From Barron s The Best Online Brokers of 2014

Post on: 25 Июль, 2015 No Comment

Scott Pollack for Barron’s

Rising stocks are everywhere: They’re on your desktop, your laptop, your tablet, and, increasingly, your phone.

Small investors can rightly complain about lots of things, but they can’t gripe that the historic 173% five-year gain of the Standard & Poor’s 500 was out of their reach. It has literally been at everyone’s fingertips. Online brokerages estimate that, on average, 15%-20% of retail trading now takes place on mobile devices, most of them Apple products that aren’t much older than the bull market.

The thinking among brokerage executives is that investors use their smartphones to track the market and place trades during the business day, but once the sun sets, the tablets come out. Tablets give users more real estate on which to manage their portfolios, learn about the markets via streaming video, conduct research, and think up tomorrow’s trades.

It’s clear that the devices we use, and the ways that we use them, are fundamentally changing, and that provides investors with room for growth, limited only by the creativity of the tools we provide, says Ram Subramaniam, president of Fidelity Investments’ retail brokerage business.

IN RESEARCHING Barron’s 19th annual ranking of the best online brokers it was clear to us that personalizing each client’s trading and investing experience, regardless of time or location, was becoming a reality. It’s more than just hardware. Our top brokers let you customize everything from your trade ticket to your portfolio analysis reports, speeding you through placing orders while helping you — understand your gains and losses.

Clients are getting to the point where they want a robust mobile trading platform with cloud capability that can parallel their desktop trading platforms, says Steve Sanders, an executive vice president of marketing and product development at Interactive Brokers.

In poking and prodding various Websites, downloadable systems, and mobile applications to see what they could do, we realized that some brokers have reversed the development process: They create mobile applications first, and then adapt them to work across their other platforms.

For instance, TD Ameritrade’s Mobile Trader allows you to set up a column listing your positions, and gives you the ability to assess your portfolio against any index or stock. Once it’s created, the same display shows up when you log into the Web platform.

It’s remarkable when you consider that cellphones’ financial applications were initially thought of as nice ways to check an account balance or a closing stock price. Today, you can even place a multileg options trade on your iPhone or Android.

The bull market, along with the proliferation of electronic distribution venues, made 2013 a good year for most brokers. Overall, there was a 21% increase in stock and options transactions for the online brokers who report those figures. Our review includes a new firm, Livevol, but another new outfit, ZacksTrader, launched too late for inclusion in the ranking that accompanies this article. The pace of buyouts in the online brokerage industry has slowed, following TD Ameritrade’s takeover of thinkorswim in 2009, Charles Schwab’s purchase of optionsXpress in 2011, Capital One’s acquisition of ShareBuilder in 2012, and the TradeKing merger with Zecco that same year. The most recent takeover was of SogoTrade, acquired by a group of private investors who plan to direct it toward Chinese investors looking to buy U.S. securities.

THAT SAID , IT’S STILL a very competitive, price-conscious marketplace that could lead to more deals, especially with brokers’ share prices surging (see accompanying chart), adding to the impetus for corporate growth. Further consolidation may occur as an ever-more-costly regulatory environment puts pressure on broker profitability, says Sanders. He believes that fully automated firms that can utilize economies of scale will prosper. Low fees and low interest rates make it tough to gain entry to the business, notes Jim Swartwout, president of tradeMonster. However, he adds: Small players will continue to look for innovative ways to deliver services.

Today, that means offering mobile to stay connected with customers — or possibly connecting with someone else’s customers. Only three of the 20 firms in this year’s survey don’t have some sort of mobile application. In fact, a handful declined to participate because they wanted more time to create or upgrade mobile capabilities. Mobile investing is still in its infancy and is much like Internet investing was in the late ’90s, notes Swartwout. There is substantial upside for high-quality, well-designed platforms to continue to gain market share via mobile.

So who’s doing the best job for investors? Four of the 20 brokers we reviewed this year earned 4½ stars out of a possible five. They are Interactive Brokers, tradeMonster, Place Trade, and TD Ameritrade.

