FRMI Duration Tutorial Master the Art of Calculating Duration Convexity

Post on: 16 Март, 2015 No Comment

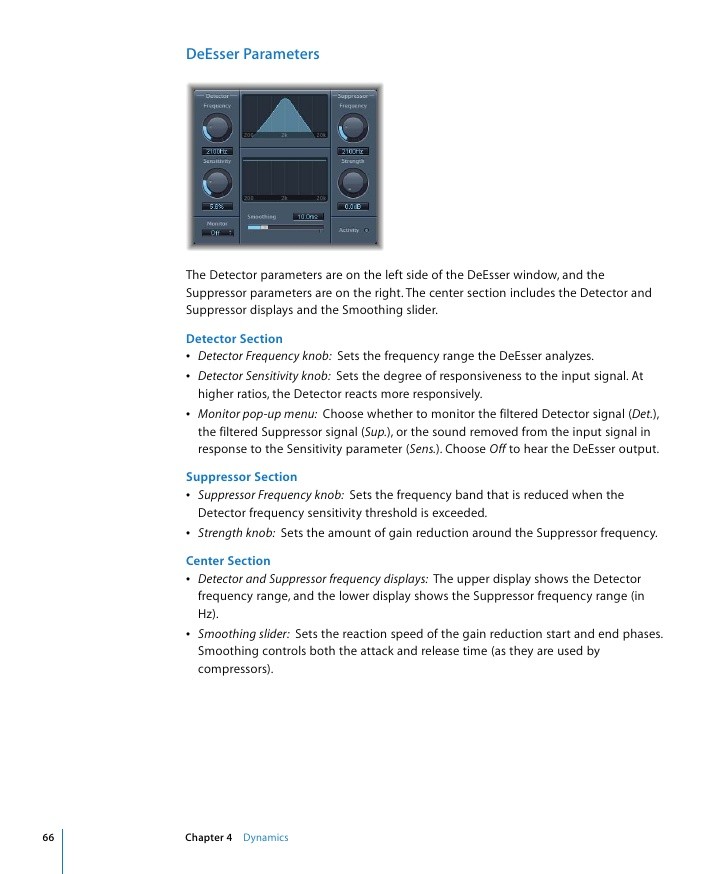

Attend Repeat Telecast of the same webinar

Risk management practices, in the wake of the financial crisis have become a need rather than a luxury. One important type of risk is the interest rate risk. One sudden change in the interest rates can be potentially devastating to many financial institutions. This is because the value of fixed income securities like bonds depends on the interest rates i.e. the yield apart from the coupon rate and time to maturity.

Fortunately, one can estimate to a fair degree of accuracy the change in the value of a bond given a change in the interest rate. This estimate can be used either to reduce/increase exposure to interest rate sensitive investments or to hedge out the interest rate risk by matching the interest rate volatility of assets to that of liabilities. This can be done using sensitivity measures such as — Duration, Convexity and Key Rate Analysis.

In this article, we will cover the Duration and Convexity measure. Duration concept is also highly testable in exams like the CFA Program and FRM.

Duration

Duration is the most widely used interest rate sensitivity measure for bonds because it captures the bond’s interest rate volatility based on the yield, time to maturity and the coupon in a single measure. Duration has three main variants:

Macaulay Duration: Simply ‘duration’ can be defined as the average time it takes for a coupon payment of the bond. Here the average is a weighted average and not the simple arithmetic mean. The weight for each coupon period is determined by dividing the present value of the payment in that period by the present value of all payments which is the bond price.

To understand this concept clearly, consider a zero coupon bond of par value $100 which matures in 5 years. Here there is only one payment of $105 that occurs at the end of 5 years. The present value of the payment is nothing but the bond price.

So, the Macaulay duration of a zero coupon bond maturing in five years is 5 years. Although it’s misleading that Macaulay duration can be expressed in terms of years, it’s still a sensitivity measure which is nothing but the derivative (rate of change) of the bond value with respect to interest rate(yield) interpreted as below.

A 1 basis point change in interest rates will lead to a change of 5 basis points in the price of a zero coupon bond maturing in 5 years!

We can generalize this concept and apply it to coupon paying bonds also. The formula is given below;

The equation seems complicated and can put you off, but no need to worry! It’s nothing but the weighted average time taken for each payment including the last principal repayment; where the weight is present value of the payment divided by bond price.

To understand this, consider a $100 par-value bond which pays a coupon of 5% semi-annually and matures in 2 years. The yield or the interest rate is 4% per annum. The calculation of duration as per the above formula is included below. You can also build your own Excel (in attachment and will be given to students attending webinar) sheet quite easily.

As per figure 1.0, the duration of the bond is 1.87. So according to definition, any change in interest rate should reflect 1.87 times in the change in bond price.

Let’s put this definition to test by raising the interest rate by 10 basis points which should lead to approximately 10×1.87=19(approx) basis point change in bond price.

As highlighted in the figure 1.1, the change in price of the bond is 20 basis point which is estimated by the duration with fair amount of accuracy as 19 basis points.

You can join our free Webinar to understand the concept of Duration in more detail

The next logical question could be ‘Is this relation between bond price and interest rates positive or negative?. As evident from figures 1.0 and 1.1, the relationship is negative, which means an increase in the interest rate (yield) will lead to a decrease in the bond price and vice versa. This is demonstrated as duration effect and is given below.

Duration effect: Duration effect captures both the direction and magnitude of change in bond price due to a change in yield.

Modified Duration:

Modified duration is very similar to Macaulay duration, but improvises by discounting the Macaulay duration back by one payment time period. For example, if the bond is a semi-annual bond, the Macaulay duration should be discounted back by six months using the current yield.

Applying this to previous example where m=2 (semi-annual), y=4% and Macaulay duration=1.87

We get Modified duration of about 1.833 which is not so different from Macaulay duration.

Limitation of Duration:

Duration works only for small changes in the yield. When the change in the yield is high, say 200 basis points, duration becomes inaccurate due to the convexity effect.

Convexity

Duration assumes a linear relationship between bond price and yield, which is not true especially when there is high volatility in yields. Convexity takes off where duration stops in a sense that it gives a more accurate price of a bond based on interest rate changes than Duration.

The formula for measuring convexity is:

T he second term in the above equation is the second derivative of the bond price and yield functions. The first derivative measure that is duration measures how price changes with yields, while second derivative is a measure of changes in the first derivative with changes in the yields.

The relationship between yields and bond prices is more of a curved line rather considering a straight line as estimated by duration.

This curvature in bond price can be best estimated when we combine Duration effect and the Convexity effect which results in a more accurate price of the bond.

The different types of duration and the convexity will be discussed in more detail in our free Webinar on Master the art of calculating Duration & Convexity and its effect on Bond prices.