Four finance giants still wallow in debt The Boston Globe

Post on: 16 Май, 2015 No Comment

E-mail this article

NEW YORK — Even as the biggest banks repay their government debt in what is being heralded as a successful rescue program, four troubled giants of the financial world remain on government life support.

These companies, American International Group. Fannie Mae. Freddie Mac and GMAC, are not only unable to repay the government, they are in need of continuing infusions that make them look increasingly like long-term wards of the state.

And the total risk they pose to the taxpayer exceeds that of the big banks. Fannie and Freddie, in the final days of the year, are even said to be negotiating with the Treasury about greatly expanding the money available to them.

Though the four are not all in the same businesses, they were caught in one of the same traps: They sold mortgage guarantees — in some cases to each other. Now when homeowners default, as they are doing in record numbers, these companies are covering the losses. Essentially, taxpayer money to these companies is being used partly to protect banks and other investors who own the mortgages.

Like the big banks, these four companies would no doubt prefer to be free of government assistance, which comes with pay and other restrictions on their executives. But they appear at risk of getting onto a debt merry-go-round, where they have to draw new money from the government just to keep up with their existing government debts. Fannie Mae recently warned, for example, that it could not pay the dividends it owes the Treasury, so future dividend payments will be effectively funded with equity drawn from the Treasury. All the companies have recently drawn fresh money from the government or are in talks to do so.

Capital commitments from the Treasury do not capture the full scale of government aid. The government has also bought mortgage-backed securities and guaranteed corporate bonds, while the Federal Reserve Bank of New York has made an emergency loan.

Timothy F. Geithner, the Treasury secretary, welcomed the repayment plans from Citigroup and Wells Fargo this week, saying the actions by the biggest banks mean taxpayers are now on track to reduce TARP bank investments by more than 75 percent. That means that of the $245 billion awarded to banks, more than $185 billion is either recovered or is about to be.

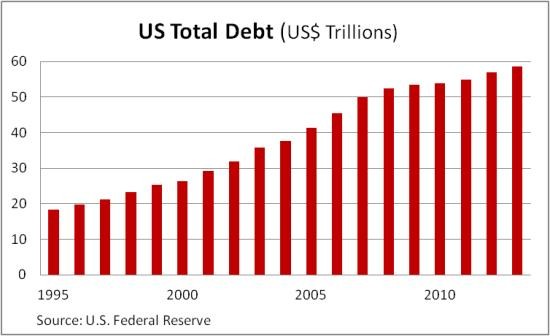

But that is just a fraction of the money the four troubled debtors have received or may still get. Together, they have been offered nearly $600 billion, and that lifeline could climb to nearly $1 trillion if the commitment to Fannie and Freddie is doubled, as some predict. Whats more, the companies seem short on strategies for going it alone.

A spokeswoman for GMAC said the company has made all its scheduled dividend payments to the Treasury, as has Freddie Mac. Fannie Mae has said it will have trouble paying its dividends; AIG does not have to pay them.

A spokeswoman for AIG said the insurance company is committed to repaying taxpayers, but repayment will depend on market conditions. A Freddie Mac spokesman said the company depends on continued support from the Treasury to stay solvent.