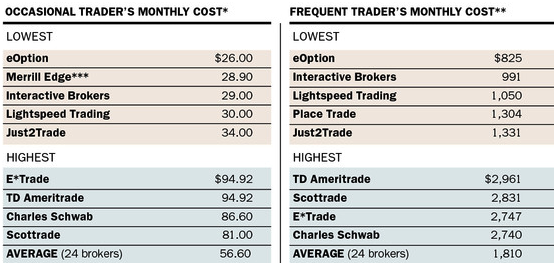

Recognizing that your trading and investing style may differ from our model, we also identify the top online brokers in six categories — high-frequency trading, in-person service, international investing, long-term investing, services for novices, and options trading — to help you decide where you should open (or transfer) an account. We show the brokers that were at the extremes when we calculated the monthly cost of trading for infrequent traders, as well as for those who trade multiple times per day.

Barron’s has tried to make the selection process a little easier this year. We’re providing readers of Barrons.com with separate side-by-side comparisons so you can see how our numerical totals were arrived at and how stars were awarded. You can not only see our firm grading for, say mobile offerings, but a breakdown of what specific mobile platforms an individual online broker supports or whether its mobile platform allows trading of foreign stocks, for instance. We start with our top, 4½ star, brokers and then proceed to the rest, each grouped by their star ranking. It’s the most comprehensive review we’ve produced.

Based on Barron’s numerical calculations, Interactive Brokers (interactivebrokers.com ) claims the No. 1 spot overall for the third-straight year. The firm has continued to improve its standard downloadable platform, and has updated its mobile offerings so they can be personalized by clients. New tools for options traders include Strategy Builder and Option Strategy Lab, which help you formulate and then test the suitability of strategies. Both tools explain what they’re doing in plain English, so you also learn more about options trading.

We also like Interactive Brokers’ new Probability Lab, which translates a stock’s options prices into the market’s price forecast for that particular equity. For instance, let’s say you’re considering trading some Tesla Motors (ticker: TSLA) options. You would enter your price forecast for the stock, and then the Probability Lab calculates the odds that your target will be reached. You can build a strategy with the highest expected profit, based on your forecast.

The online broker’s upgrade of its Mosaic trading platform lets a user set up multiple trading layouts using tabs, which means you can build work spaces based on a task or a trading style. For instance, you could collect all of your favorite research tools under one tab, and switch to it quickly when you need those capabilities. There’s an iPad look and feel to the new layout, making the transition from mobile device to desktop a smooth one.

LESS-FREQUENT TRADERS. who’ve never been the firm’s target audience, may find themselves more interested than they were before, because Interactive Brokers recently waived its $10-per-month minimum for those with $100,000 or more in their household accounts.

In the past, we’ve shied away from recommending Interactive to anyone who isn’t a big trader because its tools and offerings cater more to hedge funds and registered investment advisors. But today, it offers a lot more support to new clients, including individuals, especially those with larger accounts. Yes, using the word support in the same sentence as Interactive Brokers (without the modifier dismal) is a change for us, but the firm has clearly made this a point of focus.

Interactive Brokers continues to have extremely competitive pricing, and the lowest margin fees of any broker in our survey. You may incur some data fees, but the firm takes care of any options-exercise costs, which can generate unexpected fees at many other brokers.

TradeMonster (trademonster.com ) again takes second place, based on our tabulations. A key to its continued high ranking is the firm’s success in bringing desktop functionality to mobile devices. The tradeMonster experience remains relatively consistent, regardless of where you are. The firm’s recently launched mobile liveAction market scanner, which offers a wide variety of technical and fundamental scans, can now be run on iPads and iPhones and will soon be available for Android devices.

One of our long-running favorite features, tradeCycle, also has been extended to mobile platforms. TradeCycle brings discipline to the trading decision by including extensive analysis of the potential transaction’s profitability, and allowing the creation of an exit strategy. It includes context-sensitive help, so you can be prompted to make your next move, regardless of where you are in the platform. Just click on the question mark visible on each screen, and you get an explanation.

TradeMonster lowered its equity commissions by $2.55 on March 3, to $4.95 per transaction, making its fees extremely competitive. The online broker integrated futures trading into its platform on March 11, along with lots of related educational materials. Previously, futures trading required a separate login. The firm also has rolled out a futures ladder tool called Vertigo, along with 11 order types for futures trading. Futures traders sometimes must guess at what a potential transaction will do to their margin balances and buying power, but tradeMonster’s futures platform has real-time calculations for both built in.

