FUND PICK Tata ShortTerm Bond Fund

Post on: 25 Июнь, 2015 No Comment

Launched in August 2002, Tata Short-Term Bond Fund is an open-ended short-term income fund. It has been ranked CRISIL Fund Rank 2 (good performance) in the short-term income fund category by the CRISIL Mutual Fund Ranking for the quarter ended September. The fund, managed by Raghupathi Acharya (since May) and Akhil Mittal (since June), has been ranked in the top 30 percentile (CRISIL Fund Rank 1 and CRISIL Fund Rank 2) of its peer group for seven quarters under the short-term income category.

The funds average assets under management (AUM) increased from Rs 320 crore for the quarter ended September 2013 to Rs 1,366 crore for the quarter ended September 2014. The categorys AUM decreased 22.77 per cent.

Fund objective

The investment objective is to create a portfolio of debt as well as money market instruments to provide reasonable returns and liquidity to unit holders.

The fund intends to invest in debt instruments (including bonds, debentures and government securities) and money market instruments such as Treasury bills, commercial papers (CPs), certificates of deposit (CDs), repos of different maturities and as permitted by regulation to spread the risk across different kinds of issuers in the debt market. Investors can consider short-term income funds to take advantage of high interest rates as these funds invest in the shorter-tenure paper and hold them until maturity, making it less susceptible to interest rate changes.

Risk/return attributes

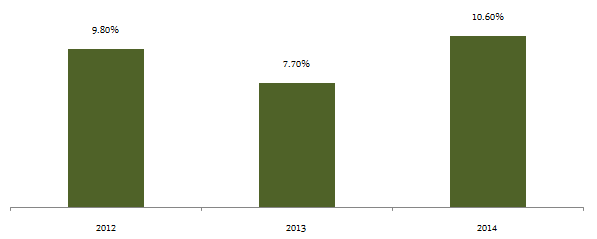

The fund has outperformed its benchmark (CRISIL Short Term Bond Fund Index) and the category across various time frames six months; one, three, five and 10 years as on November 20. Over three years, the fund has earned 9.72 per cent compound annualised return vis—vis the categorys 9.42 per cent and the CRISIL Short Term Bond Fund Indexs 9.25 per cent.

A sum of Rs 1,000 invested in the fund at its inception would have grown to Rs 2,522 by November 20 compared to Rs 2,271 for the benchmark and the categorys average of Rs 2,427.

The fund is also less volatile than its category; annualised volatility of the fund for the year ended November 20 is 0.85 per cent whereas the categorys average is one per cent.

Portfolio analysis

The fund has dynamically churned its portfolio between CPs, CDs and non-convertible debentures (NCDs) to benefit from variation in interest rates. It increased its exposure to NCDs to 63.13 per cent in April 2014 from 42.43 per cent in November 2013, while reducing its exposure to CDs from 29.45 per cent to 12.51 per cent. This dynamic asset allocation has also had an impact on its average maturity, which changed from 1.29 years to 1.95 years in the aforesaid period. The fund has maintained its average maturity on average at 1.81 years after April, which has helped it to garner superior returns due to the subsequent decline in interest rates.

In terms of the credit profile, the fund continued to maintain a majority portion of its assets in the highest-rated papers. Over one year ended September, an average 72 per cent of its portfolio has been invested in the highest-rated paper.