GM bonds conversion to stock creates new set of problems

Post on: 23 Май, 2015 No Comment

💬

QUESTION: I have always invested in bonds because I like certainty. Several years ago, I bought General Motors bonds. I thought I could rely on a car company, and the interest was good. Now I find out that my bonds are going to be converted into stock by the bankruptcy court. What happens if I sell the stock after I get it? Will there be tax consequences?

ANSWER. For a person who likes certainty, the GM bankruptcy must be disconcerting. It’s a vivid example of what can happen to people who buy bonds in a well-known company that deteriorates financially over time.

Whenever people buy corporate bonds, there’s a chance that the company’s financial strength will change, and they could lose money. In a bankruptcy, bondholders generally lose part of the money they invested, and they can lose everything. That’s why bondholders, like stock investors, must monitor the company to make sure its financial condition isn’t worsening.

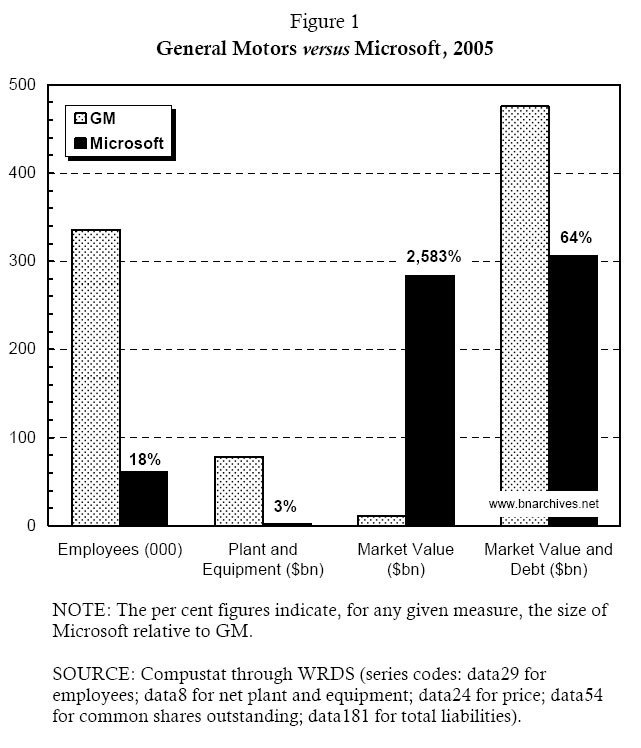

Attentive GM bondholders could have recovered much more than now. In 2005, some analysts predicted that bond investors would lose half the value of their holdings in a possible bankruptcy.

Now, instead of receiving any money, bond investors will get stock that may or may not increase in value. Estimates are that bondholders might get about 20 percent of the value of their bonds in stock, but that’s fluid, and probably won’t be resolved until next year.

Once you receive stock, you can sell it if a broker can find a buyer. But that’s not likely to be the best move. Eventually, the new GM is supposed to have an initial public offering. Estimates are that this will occur in the second half of next year.

At that point, you’ll be like anyone else who owns stock in a company that trades in the market. The price will go up and down. In theory, the new GM should do better than the old one because the bankruptcy court wiped away some debts. If the newly formed car company is doing well as time goes on, your stock might go up and you might want to sell it. If you think the company will do poorly, you might want to sell it before the stock price falls.

Typically, when people sell a stock that has increased in value since they bought it, they experience a capital gain. They have to tell the IRS how much money they made on the stock compared with what they paid for it and will be taxed on the profit.

If you hold a stock for at least a year after buying it, the gain is taxed at a maximum 15 percent rate. But if you sell it less than a year after buying it, you have a short-term gain and will be taxed at your regular tax rate. For many people, that means more than 15 percent.

Still, if the tax situation has been bothering you, the General Motors transaction is different from typical stock purchases. Instead of buying the stock, you received it in exchange for your bonds, so what matters is the date of maturity on the bonds, not the date when you receive the stock, said Andy Cordonnier, a certified public accountant at Grant Thornton.