Funding From Angel Investors What They Look For

Post on: 16 Март, 2015 No Comment

Advertisement

Angel investors typically have a successful history in business development themselves and want to spend their money helping other entrepreneurs grow. The angel investor fills the crack in funding between the bank and the venture capitalist.

If you need funding between $250,000 and $5 million, an angel investor may be interested in you. They are increasingly wanting shorter returns on their money (5 years) so your product better be hot.

There is much more to the equation than just how much money you need and how much the angel investor is willing to spend. Angel investors, like anyone else, have an agenda and want to find businesses that fit the profile on this agenda. While not every angel investor is the same, there are some generalities that define the majority of angels in the market right now:

Angel investors are interested in technology

They focus on start ups that are developing new capabilities and are on the cutting edge. Inc. magazine says: It wouldn’t hurt if your business was built around some leading-edge proprietary technology in a market no other company dominates. This can be hard to d.

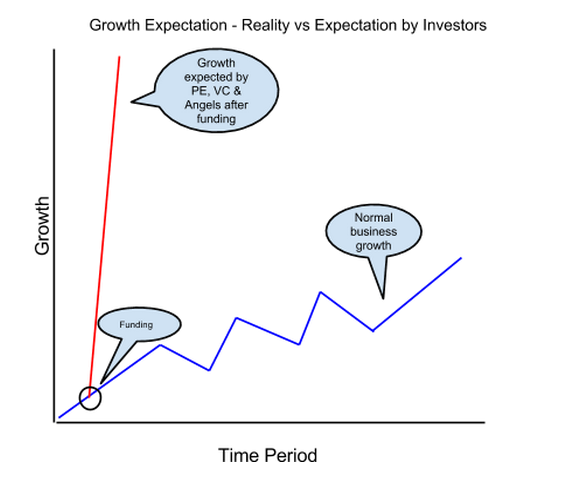

Angel investors are looking for a higher return than they would see from more traditional investments

They want your business to grow! They are, however, usually more patient than venture capitalists about seeing their return. Also, angels are not as intrusive (although this can vary). Just be prepared that angel investors do expect to offer expertise, experience and contacts in addition to the money they give. Even so, they normally don’t insist on the control that venture capitalists do.

Angel investors prefer to back business ventures they have some knowledge about

It is rare that they will explore areas that lie outside of their own expertise. We want to go into businesses where we’re not the dumb ones, says one angel investor in an article in Inc. magazine.

Angel investors seriously consider enterprises that are relatively close to home for them

Geography does play a role in their decision making. This is so that these investors can easily arrange for a meeting with entrepreneurs, and not have to spend money on travel and accommodation costs.

Most angel investors do not invest alone

They work as part of a larger group. The reason for this is that they can make more of an impact when their funds are pooled. Also, there is safety in numbers. Angel investors tend to be more interested in a start-up when colleagues are also interested. It makes giving money away a more sound investment because it is backed by others in the field.

Angel investors look at the entrepreneur as well as the business

They want to know who they are dealing with as much as what product they are investing in. For more information on what investors look for, check out Impressing the Bank or Investors.

Angel investors can be picky

According to some, the reasons for not investing in a business are: insufficient growth potential, overpriced equity, lack of sufficient talent of the management, or lack of information about the entrepreneur or key personnel.

Finding an angel investor is probably the hardest part

They are very private individuals who prefer to find you, rather than you find them. So make yourself and your business venture known in your community. Share your growth with the local Chamber of Commerce and other professional organizations. You never know when an angel is watching. If you would prefer to take a more active role in identifying an angel investor, check out this SBA sponsored site that helps to bring you together with an angel — https://ace-net.sr.unh.edu/pub/

Other External Sites To Check Out: