Government bond Wikipedia the free encyclopedia

Post on: 16 Март, 2015 No Comment

A government bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date. Government bonds are usually denominated in the country’s own currency. Another term similar to government bond is sovereign bond. Technically any bond issued by a sovereign entity is a sovereign bond but sometimes the term is used to refer to bonds issued in a currency other than the sovereign’s currency. If a government or sovereign is close to default on its debt the media often refer to this as a sovereign debt crisis. [ 1 ] [ 2 ] [ 3 ]

Contents

History [ edit ]

The first general government bonds were issued in the Netherlands in 1517. Because the Netherlands did not exist at that time. the bonds issued by the city of Amsterdam are considered their predecessor which later merged into Netherlands government bonds. The average interest rate at that time fluctuated around 20%.

The first ever bond issued by a national government was issued by the Bank of England in 1693 to raise money to fund a war against France. It was in the form of a tontine. The Bank of England and government bonds were introduced in England by William III of England also called William of Orange who copied the 7 Dutch Provinces approach of issuing bonds and raising government debt where he ruled as a Stadtholder to finance England’s war efforts.

Later, governments in Europe started issuing perpetual bonds (bonds with no maturity date) to fund wars and other government spending. The use of perpetual bonds ceased in the 20th century, and currently governments issue bonds of limited term to maturity.

Risks [ edit ]

Credit risk [ edit ]

Government bonds in a country’s own currency are sometimes taken as an approximation of the theoretical risk-free bond. because it is assumed that the government can raise taxes or create additional currency in order to redeem the bond at maturity. There have been instances where a government has defaulted on its domestic currency debt, such as Russia in 1998 (the ruble crisis ) (see national bankruptcy ).

Currency risk [ edit ]

Inflation risk [ edit ]

Inflation risk is the risk that the value of the currency a bond pays out will decline over time. Investors expect some amount of inflation, so the risk is that the inflation rate will be higher than expected. Many governments issue inflation-indexed bonds. which protect investors against inflation risk by linking both interest payments and maturity payments to a consumer prices index.

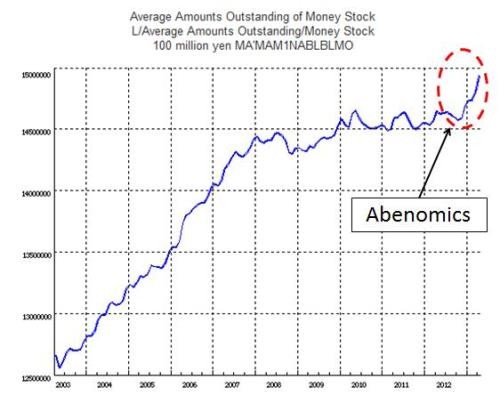

Money supply [ edit ]

United Kingdom [ edit ]

UK gilts have maturities stretching much further into the future than other European government bonds, which has influenced the development of pension and life insurance markets in the respective countries.