For options trading, which is the firm’s focus, a long list of new features has been added. Among them: inclusion of nonstandard options (minis, jumbos, adjusted options) into all of the platform’s tools. All quotes are streamed, including options chains and calculations that affect the risk profile of a strategy, so you’re always using current data.

New features in tradeMonster’s streaming charting package include the display of options trades, which is fairly rare. You can even see a spread’s price history in the options charts.

TradeMonster’s strategySEEK forecasting engine lets you drill down into specific events, and the firm has added a lot of firepower to its servers, so that additional screens can be run. We like this platform for its consistent look and feel across devices, and for its holistic approach to buying and selling.

IN THIRD PLACE is a full-service brokerage built on the Interactive Brokers platform, Place Trade (placetrade.com ). Its fee structure is slightly higher than Interactive Brokers’, but it offers more service amenities.

CEO Sarah Place notes that her firm added some a la carte financial—planning services, which work for either online or full-service clients, even if they don’t have a Place Trade account. We have been able to help out some people who felt that other firms were not interested in helping them or giving them unbiased advice, she says.

Interactive Brokers’ suite of tools for registered investment advisors allows firms like Place Trade to use the technology while wrapping it in a different level of service. Place Trade’s clients range from totally independent online traders and individuals who use the full-service functions to mutual-fund and hedge-fund traders, as well as other financial institutions. Place Trade says that clients can buy and sell on their own or ask for as much advice as they want. Full-service commissions, which start at $15 a transaction, kick in when you bring a financial advisor into your decision-making.

TD Ameritrade (tdameritrade.com ) takes the fourth spot in our numerical ranking. This brokerage has altered its development strategy in the past year and is one of those that creates features for mobile trading and then drives them back to the desktop platform. The mobile emphasis is supported by TD Ameritrade’s trading and account statistics, which show that almost half of its new customers download the mobile app before signing on to the desktop. A growing percentage of TD Ameritrade’s customers are mobile only — it’s still under 10%, but the percentage is on the rise.

TD Ameritrade has created a nearly seamless way of working on multiple devices. A watch list you set up on your iPhone can be used the next time you sign onto the desktop. You can share charts across -devices, as well as test trading ideas on any platform. TD Ameritrade’s recently launched Android app isn’t quite as powerful as the iOS apps, but it has most of the features, including customizable charting.

The most powerful platform in the suite, especially for options traders, continues to be thinkorswim, which came to TD Ameritrade via the 2009 acquisition. It can be personalized. Options statistics display where orders are executed relative to the bid and ask price, which can give you clues to future price movements. Most screens in thinkorswim include a button labeled share, which lets you post to any social-media site a link to the chart, watch list, or news item you’re looking at. If you share with another thinkorswim customer, the entire screen is duplicated on that person’s desktop.

TD Ameritrade’s revamped Website was rolled out slowly in order to avoid shocking established customers, but the more modern layout makes finding features much easier. It uses a grid framework and -includes a consolidated search function that can locate anything, from ticker symbols to tips on using a particular piece of technology. Most functionality can be accessed from a single screen. There’s no need to click through multiple menus.

Educational programs are a real strength at TD Ameritrade, which organizes them by topic. They include a variety of high-production-value videos that are arranged into playlists. As you watch these playlists, you earn points that can be swapped for books, commission-free trades, and other interesting stuff.

TD Ameritrade has a huge customer base, and continues to try to serve everyone, from mom-and-pop investors to hedge funds to Gen Xers and Millennials, who are used to engaging visual experiences.

TradeStation (tradestation.com ) continues to lead the way for frequent traders who like to develop their own strategy. Version 9.5 of the downloadable platform features added horsepower for strategy testing and optimization, designed to speed calculations considerably. Speed tests run on the new platform show many calculations executing in about one-quarter the time of the previous release.

The firm announced last month the opening of the TradingApp Store, which allows TradeStation developers to share and sell their analysis applications and other add-ons to the platform. You can find proprietary TradeStation apps as well as those written by third-party developers on the TradingApp Store, making the downloadable platform very flexible. Just announced is the Bollinger Bands Toolkit; you can attend a Webinar featuring author and market professional John Bollinger on March 19 at 4:30 p.m. ET.

Investors with $100,000 or more in their TradeStation account have the $99.95/month platform fee waived, making these tools accessible for less-frequent traders. For those wanting to trade all over the globe, TradeStation has added numerous futures products as well as access to international exchanges and forex products.

The mobile apps have been updated as well; the displays on the iPad app can be as detailed as you’d like. The charting features on the iPad are extensive and include most of the technical indicators you’d find on the downloadable platform. TradeStation’s Web-based platform, which was very basic until recently, has been significantly improved and made very customizable. This platform is still heavily analytical, and may be too much for the casual trader.

OptionsXpress (optionsxpress.com ) focused on its mobile platforms over the last year, integrating its All-in-One Trade Ticket across all available devices. You can also trade three- and four-leg options strategies, and use the firm’s Walk Limit order type to enter spread orders and save some money on the transaction.

The Walk Limit now allows customers to choose the start price, end price, and price increment as well as the amount of time the order rests on each price point, from two to 60 seconds, before moving. Overall adoption of the product continues to grow — especially for spread and single leg traders, says CEO Joseph Vietri. Walk Limit has become a customer favorite as we see continued usage month over month among our options traders, he notes.

OptionsXpress has had a feature called Trading Patterns on its Web platform for the last decade. It showed what others who were trading the equity you’re analyzing also bought. The idea was like online shopping tools that tell you what you might want to buy based on what’s in your shopping cart. This functionality has now been extended to options trading, and gives customers insight into the highest-volume calls and puts for their favorite symbols.

Following its acquisition by Schwab in 2011, the OptionsXpress integration into the Schwab platform continues apace, with the goal of pulling the two platforms completely together in 2015. Though most of the technology benefits are flowing into the Schwab platform, optionsXpress customers can take part in free 60-minute sessions with a trading specialist to get a thorough personalized platform walk-through. Streaming charts were enhanced with symbol comparison charting and additional volatility time calculations.

OptionsHouse (optionshouse.com ) made numerous enhancements to its alerting capabilities, which now work like following a Twitter feed. If you click Follow when looking at a particular ticker symbol, you’re prompted to enter the sort of alert you’d like, which can be price changes or even a technical event. You control the delivery channel of each alert by specifying e-mail, text, a pop-up if you’re logged in, and others. When the alert fires, you can create a trade ticket directly from the pop-up, which can be extremely helpful if your alert was set to take profits or stop a loss. These alerts even work on options spreads.

CEO George Ruhana says, Historically, alerts have been bolt-on products but we are making them a core piece of the platform. He sees devices being connected through alerts, and extensive use of mobile devices with this technology. Extensions to alerts will include portfolio and account alerts as well as changes to the firm’s proprietary Risk Scores, so stay tuned.

As its name suggests, this broker devotes a lot of resources to options analysis. The Risk Viewer gives you a look at what will happen over time to a spread. Calendar events, including dividends and other corporate actions, are reflected in watch lists and portfolios, so you can quickly see what’s coming up that will affect your investments. The Trade Generator lets you find possibilities based on strategies and your market outlook. This sort of tool can be extremely helpful if the bull market fades and turns bearish.

TradeKing (tradeking.com ) is growing by acquisition. In 2013, TradeKing took over the assets of GAIN Securities smoothly, having picked up some experience in a previous purchase, of Zecco. Much of their work over the last year was behind the scenes, including some major technology infrastructure changes such as upgrades to all of the firm’s hardware, software and network gear. CEO Don Montanaro says, The result of these changes positions us to be more efficient and scalable as our customer base grows.

TradeKing will roll out more client-facing features in 2014. Like other brokers, the development strategy will start with the mobile platforms and then be extended to the desktop. The goal is to create a single user experience, no matter how the customer is accessing TradeKing’s capabilities. We are big believers in this strategy, Montanaro says, and it will be interesting to see how the rest of the industry responds to this growing trend.

TradeKing has assembled a TradeKing User Group, which currently numbers just north of 2,000, to help plot the roadmap to the future and plan new features to launch this year. One piece of feedback already implemented is a refresh of the Account Summary page including the ability to view only your options positions.

Fidelity (fidelity.com ) recently released Trade Armor, which is integrated into its Active Trader Pro platform, intended to encourage you to develop an exit plan and act on trading opportunities. Additional options analytics have been folded in to Active Trader Pro, along with well-designed probability calculators and volatility tools.

Though Fidelity is always one of our best brokers for long-term investors, it has seriously beefed up its options analysis and trading tools. The firm was a very early adopter of mobile trading, and added streaming market data for all mobile platforms this year. One interesting tool is that you can access the data stream and a great deal of market data before logging into the mobile app, as long as you log in at least once every 30 days. This way you can monitor the markets prior to typing in all those numbers and letters — a very nice touch.

Speaking of long-term investors, Fidelity now offers 65 ETFs that can be traded commission-free as well as thousands of mutual funds. The new Fixed Income Analysis tool makes it possible to forecast cash flow and generate risk statistics. The Online Bond Ladder Tool offers a three-step process for selecting bonds, with a full array of principal and interest charts, risk analysis tools, and educational offerings to prompt you along.

One ongoing issue with Fidelity platforms should be solved shortly thanks to some infrastructure upgrades. The Website and the Active Trader Pro platforms have offered very different experiences, with the mobile platforms offering yet another way to access Fidelity’s tools. The firm is making a serious effort to consolidate these experiences in the next year or so. Some integrations have already been made, such as conditional trades on Active Trader Pro, which were only available on the Website previously.

E*Trade (etrade.com ) also has emphasized its mobile apps, which include a variety of screeners, mini options, and additional news sources such as S&P MarketScope and Barrons.com’s parent, Dow Jones. The app for iPhones and Android phones provides more than 50 educational videos that offer information for novice, intermediate, and experienced investors.

Responding to customer requests, the firm added the ability to trade from charts to its Pro offering, as well as six new technical studies. You can also attach custom notes to charts, which should help remind you why you’re using a particular study. Pro users can also take advantage of the integration of forex trading functionality into the platform.

On its Website, E*Trade is testing a new navigation scheme that will simplify getting around, but it wasn’t fully launched in time for this review; it will, however, reduce the multiple mouse clicks now needed to shift from one function to another. Another welcome enhancement is a real-time margin-analysis tool, which lets you test what will happen to your buying power in advance of a trade. The education area includes timely topics with instructional material, investment ideas, and links to tools that include Fixed Income in a Rising Interest Rate Environment and Building a Foundation With Infrastructure Investments. The extensive calendar function shows upcoming events; this will be more useful once customers can filter the calendar based on their current holdings or watch lists.

Much of E*Trade’s updated education offering can be accessed prior to logging in as a customer, so noncustomers can view it as well, which is a good thing.

Merrill Edge (merrilledge.com ) is rolling out the red carpet for its Preferred Rewards customers, giving free stock trades to those who consolidate their assets with the firm. Those with $100,000 or more in assets with Merrill can make 100 free equity or ETF trades per month, which is factored into Barron’s cost calculations. (This benefit is currently offered in five states, but will soon be available nationally.) The rewards start to kick in at the $20,000 asset level; those with $50,000 in their Merrill accounts receive 30 free equity/ETF transactions.

The gamification trend, which assigns benefits to customers as they bring in assets or complete educational tasks, is one that Merrill is embracing to appeal to the next generations of investors. Simplicity, intuitive design and immersive user experience common in gaming frameworks are themes we’re very focused on and believe will be an evolutionary catalyst for the industry going forward, says Alok Prasad, who heads Merrill Edge. One gamified experience is Merrill’s Face Retirement feature, which is available outside the customer login. You are prompted to start saving and investing for retirement by seeing what you will look like several decades in the future. Prasad sees room for additional innovation in the mobile arena, especially with wearable technology.

Merrill has made a huge effort to combine banking and brokerage experiences through its relationship with Bank of America. Merrill customer service reps in BofA branches number over 2,000, and the firm is adding more as quickly as it can.

The Market Pro platform, which provides streaming data and charts, is being fleshed out with quarterly updates and research-house Recognia’s software that analyzes technical patterns in the market. The Strategy Builder lets you concoct screens for investments based on both fundamental and technical events; the results are ranked based on how closely they fit your criteria. This tool is a bit misnamed as the results are all equities; I usually associate the word Strategy with options trading. Trading defaults that you set on your desktop carry over to your mobile devices, which is a nice touch.

