GLOBAL PERSPECTIVES Does China Really Care About Europe

Post on: 5 Июнь, 2015 No Comment

By: Jim Trippon

Editor-in-Chief, China Stock Digest

The headlines go back and forth between China being a key player at the table in solving Europes problems and China not wanting to get stuck in the Eurozones quicksand. But theres more to the story, writes Jim Trippon of Global Profits Alert .

With the seemingly interminable drama concerning the Eurozone debt and particularly Greece, one of the backdrops has been that Chinas name has periodically been invoked.

Chinas been mentioned as everything from a potential financial savior, to economic lender of last resort, to a keenly interested bystander, to just about anything else you can imagine that has some financial import for Europe.

Almost daily, stories change regarding Chinas potential role, or perhaps even its preference as far as how it wants to engageor notthe Eurozone crisis. One day, its that the CIC gives a cold shoulder to Germanys Chancellor Angela Merkel, another day its that China maintains it will keep its investments in the Eurozone. Then another day, there are stories that China will seek new investments to help Europe out.

So, China investors want to know, which, if anyor even perhaps all of theseare true?

The first thing we might point out is that China has been observant. Early in the days of the more hysterical global realizations of the extent of the Eurozone problem, with the PIIGS and especially Greece, some in Europe immediately jumped to the conclusion that China would be a prime candidate to help or bail out, depending on the level of candor.

Early on, however, Chinas leadership in Beijingwhile offering encouraging, even soothing wordswanted no part of positioning itself underneath the mess to catch what might be thousands or millions of falling knives, better known as sovereign debt. The suggestion that China soak up these questionable bonds was met with a consistent, polite, but firm no.

When there was some disappointment in Europe that China failed to immediately ride to the rescue, it was pointed out that of Chinas $3.2 trillion in currency reserves, estimates of perhaps as much as $800 billion of that, or one quarter, are invested in Europe. This apparently included sovereign debt and other instruments. China had no wish to expand this to include what by any measure would have to be considered high-risk investments.

Words Of Support

China has consistently supported Europe in its struggle by word, if not deed. Although cynics would point out that China, as any world economic or political power, often says one thing and does another, it was clear China was taking a wait and see attitude.

Recently, Chinas central-bank governor, Zhou Xiaochuan, reiterated his countrys supportive words. As quoted in a recent Reuters article, Zhou said, We strongly believe European countries can work together to handle the challenges. They are able to solve the sovereign debt crisisThe PBOC firmly supports the ECBs recent measures to address the difficulties.

Although there were recent reports that some of the industrial companies in China would try to step up their business with Eurozone countries, this again was seen as more supportive talk that would be difficult to quantify in action, as the EU struggles on the verge of recession in many of its weaker member countries.

But there was talk that was linked with substantive action beyond encouraging words. Zhou did say that China will not cut the proportion of euro exposure in its reserve investments.

Thus, the $800 million or whatever amount of currency reserves China has already committed will stay. Thats no small thing; China isnt yanking away what is already a pillar of support.

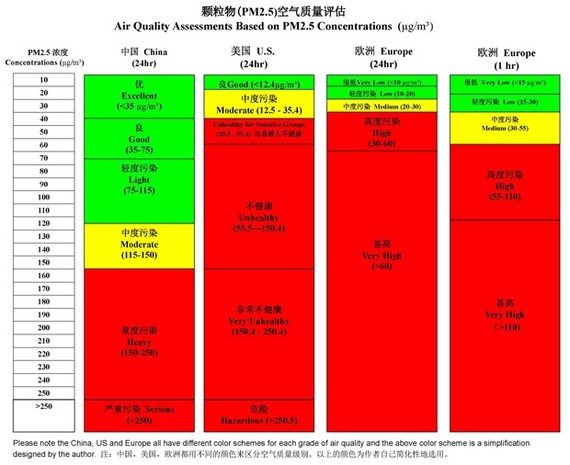

Click to Enlarge

More to the point, Zhou added that Chinas investment continued in Europe with an eye toward safety, liquidity, and commercial return.

And that last point, the one about investing for commercial return, is at the heart of thingsand rightly so. China, although it has been accused by critics of buying up the world, is keenly interested in investing in hard assets, real assets in Europe, assets that would make a profit. This is consistent with its policy that has been unfolding long before the Eurozone crisis.

Its state-owned companies have been encouraged to venture overseas to expand their asset bases and to make quality investments. Chinas energy companies and power companies have been doing so.

The State Power Grid company has been investing in overseas power companies, such as in Portugal and the Philippines. Chinas major oil companies are investing in Canada and Australia.

Now, there may be more European opportunities. What drives this? Chinas need for resources and its desire for profits. Nothing untoward there.

Subscribe to Global Profits Alert here

Related Reading: