Gundlach Mortgage Bet Best of Bond Funds Riskless Return Bloomberg Business

Post on: 7 Апрель, 2015 No Comment

DoubleLine Capital LP Chief Executive Office Jeffrey Gundlach achieved his results buying mortgage-backed securities, blending together packages of home loans with different risk qualities. Photographer: Scott Eells/Bloomberg

June 5 (Bloomberg) — Jeffrey Gundlach, explaining why he named his firm DoubleLine Capital LP, compared running a fund to driving on a winding mountain road where a motorist mustn’t cross “the double line into the oncoming lane of risk.”

So far, he’s proven to be a skillful driver. His $41 billion DoubleLine Total Return Bond Fund returned a risk-adjusted 11 percent over the past three years, best among comparable funds run by managers such as Bill Gross of Pacific Investment Management Co. and Tad Rivelle of TCW Group Inc. Gundlach had the second-highest absolute return while keeping price swings below average in a group of 27 rivals, according to the BLOOMBERG RISKLESS RETURN RANKING.

Gundlach, 53, achieved his results buying mortgage-backed securities, blending together packages of home loans with different risk qualities. He has supplemented that work with prescient calls, including a prediction in 2011, the year Gross stumbled, that the U.S. economy was weakening and interest rates would fall. This year, Gundlach is sounding a similar alarm, warning of the riskiest assets such as subprime securities in what he believes is a worsening economy. He put half his fund’s assets in government-backed mortgages and debt as of April 30.

“The market is euphoric today,” Gundlach said in a telephone interview. “I think people are wrong. The global economy is slowing.”

‘Fascinating Combination’

At the DoubleLine fund, which opened in April 2010, Gundlach has built a portfolio that mixes government-backed mortgages and non-agency mortgages, debt that isn’t guaranteed by the U.S. government. The government mortgages behave like U.S. Treasuries and rise in price when the economy weakens, Gundlach said. The non-agency debt does best in a strong economy when housing prices climb and defaults ebb.

“They make a fascinating combination, with different risks and rewards,” said Gundlach.

Navigating the market by adjusting investments in both types of debt has helped Gundlach steer DoubleLine Total Return to the best risk-adjusted performance among total return bond funds with at least $1 billion in assets. The fund returned 34 percent on an absolute basis in the three years ended June 3, with volatility of 3.2, for a risk-adjusted gain of 11 percent.

The total return category includes funds that invest in intermediate-term, investment grade bonds — core holdings for investors seeking to put money into fixed income — and excludes municipal bond funds and funds with less than $1 billion in assets.

JPMorgan, Pimco

The $9.5 billion TCW Total Return Bond Fund, run by Tad Rivelle, ranked second, gaining 8.5 percent when adjusted for volatility. Rivelle, the chief investment officer for fixed income at Los Angeles-based TCW, took over the fund in December 2009 after TCW fired Gundlach following a dispute.

The $4.2 billion JPMorgan Mortgage-Backed Securities Fund ranked third with a risk-adjusted gain of 8.3 percent, combining below-average returns with the second-lowest volatility in the group.

Gross’ $285 billion Pimco Total Return Fund ranked 19th in the group with a volatility-adjusted gain of 4.2 percent, hurt by subpar performance in 2011 when it trailed 70 percent of rivals, according to data compiled by Bloomberg. Gross also suffered relative to Gundlach because of a smaller allocation to non-agency mortgages. At the end of April, Gross’s Total Return Fund had 5 percent in that asset class compared with 26 percent for Gundlach’s fund.

Mortgage Rally

The risk-adjusted return isn’t annualized. It’s calculated by dividing total return by volatility, or the degree of daily price variation, giving a measure of income per unit of risk. Higher volatility means the price of an asset can swing dramatically in a short period, increasing the potential for unexpected losses.

Gundlach had the best risk-adjusted return in 2010 and ranked second in 2011. He more than tripled the performance of the Barclays US Aggregate Bond Index, before adjusting for price swings, in the last nine months of 2010, capitalizing on a rally in both types of mortgages.

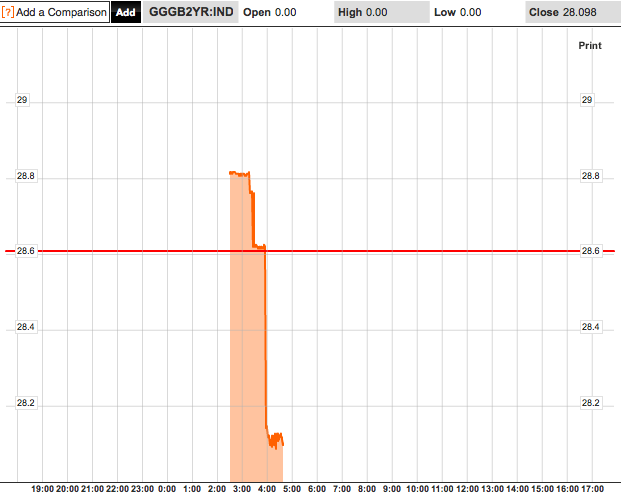

In 2011, he beat the index and peers in total return by boosting government-backed securities from 41 percent of his fund to 47 percent between April and October. Gundlach sought to take advantage of falling interest rates in 2011 as the yield on the 10-year U.S. Treasury note dropped from 3.3 percent to 2.1 percent over that six-month stretch, according to data compiled by Bloomberg.

