Green America Social Investing What to Know

Post on: 12 Июль, 2015 No Comment

What to Know

Whether you are a beginner or an expert investor, heres some important information about social investing and how it works.

What is social investing?

Integrating your personal, social, and environmental concerns with your financial considerations is called socially responsible investing (SRI). SRI helps you meet your financial goals while ensuring that your investments have a positive impact on people and the planet.

Whether youre just getting started with a simple savings account or you have a highly diversified portfolio of investments, you can be a social investor.

How can I get more information about becoming a social investor?

Green America is one of the leading sources of information about socially responsible purchasing and investing. For individual investors, we publish the Guide to Socially Responsible Investing . a comprehensive guide to understanding investing for you, your family, and the future of the planet. We also publish the Green American , our popular bi-monthly magazine packed with tips and ideas for green living, purchasing, and investing.

Both of these resources are free with membership. You can order them for a small fee. Call 1-800-58-GREEN.

What is screening?

Screening describes the inclusion or exclusion of corporate securities in investment portfolios based on social or environmental criteria. Socially concerned investors generally seek to own profitable companies with respectable employee relations, strong records of community involvement, excellent environmental impact policies and practices, respect for human rights around the world, and safe and useful products. They also will try to avoid investments in those firms that fall short in these areas.

Some examples of issues used by SRI funds in screens include: alcohol, tobacco, defense weapons, animal testing, environment, human rights, labor relations, employment/equality, community investing, and proxy voting.

For specific information on the screening and advocacy practices of socially responsible mutual funds, visit US SIF’s Mutual Fund Performance Chart

How do investments in socially screened mutual funds work?

A mutual fund is an investment that gives you instant diversificationinvestment in a variety of stocks and/or bondsand professional management.

Diversification means that you don’t have all your eggs in one basket. Your money is spread among a range of stocks and/or bonds so that the performance of any one will be balanced by the performance of others. Professional management means that professional investors are doing the research to pick the investments.

Mutual fund companies invest in multiple assets (usually stocks, bonds, or a combination), and sell shares of their portfolio to the public. Shares in mutual funds are bought and sold based on the fund’s net asset value (the value of all the stocks and/or bonds in the fund) at the end of each business day. When you buy shares of a mutual fund, you take an ownership stake or become a shareholder — in all the companies in the mutual fund’s portfolio. Your investment in a mutual fund entitles you to a share of any dividends or interest income earned by the stocks and bonds, as well as any profits or losses realized from the sale of these securities. Mutual funds are not insured, do not guarantee returns, and pose a higher risk than a savings or money market account.

However, mutual funds are a good place to start investing because they allow you to start with relatively small amounts of money.

Do my investments suffer if I choose a socially responsible mutual fund?

The myth that choosing socially responsible investments hurts financial performance is just that, a myth. The socially responsible investor has a wide variety of high-performing funds to choose from, including several index funds designed to match or better the performance of the market as a whole.

You’ll also find bond funds, balanced funds, and a wide variety of equity funds, including those that focus on large companies, mid-sized companies, small companies, and companies in other countries. Before investing, be sure to read the prospectus and understand the risks.

For information on the performance of socially responsible mutual funds that are members of our Green Business Network and US SIF (the association for socially responsible investment professionals and institutions), visit US SIF’s Mutual Fund Performance Chart. Socially responsible funds use multiple strategies to promote corporate responsibility, including social and environmental screening, shareholder action, and voting their proxies.

What is shareholder activism?

Shareholder activism, also known as shareholder advocacy, describes the efforts of a growing number of investors to use their status as part-owners of companies to influence corporate behavior. The process of dialogue and filing shareholder resolutions generates investor pressure on corporate executives, garners media attention (which adds even more pressure on corporations to improve their behavior), and educates the public on often-ignored social, environmental, and labor issues. The process has served as a powerful tool to encourage corporate social and environmental responsibility.

What is Community Investing?

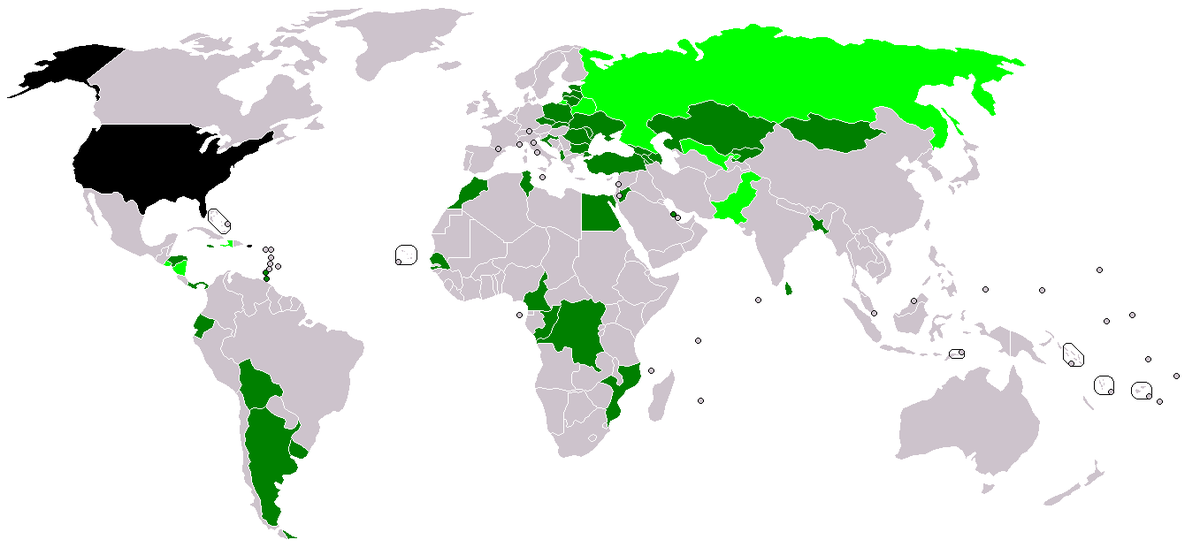

Community investing is financing that creates resources and opportunities for economically disadvantaged people in the US and overseas that are underserved by traditional financial institutions.

You can put your money to work re-building these communities that have been left behind. From opening a checking account at a community bank to investing in a mutual fund that puts assets into communities, you haa range of options.

Learn more about Green Americas Community Investing Program