less buying power in return.

The Game Plan: Profit from the eventual collapse in the long bond

As interest rates rise, as they eventually must with the strengthening of the economy, you can position yourself now to profit from this pivotal point in the economic cycle. Some smart hedge fund managers, John Paulson among them, used instruments to position themselves for the credit crunch and eventual housing collapse of 2008-2009. They made billions for themselves and their investors.

There are instruments available for you to position for this interest rate event too.

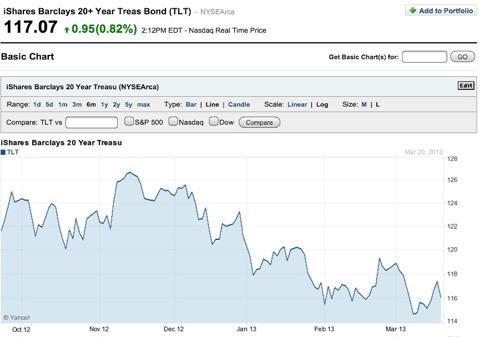

This is a chart of a long bond US Treasury ETF, iShares Barclays 20+ Year Treasury Bond, (NYSEARCA:TLT ) available to be traded freely and easily by anyone, just like a stock.

This ETF tracks closely the price movement of the 20 year US Treasury bond. Notice that since mid-November 2012 the price of this ETF has cratered from around $127 to $116. Shorting this ETF in mid-November until now would have resulted in a gain so far of 8.66%.

Now, look at a chart of another ETF, ticker symbol (NASDAQ:DLBS ).

This is a 6 month chart of the iPath US Treasury Long Bond Bear. This ETF has short positions in the long bond, betting, as we are, that the long bond will decline as interest rates rise. Notice again, since mid-November 2012, the price of this ETF has risen from approximately $26.25 to $29.74 today, an increase in value so far of 13.3%.

Look at the overlay comparison of these 2 ETF’s compared to the interest rate movements on the US Long bond over the past 6 months:

Note as the interest rate on the 30 year treasury has been rising since mid-November, the TLT price has been dropping in a mirror image. Since it so closely tracks the long bond, shorting TLT is an excellent way to position for profit from this trade.

Here is a 6 month chart of DLBS overlaid on the 30 year long bond yield:

It is clear that since DLBS shorts the long bond, and long rates have been rising while the value of the long bond has been falling, the DLBS shows very close correlation. Purchasing of this short ETF allows you to play the same trade, only from a different perspective.

Slow and Steady Wins the Race

The potential gains on this trade are very large. The largest profit will not come overnight. Patience and time will allow this trade to blossom and be very fruitful.

Risks to This Trade

Profit from this trade will not arrive on a schedule, nor will it show a consistent, straight path to the top. It will be a slowly developing trade, with ups and downs along the way. Should you believe that the economic cycle is still intact, as I do, then rest assured that in time this trade will yield handsome profits.

Because time is such a factor in this trade, it is suggested that the investor devote only a small portion of investable funds, say 10-20% of his portfolio, to this trade. Let time and the steady healing of our economy do its work for you on this trade.

Recommended for your further due diligence, purchase DLBS and short TLT.

As sure as the sun will rise, interest rates will too.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Conduct in-depth research on TLT and 1,600+ other ETFs with SA’s ETF Hub