Going Beyond Investing Basics with Yahoo! Finance

Post on: 2 Июнь, 2015 No Comment

Finance.Yahoo.com

If youve ever wanted to learn about the stock market but didnt know where to begin, one of the best tools to use is Yahoo! Finance. It may be a bit overwhelming at first, given that the plethora of financial information available can make your brain hurt. Yet, after a few visits, you should be able to work your way around the site to look up stock information and financial news with relative ease.

While Yahoo! Finance isnt the only one of its kind on the webGoogle Finance. for example, serves essentially the same purpose but with less contentit is one of the most reliable sources to get information you need. The Yahoo! Finance news section is hard to beat just because of the sheer volume of content it has.

Going beyond that, there are other features that can be used to help you sort and find the little gems in the market. You can also get investment information beyond stocks like bonds, commodities, mutual funds and so on.

Financial Tools For Investors

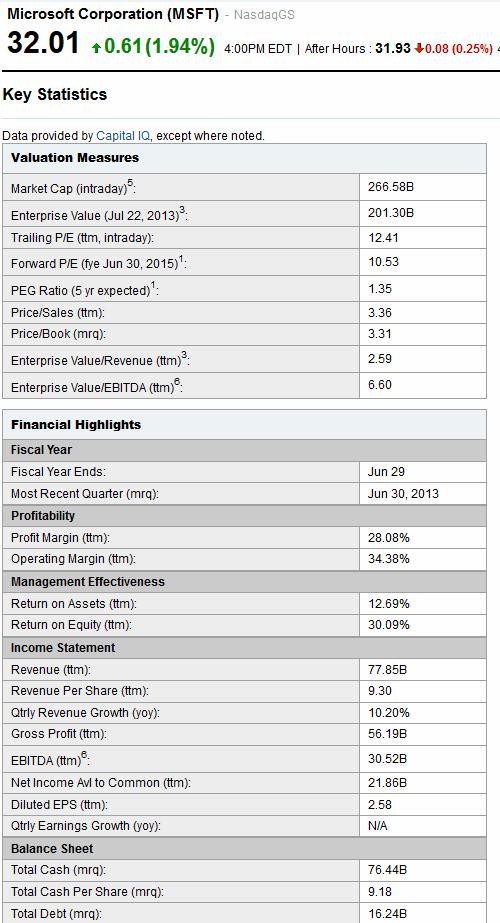

Most of the Yahoo! Finance widgets can be found on other financial news sites as well. Things like stock screeners, portfolio managers and real-time quotes are available on sites of similar caliber. But going beyond that, investors can also look at information such as analyst opinions on specific stocks, schedules for IPOs and splits, information on other investment classes and a wider selection of content.

Here are a few to look at once youve got the basic fundamentals down:

- Analyst Ratings/Estimates: If youre like most beginning investors, you probably love financial advice that comes in the form of Buy, Sell or Hold recommendations with a price target slapped on it. This area has you covered. Just remember that analysts are far from always right. Take into account whos making the call, their track record and compare it to your own research.

- Earnings Calendar: If youre curious about which stocks are going to be in the news, checking out the earnings calendar will help. It lists the dates and names of companies that are about to release their quarterly performances, which are like report cards for stocks.

- Conference Calls: Its important to get information right from the source whenever you can. Listening in on conference callsalbeit a little boring for someis a great way to learn more about a company. Even better, investment analysts are usually present with questions for some of the top executives from the company.

- Market Movers: Curious about the best and worst performing stocks of the day? Check this section out. Companies on this list experienced huge percentage swings based on their share prices. You can also track volume, too, which is how many times their shares were traded.

- Message Boards: Though not necessarily the best way to get your stock information, you may be able to make a friend or two that follow the same investments you do. Beware, though, as with most money-related message boards, spamming is very common.

- Content: One of the biggest strengths that all Yahoo! sites have is just the vast amount of content it makes available to visitors. While it may take a while to sort through what you actually want and filter out whats essentially just noise, you do get a good number of perspectives about the market and stocks. Thats assuming you want that much, of course.

Using Yahoo! Finance

Whether you like using Yahoo! Finance, Google Finance, Bloomberg, MarketWatch or any other option, its really hard to say if any one site trumps the other. This isnt necessarily a bad thing, as consumers usually benefit when businesses compete. Find the ones that work for you and stick with them.

Keep in mind, these finance sites are used as tools to help you make informed decisions about your investments. You should only use them as a way to keep yourself informed, which is vital to investing, but also remember youre not learning anything that isnt available to millions of other users.

If youre unsure about any investment, never be afraid to consult an investment professional first before making any trades.

How do you follow your investments?