Global Bond Markets How Yields in Europe Can Affect the ViceVersa

Post on: 25 Май, 2015 No Comment

Getty Images

Can events in the German bond market affect the direction of yields in the United States? And can fluctuations in U.S.yields affect the bond market in Uruguay? The short answer: absolutely.

In today’s interconnected markets, yields in one country can make yields in another more, or less, attractive on a relative basis. As a result, bond markets increasingly move in tandem – a phenomenon discussed here .

The Global Search for Yield

With respect to the global bond markets, the important issue to remember is that no country’s market exists in a vacuum. Big-time bond investors – not people like you or me, but large institutions – shop around for yield just as an average person would shop around for the best price on a car. If one bond market is yielding substantially more than another, and the two have a comparable degree of risk, this disparity exerts a downward pressure on the yields of the higher-paying country (with a corresponding upward pressure on prices).

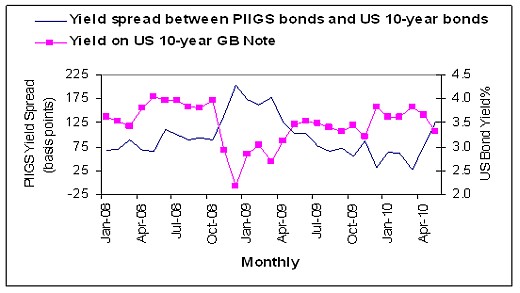

This was on display in the first half of 2014. Yields in Europe fell across the board, as investors reacted to the outlook for slowing growth and possible interest-rate reductions by the European Central Bank. Yields in France dropped below 2%, while yields in Germany fell below 1.5%. The U.S. bond market, for its part, came into the year yielding just over 3% as measured by the 10-year Treasury note. Since the United States is seen as being of comparable risk compared to France and Germany, falling yields in these nations were widely cited as being a key factor in the corresponding decline in U.S. bond yields. After all, why would an institution settle for a 1.4% yield in Germany when it could earn much more in the United States? The relative attractiveness of U.S. yields fuels more buying, and prices rise (while yields fall) as a result.

This dynamic occurs in varying degrees across several segments of the market. Developed markets often take their cues from one another, while bond yields in the emerging markets are linked both to each other and to developed-market yields. For instance, an investor who wants to buy Brazilian bonds values the market based on its yield spread. or yield advantage, relative to the United States. All else equal, a yield spread that is too “tight,” or narrow, may cause buyers to lose enthusiasm for Brazil and seek opportunities elsewhere, while a yield spread that’s “wide,” or above the historical average, may attract buyers.

Other Issues to Consider

Keep in mind that these competitive forces are only one of many factors that influence market performance. Other, more important, factors are inflation. the varying economic growth trends and central bank policies among various countries, as well as investors’ appetite for risk – which, as it shifts, may make investors more or less willing to buy riskier bonds. Just because two markets with similar risk profiles have divergent yields, then, doesn’t mean that this gap necessarily needs to close. Instead, the lesson here is that investors need to consider these competitive forces as being one of the various factors that can influence bond market performance.

Also, for U.S.-based investors, it’s important to keep in mind that it’s usually the United States that leads other markets, and not other way around – notwithstanding events of the first half of 2014.

A table showing the yields and recent returns of the major developed and emerging government bond markets can be found free from Barron’s here .