General Stock Investment Strategies Stock Analyst stat books cfa institute

Post on: 15 Апрель, 2015 No Comment

Advertisement

Question

QUESTION: Hi Mr. Borek,

I believe that my question may be concerning becoming a stock analyst, but I am not for certain.

I would love to have a job analyzing companies, stocks, bonds, statistics, etc. to figure out which ones are most likely to be winners and flops in the future. I used to love studying the stat books to pick the winners at the dog races when I lived near a dog track in New Hampshire. I also enjoy doing a lot of research on my computer.

What college degree or title should I try to earn to become employed in a field such as this? Also, can I get a decent eduation online or through distance learning? I am 54 years old and am even wondering if companies hire people my age or above in this analyst type of field?

Thank you for any advice.

Sincerely,

Mike E.

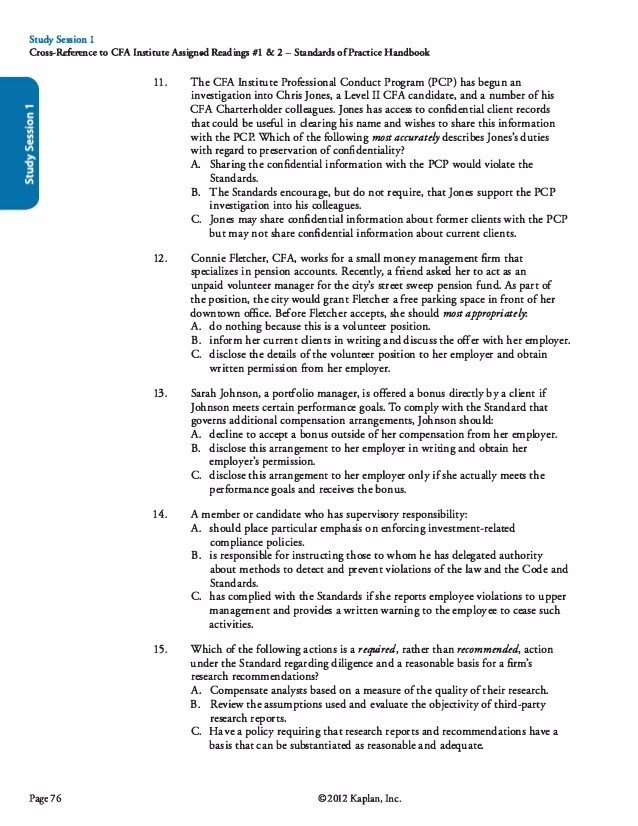

ANSWER: Hi Mike-

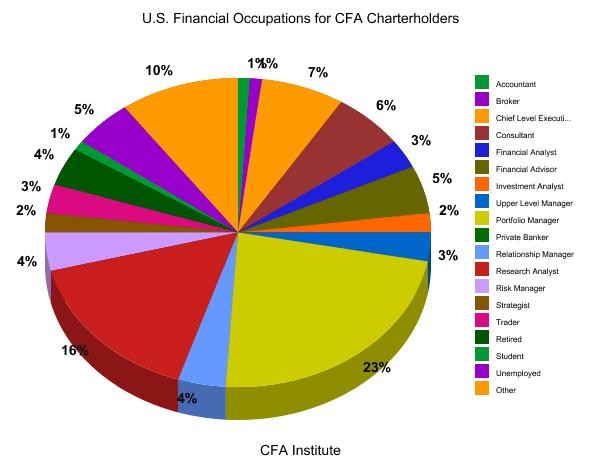

You might want to research the CFA credential, that’s very common among analysts. CFA = Chartered Financial Analyst, it’s a designation overseen by the CFA Institute. Kind of the gold-standard among stock analysts.

It sounds though like you’re not working in a financial field right now? If so I don’t know how realistic a career this would be for you. It takes 3 years to earn the credential and it’s not an easy series of tests to pass. Depending on your background you might have other job possibilities that are more likely to pan out — you mentioned stats, if you have professional experience in that field there may be some positions for you at financial services companies. I believe changing careers at age 54 — getting the CFA, finding a position as a stock analyst — would be very difficult.

I don’t want to sound negative but I’m trying to be realistic. Keep in mind also that you can always gain expertise for Client Number One (yourself). If you spend the next 5 years learning how to analyze stocks you might not care about applying that knowledge to anything beyond your own retirement portfolio. It can pay a lot more than the dog races (which from my one experience with them look fixed!!)

Please post any follow-up Q’s, I’m glad to help.

-Tad

QUESTION: Hi again Tad, and thank you much for your reply. You brought things to light. By the way, if I do want to learn to analyze stocks for my own purposes and retirement, what materials, courses, etc. might be best to study where I wouldn’t have to attend courses on campus?

I see those infommercials such as Daytrader on software one can buy to analyze stocks for oneself but I don’t know if they’re worth the expenditure or how effective that they really are. I don’t know anyone that has one either.

I would greatly appreciate any further guidance.

Sincerely,

Mike E.

Answer

Hi Mike-

As I’m sure you know that’s a big question but let me get you pointed in the right direction.

First of all, it would be good to frame the problem, meaning see the challenge you’re up against. There’s a lot of academic research suggesting that attempting to pick winning stocks is futile, so don’t bother trying. Think in common-sense terms. there are literally millions of investors out there and for every stock, there are probably hundreds or thousands of investors — both professional and personal — following every aspect of the company every day. That constant analysis sets the current supply and demand for the stock, which sets the current price. You’re about to hop in. how can you beat that? Why will you be better at judging the correct value of a stock than some professional analyst who has been following it for the last 5 years? The same question applies to professionals, by the way.

A good book for the big picture — not just this point, but many many other aspects of investing — is A Random Walk Down Wall Street by Burton Malkiel. This is one of the true investing classics and I tell everyone interested in stocks to read it.

Another classic is The Intelligent Investor by Graham. Then there are books to get you familiar with some different approaches to stock-picking. Peter Lynch’s Beat the Street or other books. John Neff’s on investing — a value approach. David Dreman’s Contrarian Investment Strategies. These guys have a lot of credibility. There are hundreds of other titles out there, just watch out for the latest bestseller on a get-rich-quick scheme — those never work.

A good summary textbook on finance and investments would be good too. If you live near a university, go to the book store and pick up some used copy of a fat textbook. If that’s not close by, sift through amazon and any of the online-textbook stores and see what you can find. I like Investments by Sharpe, Alexander, Bailey.

Start reading the business press regularly, especially the Wall Street Journal (online is cheaper). Stock-picking is largely about understanding the stories of the businesses and you have to keep up with them. The Yahoo Finance kinds of sites don’t quite do it.

I don’t see the point in doing an organized program if it’s just going to be for your own investments, not a career. Just read, read, read. if you did something online I’d recommend something in basic finance & accounting just to get familiar with terminology. Not a whole degree program though, why bother?

As for infomercials & all those software packages and whatnot — just categorically rule them out. It’s in the same category as fad diets and exercise machines.

My suggestion though is to think of this as a life-long learning process and don’t jump in with real money for awhile. In fact (see Random Walk) you might not even bother, and stick with mutual funds instead — most people end up with more money that way. I first started learning about stock-picking over 20 years ago and am still working on it. And I still keep money in mutual funds alongside individual stocks.

-Tad

Questioner’s Rating