Charles Schwab (schwab.com ) has borrowed a great deal of technology from its subsidiary optionsXpress to enhance the options-trading capabilities of StreetSmart Edge, which has also been updated to include personal touches such as choices of colors and fonts. One welcome enhancement is the ability to roll an options strategy with a single mouse click. A CNBC video feed as well as Schwab’s market commentary are available on all Schwab platforms, including mobile.

StreetSmart Edge now includes the All-in-One Trade Ticket, which makes placing any kind of trade incredibly easy. Other options-oriented improvements include enhanced options chains and position views as well as better pairing of complex options in order to reduce margin requirements. Watchlists now persist from desktop to mobile so you only have to build your list once.

Schwab offers the largest number of commission-free ETFs — 119 in all. Its education center was designed with the idea of helping people synthesize all the information they’re getting from various sources. You can attend a Trader’s Lunch every Thursday and take part in a technical analysis question-and-answer period. The education offerings have been reorganized around trading paths, with the goal of moving clients from information to execution.

We are seeing an ongoing effort to streamline the investing experience on all the Schwab platforms, which can only help.

Scottrade (scottrade.com ) reworked its infrastructure and recently relaunched the ScottradeElite platform. A key feature is a very customizable watchlist, which can display a variety of technical and fundamental data fields. Drag-and-drop functionality lets you set the columns in whatever order you’d like. The news stream can be sorted by symbol, and the charting capabilities have also been enhanced.

The platform includes a proprietary sector-momentum indicator that lets you know whether a particular market sector is a potential buy or sell. You can start with an overview and then drill down to individual stocks to find trading possibilities. You can plot this proprietary indicator on the enhanced charts, too. Other trade analysis tools include Recognia’s Intraday Trader and the NASDAQ Velocity and Forces tool. The firm has created an Active Trader help desk in the last year that supports the Elite platform, as well as options-trading and margin calculations.

For options analysis, you can customize the display of strikes and expiration dates, and a variety of volatility calculations have been added to the display. You can still trade only single-leg options on Scottrade.com as well as the Elite platform; for multi-leg analysis and trading, you have to log in to the separate OptionsFirst platform, which is powered by OptionsHouse.

This new Elite platform is a big improvement on its predecessor. We look forward to later this year when multi-leg options trading will be available as an integrated experience.

Lightspeed Trading (lightspeed.com ) is aimed at very frequent traders, hedge funds, and those who automate their trading strategies. Its clients execute a huge number of trades relative to the size of the customer base; many of the features we consider useful for retail traders are just not a concern for these institutional traders. Chief Operating Officer Mike Sedek says Lightspeed is fifth overall in terms of DARTs (Daily Average Revenue Trades), because it focuses on giving professional traders technological advantages, especially when it comes to executing rapid-fire trades.

Lightspeed Trader, the firm’s downloadable trading package, can be extensively customized in its current version (8.0.35). Each window on the screen can be populated with a widget, which can be repositioned and resized as needed. The options chains window, for instance, can be set up to display just what you want to see in terms of Greeks, volume, and prices. You can link the options chains to Level 2 options quotes as well; the depth of market displays is nicely formatted. In addition, you can direct your equity and options orders to any available exchange; utilizing the Lightspeed smart router will sweep dark pools for liquidity as well.

The firm’s Web-based trading platform was originally pretty basic, but Lightspeed has worked to recreate the downloadable platform experience. Real-time streaming data are available as well as several tools for generating trading ideas. You can’t choose where to route your order on the Web because this platform isn’t meant to be used by the hyperactive trader, but it’s a reasonable introduction to the firm’s capabilities.

There is no mobile trading app for Lightspeed as Sedek says his firm’s professional trading customers are usually at their computers all day anyway. The lack of mobile capability hurts them in our rankings, but may not be important to the customers Lightspeed seeks.

Livevol (livevol.com ) is the most recently launched broker we covered. It was an options-analytics platform starting in 2009, but can now be used to put on trades. Livevol’s 80-plus live market scans, which can be customized, helps you identify potential trades, especially options spreads. The options montage, which is the focus for most of the firm’s customers, lets you play around with implied volatility so you can build your own model of an option’s price.

