Goldman Sachs Bet against the loonie in 2014

Post on: 21 Апрель, 2015 No Comment

The Canadian dollar touched the weakest level against its U.S. counterpart since July, as one of the most influential investment banks advised its clients to bet against the loonie in 2014.

The currency weakened as futures of crude oil fell 1.4% to US$92.39 per barrel in New York. So-called commodity currencies, which include Canada’s and the Australian and New Zealand dollars also declined. Yields on Treasury 10-year notes have increased to 19 basis points more than Canadian debt, from negative nine basis points in January, amid speculation that U.S. policy makers will reduce monetary stimulus earlier than Canadian officials.

The market thinks “the Bank of Canada will lag the Fed in taking away the easier policy,” Ken Dickson, an Edinburgh-based director for foreign exchange at Standard Life Investments Ltd. which oversees about $291 billion, said in a phone interview. “On that relative basis, we think that will favor the dollar against the Canadian dollar through 2014.”

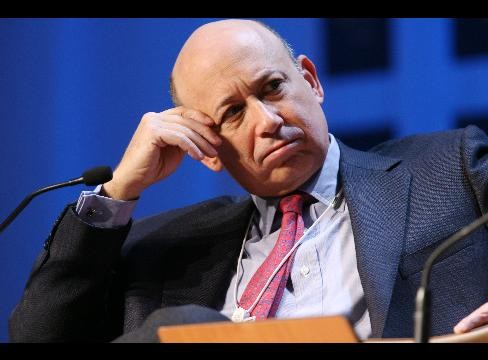

Investors should bet against the Canadian currency versus the U.S. dollar, in what Goldman Sachs Group Inc. analysts in a client note called their third top-trade recommendation for 2014.

The loonie fell 0.5% to $1.0595 per U.S. dollar at 5:00 p.m. in Toronto, after reaching $1.0603. One loonie buys 94.38 U.S. cents.

The nation’s benchmark 10-year government bonds fell, pushing yields up three basis points to 2.55%. The price of the 1.5% securities maturing in June 2023 declined 20 cents to $91.23.

BlackRock Inc. the world’s biggest asset manager, is recommending Canadian investors bet on a widening gap between short- and long-term debt in anticipation of less U.S. monetary stimulus next year.

Canadian debt maturing in one to three years returned 0.9% since May through Nov. 25, compared with losses of 5% for bonds with maturities of 10 to 15 years, Bank of America Merrill Lynch index data show.

The Canadian dollar has lost 3.3% this year against nine developed-market peers tracked by the Bloomberg Correlation-Weighted Index. The U.S. dollar is up 4%, while the Australian currency fell 11%.

“We’ve seen steady interbank buying of dollar-Canada since today’s open and that appears to be what has pushed us up here,” said George Davis, chief technical analyst for fixed- income and currency strategy in Toronto at Royal Bank of Canada. “Oil also under pressure, which is not helping.”