Harrisburg Pennsylvania Votes to Explore Bankruptcy Bloomberg Business

Post on: 8 Май, 2015 No Comment

Sept. 29 (Bloomberg) — Pennsylvania’s capital city of Harrisburg, faced with $43 million in bond payments due before year-end, rejected a state-funded financial adviser and plans to seek advice on entering bankruptcy court protection.

The City Council’s 5-2 vote last night to hire bankruptcy advisers resisted a personal plea from first-year Mayor Linda Thompson. Harrisburg needed state aid two weeks earlier to avoid becoming the second-largest borrower to default on a general-obligation bond this year.

“The whole world is watching Harrisburg,” Thompson said in a 40-minute speech to the council, where she sat until becoming mayor in January. “Our bondholders are looking to make us the poster child of the world to municipalities in financial difficulties. And they don’t plan on losing.”

Harrisburg, with 47,000 residents, has missed about $8 million in debt-service payments this year on more than $200 million of bonds issued in connection with a trash-to-energy incinerator. The seat of the sixth most-populous U.S. state’s government faces lawsuits over the debts from its home county of Dauphin and Assured Guaranty Municipal Corp. a bond insurer.

Councilor Brad Koplinski, who proposed considering bankruptcy and voted in favor of hiring advisers, said it would take a “devastating tax increase” to cover the debts.

Bankruptcy Not Fatal

“I’m not going to have that $210 million payment on the backs of taxpayers,” he said in an interview after the vote. “Bankruptcy, I don’t think, would kill our city. I think the tax increases would kill our city.”

Council President Gloria Martin-Roberts said she feared that bankruptcy would prompt retaliation from Hamilton, Bermuda-based Assured Guaranty and holders of the debt.

“I’m very concerned that bondholders are going to get sick and tired of what they think is a shell game, and lower the boom on us,” said Martin-Roberts, who voted against the proposal to hire bankruptcy advisers.

“Assured Guaranty is probably a little less assured today than they were a little earlier in the day,” Chuck Ardo, a Thompson spokesman, said after the vote.

The company is “disappointed” with last night’s vote, Betsy Castenir, an Assured spokeswoman, said by e-mail. The company backs some of the debt connected with the incinerator, owned by the independent Harrisburg Authority.

‘Inability’ to Cooperate

“The City Council has once again demonstrated its inability to work with the mayor to take concrete steps to develop a restructuring plan that allows the city and the authority to meet their obligations to bondholders, AGM and the county,” Castenir said.

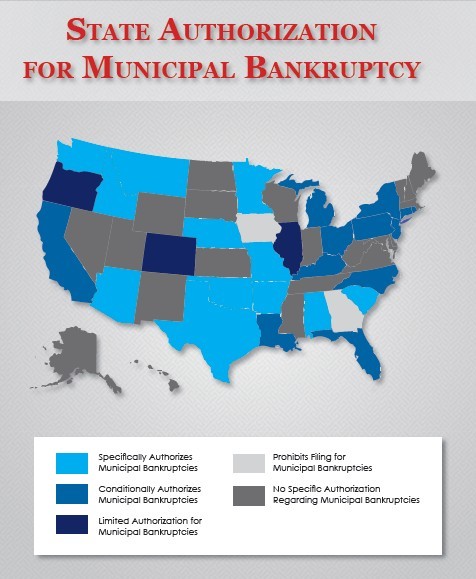

Should Harrisburg seek bankruptcy, it would be only the second community in the state to do so. Westfall Township, in northeastern Pennsylvania’s Pike County, entered Chapter 9 court protection last year in the face of a $20 million legal judgment, about 20 times the town’s annual budget. The case was resolved earlier this year.

Under the resolution voted on in Harrisburg, the city may seek state oversight and technical assistance from Pennsylvania in lieu of bankruptcy, under the so-called Act 47 program set up to help financially troubled communities regain stability.

In February, Harrisburg’s credit rating was cut to B2, five levels below investment grade, by Moody’s Investors Service. The company said the city’s strategy for managing the incinerator debt was “weak” and raised prospects for default. The firm no longer rates Harrisburg debt, according to spokesman John Cline.

Accelerated State Aid

The city notified bondholders Aug. 30 that it didn’t have the funds to make $3.3 million in payments due Sept. 15 on its 1997 Series D and 1997 Series F bonds. The payments were made after Governor Ed Rendell accelerated $3.6 million in state aid.

For the third time this year, the city won’t be able to make a $637,500 installment payment due Oct. 1 on a loan from Covanta Holding Corp. of Fairfield, New Jersey, Thompson said in an interview. Covanta runs the city incinerator.

Meanwhile, Automatic Data Processing Inc. of Roseland, New Jersey, the city’s payroll processor, agreed to produce paychecks even though it hasn’t been paid $13,000 for prior work, the mayor said. That averted the prospect that Harrisburg workers won’t be paid today, Thompson said.

To contact the reporter on this story: Dunstan McNichol in Trenton, New Jersey, at dmcnichol@bloomberg.net

To contact the editor responsible for this story: Mark Tannenbaum at mtannen@bloomberg.net