‘Stinker’ Year

DoubleLine Total Return had a total return of 9.5 percent in 2011, compared to 4.1 percent for Rivelle’s TCW Total Return and 4.2 percent for Gross’s Pimco Total Return. Gross called his performance in 2011 “a stinker” after missing the rally in U.S. Treasuries.

Last year, the DoubleLine Total Return fund rose 9.2 percent, compared with 13 percent for Rivelle’s fund and 10 percent for Gross’s Total Return fund. Gundlach said he trailed some rivals after taking far less risk.

“People who took huge risks in 2012 had huge returns,” he said. “We don’t take huge risk so we just had great returns.”

U.S. mortgage-backed securities, about 48 percent of Gundlach’s portfolio as of Dec. 31, rose 2.6 percent last year, while bonds that benefit from an improving U.S. economy, including high-yield bonds and non-agency mortgages, soared. High-yield debt gained 16 percent and non-agency mortgages were up 30 percent, according to TCW and Bank of America Merrill Lynch indexes.

TCW Struggle

Gundlach started DoubleLine in 2009 after he lost an internal struggle for leadership at TCW, which fired him and sued for theft of trade secrets. He countersued, arguing that TCW owed him money. The suits were settled in 2011.

Gundlach built his reputation as a mortgage investor at TCW, where he ran the Total Return Bond Fund for 16 years. He said he was struck by the fact that mortgages consistently exhibited lower volatility than other categories within fixed income. He concluded that mortgages also offered an opportunity to outperform if one studied consumer behavior and the pace at which homeowners refinanced.

In 2006, just as U.S. home prices peaked, Gundlach predicted that housing was entering a slump that would last until at least 2010. He told Barron’s in a December interview in 2006 that Federal Reserve Chairman Alan Greenspan was “out of his mind” to suggest that home prices had stabilized.

‘Silly Optimism’

“This is the kind of silly optimism that one would expect from somebody who’d just passed his real-estate brokerage exam and was hoping to drum up some business,” Gundlach said.

Gundlach mostly escaped the housing downturn, with his fund at former employer TCW gaining 1.1 percent in 2008. Gross, who was also early in forecasting the housing collapse, had a gain of 4.8 percent in his fund that year, according to data compiled by Bloomberg.

In his last 10 years at TCW, ending in 2009, Gundlach had the best risk-adjusted returns among major total return bond funds, Bloomberg data show.

“He is the preeminent expert in mortgages,” Joshua Emanuel, chief investment officer with Elements Financial Group LLC in Irvine, California said in a telephone interview. Emanuel, who oversees $400 million, is an investor in DoubleLine Total Return.

Gundlach isn’t buying the prospect of a strengthening economy, even as many economists and investors are bullish. Economists surveyed by Bloomberg expect interest rates to climb and the global economy to pick up steam in the second half of 2013. Laszlo Birinyi, president of Westport, Connecticut-based Birinyi Associates Inc. among the first to advise buying U.S. stocks before the bull market began in 2009, reiterated in May that the Standard & Poor’s 500 Index may climb to 1,900. The S&P closed yesterday at 1,631.38.

Government Backing

DoubleLine Total Return had 50 percent of its assets in government-backed mortgages and other government debt as of April 30, the second-highest monthly level in the fund’s history, company data show. The yield on the 10-year U.S. Treasury note reached 2.17 percent May 28, the highest in more than a year. Gundlach said that while rates might go higher in the near term, he expects the 10-year Treasury yield to drop to 1.7 percent by the end of the year.

“It’s a horrible time to be exiting bonds at this moment,” Gundlach said yesterday during a webcast with investors.

In a September interview posted on DoubleLine’s website, Gundlach said he was reluctant to “bet the farm,” on assets that depend on a strengthening economy.

“It would be nice if that optimistic thesis plays out, but in today’s volatile environment, it’s better to prepare for the worst and hope for the best with a prudently balanced portfolio,” he wrote.

Not Impressed

Not everyone is impressed by Gundlach’s risk-management techniques. Morningstar Inc. gives his fund a “neutral rating,” the second step on a three-step scale, on concerns that, at the start, DoubleLine Total Return relied too heavily on exotic securities tied to changes in interest rates.

“You have to ask what kind of risks have been in the portfolio,” analyst Sarah Bush said in a telephone interview.

Gundlach disagrees with the idea.

“If I take so much risk when is it going to show up in volatility?” Gundlach asked. “The people at Morningstar don’t understand what we do. They don’t manage mortgages.”

Today, Gundlach sees risk in economically-sensitive assets such as stocks, junk bonds and subprime mortgages, which he called “grossly overvalued.” Subprime mortgages rose 30 percent in 2012 and 12 percent in the first five months of this year, TCW data show.

Low Duration

If Gundlach’s forecast is wrong, and rates continue to rise, his fund has some built-in protection. Its duration, a measure of sensitivity to changes in rates, was 2.6 years at the end of April, compared to 5.5 years for the benchmark index.

In May, when rates on the 10-year Treasury note rose, Gundlach’s fund lost 0.8 percent, better than 72 percent of peers, according to data compiled by Bloomberg. Pimco Total Return fell 2.2 percent, and the TCW Total Return fund declined 0.9 percent.

Bond investors need to get used to more muted returns, said Gundlach, without giving a specific forecast.

“People have to think in terms of absolute returns,” he said. “I think plenty of asset classes will have negative returns. Being up a little in bonds will feel good in comparison. Markets are over-believed right now.”

To contact the reporter on this story: Charles Stein in Boston at cstein4@bloomberg.net

To contact the editor responsible for this story: Christian Baumgaertel at cbaumgaertel@bloomberg.net