Fundamental vs Technical Analysis Difference and Comparison

Post on: 31 Май, 2015 No Comment

Technical Analysis

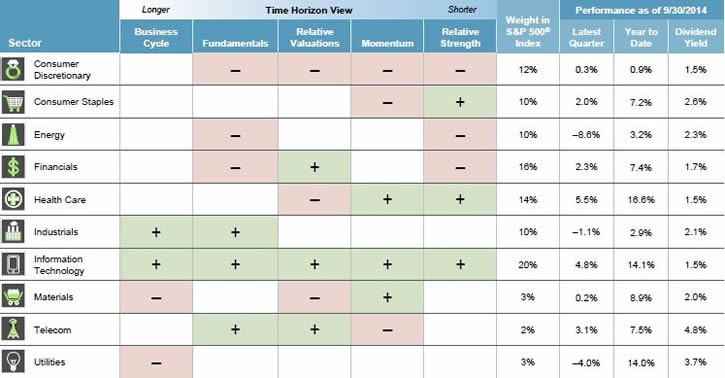

edit Time Horizon and Usage

Fundamental analysis takes a long-term approach to analyzing the market, considering data over a number of years. So fundamental analysis is more commonly used by long-term investors as it helps them select assets that will increase in value over time

Technical analysis takes a comparatively short-term approach to analyzing the market, and is used on a timeframe of weeks, days or even minutes. So it is more commonly used by day traders as it aims to select assets that can be sold to someone else for a higher price in the short term.

edit How the Analysis Works

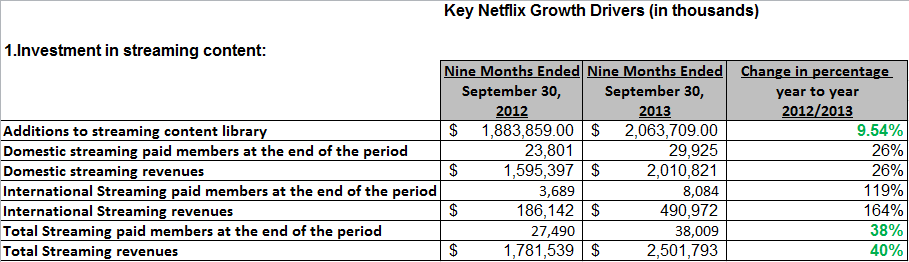

Fundamental analysis calculates future price movements by looking at a business’s economic factors, known as fundamentals. It includes economic analysis, industry analysis and company analysis. This type of investing assumes that the short-term market is wrong, but that stock price will correct itself in the long run. Profits can be made by purchasing a mispriced security and then waiting for the market to recognize its mistake. It is used by buy and hold investors and value investors, among others.

Fundamental analysis looks at financial statements, including balance sheets, cash flow statements and income statements, to determine a company’s intrinsic value. If the price of stock falls below this intrinsic value, its purchase is considered a good investment. The most common model for valuing stock is the discounted cash flow model, which uses dividends received by the investor, along with the eventual sales price, the earnings of the company or the company’s cash flows. It also considers the current amount of debt using the debt to equity ratio.

Technical analysis uses a security’s past price movements to predict its future price movements. It focuses on the market prices themselves, rather than other factors that might affect them. It ignores the “value” of the stock and instead considers trends and patterns created by investors’ emotional responses to price movements.

Technical analyses look only at charts, as it believes that all of a company’s fundamentals are reflected in the stock price. It looks at models and trading rules based on price and volume transformations, such as the relative strength index, moving averages, regressions, inter-market and intra-market price correlations, business cycles, stock market cycles and chart patterns. Chart patterns are the most commonly studied, as they show variation in price movement. Common chart patterns include “head and shoulders,” which suggests that a security is about to move against the previous trend, “cup and handle,” which suggests that an upward trend has paused but will continue, and “double tops and bottoms,” which signal a trend reversal. Traders than calculate a security’s moving average (the average price over a set amount of time) to clean up the data and identify current trends, including whether a security is moving in an uptrend or a downtrend. These averages are also used to identify support and resistance levels. For example, if a stock has been falling, it may reverse direction once it hits the support of a major moving average. Traders also calculate indicators as a secondary measure to look at money flow, trends and momentum. A leading indicator predicts price movements, while a lagging indicator is a confirmation tool calculated after price movements happen.

edit References

Related Comparisons

Stocks vs Bonds