The options charting capabilities of this platform are extensive, especially if you’re a volatility junkie. The proprietary scanner involves hypothetical 30-day, 60-day and 90-day volatility; historical volatility is displayed for every optionable security. After setting up a watchlist, you can check out time and sales for all of those items, customizing the list to filter out the orders you don’t want to see (such as very small ones).

Since Livevol executes its trades through Interactive Brokers, you can use IB’s mobile apps to check on your account, but some of the analytics specific to the Livevol platform are not available.

SogoTrade (sogotrade.com ) is undergoing a change. As of Jan. 1, a group led by Jonathan Yao, formerly the manager of Scottrade Asia, completed its acquisition of SogoTrade. The firm plans to focus on global expansion, especially serving customers in China who want to invest in the U.S. markets. CEO Yao believes that due to the recovery of the U.S. economy and the withdrawal of the Federal Reserve’s quantitative easing program, more international money will enter the U.S. market, and there will be more demand for U.S. investments from international investors.

In an effort to maintain the firm’s low commissions, Sogotrade offers its customers a book of 20 trade tickets for $60; those who make more than 50 trades per month are automatically charged $3/trade. For clients who only trade occasionally, commissions are $5 per transaction. You still have to call a representative to make mutual-fund transactions though.

There are two ways to trade with Sogotrade: its Web trading platform, which is quite basic, and its SogoElite platform, which features real-time streaming data. It includes a couple of interesting forecasting tools, the Market Forecaster and the Equity Forecaster, which are designed to help you plan your entry and exit points for stocks and options. Customers receive three months of free access to these tools; the fee is $20/month once the free trial is over for those who trade less than 20 times per month.

Capital One Sharebuilder (sharebuilder.com ) has phased out its former subscription model and is now charging flat $6.95 transaction fees. The brokerage services are also very tightly integrated with the Capital One banking capabilities, making it simple to transfer funds. If you don’t have a Capital One account and want to fund a transaction quickly, you can transfer cash from another source for $6.95 if it’s not in your Sharebuilder account at the moment.

One feature that Sharebuilder offers that we wish was more prevalent is the True Equity Exposure display. This is especially useful for those holding mutual funds and ETFs who want to make sure they’re diversified. It shows the number of shares of, say, Microsoft (MSFT) you actually own if it’s part of any fund in your account.

Sharebuilder’s iPad app is customizable, and you can even open a new account from it. The company’s customers tend to skew younger than many of the other brokers surveyed, and about 20% of its transactions take place via mobile devices.

eOption (eoption.com ) is a low-cost broker catering to (you guessed it) options traders. It converted its clearing operation in August to First Southwest (from Apex) and has affiliated with Scivantage and Interactive Data for technology platforms. There are two Web-based platforms available, with streaming data supplied by MarketQ. Unfortunately, you can’t yet trade from the MarketQ site, which launches in a separate window from the regular Web-based platform.

You can personalize the dashboard page a bit by rearranging the items and moving the elements around. The data is exportable to Excel for additional analysis. The mobile app is very basic and not customizable.

If you are primarily concerned with costs and not that interested in technology, eOption is extremely inexpensive. We would like to see more there there, to paraphrase Gertrude Stein.

TradingBlock (tradingblock.com ) spent much of 2013 building out features for its network of independent advisors, so there wasn’t much new to see for the self-directed investor.

On the Web, customers can use the TradeBuilder feature, which takes into account your outlook for a stock or ETF, and generates up to 40 possible strategies, ranked by profit and loss as well as probability of breaking even or making a profit. The Portfolio Hedger feature lets you scan for strategies to protect an existing stock or ETF position. These strategies can be ranked by cost or upside potential.

The EdgeFinder is a feature available in the firm’s downloadable software platform, which runs at least $199 per month. This tool is a real-time scanner that includes a proprietary calculation called Edge, which looks at whether a contract is trading above or below the bid or offer. EdgeFinder can help find mispriced contracts, which could mean more profitable trades.

TradingBlock does not yet have a mobile app, however.

Kapitall (kapitall.com ) is hurt in the rankings by serving only customers who have cash accounts and by trading only stocks. In 2013, it focused on enhancing the user experience rather than adding asset classes, though it did add mutual funds. Options are a focus for 2014, so we expect to have more to report next year.

While Kapitall doesn’t yet have a mobile app, it’s working on both Web-enabled TVs as well as game consoles. We’ll keep an eye on these guys.