Forex Trading Positioning According to Bond Spreads

Post on: 17 Апрель, 2015 No Comment

Positioning According to Equity Market Movements

Positioning according to bond spreads

This lesson will cover the following

If you have any questions or suggestions you are welcome to join our forum discussion about Positioning According to Bond Spreads .

In the previous article we discussed the role of commodity price changes as a leading indicator for currency movements, and more particularly for commodity-based currencies. In the current article we will turn our attention toward bond spreads and how a trader can interpret changes in bond spreads in order to predict the appreciation or depreciation of a currency relative to a counterpart.

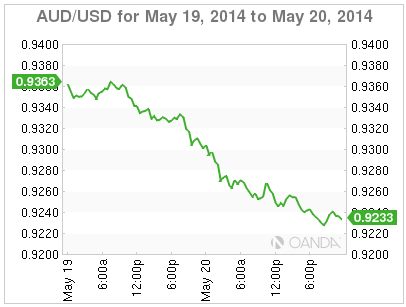

When it comes to Forex trading, the interest rate differential is the difference between the interest rate on the base currency (in AUD/USD, the AUD) and the interest rate on the quote currency (the USD). When a central bank alters interest rates, this affects its currency both in the short-term and long-term. However, the impact from the banks decision is not limited only to the national currency, but also affects its crosses across the board. Thus, if a major economys central bank decides to use this monetary tool in order to steer the economy in a desired direction, this would echo through the entire Foreign Exchange market. We have spoken a lot about the Federal Reserves role on the global economic scene and we know what kind of volatility is experienced before, during, and after the Federal Open Market Committees meetings where policy makers make decisions regarding interest rates and the pace of bond purchases under the Quantitative Easing program.

Leading indicators

Grasping the relation between rate differentials and currency pairs can yield substantial return, which is why traders use fixed-income instruments such as 10-year bond rates as leading indicators for currency fluctuations. In case you have missed it, leading indicators give an insight into future developments so that you can base price change predictions on them with a relatively high degree of confidence. Whether a leading indicator acts as such generally depends on how the majority of traders interpret it and whether they think it has more significant implications for the future state of the market compared to the current one. In our case, if rate differentials are perceived by the general public as indicative for future currency fluctuations, they will be regarded as leading indicators. The alternatives are to be a coincident or lagging indicator.

In general, however, interest rate differentials are deemed leading indicators. Because most investors are actively seeking higher profits, both individual and institutional traders will be constantly redirecting capital from lower-yielding currencies to higher-yielding ones. Thus, it is important not only to be aware of the central banks current rate decisions, but also to be informed on the expected rate changes and their timing in order to anticipate fluctuations in currency crosses. However, it is worth taking into consideration that because currency movements are influenced by a large array of economic data (economic indicators, macroeconomic events, central bankers speeches), the correlation between interest rate differentials and currency fluctuations is not perfect and is best used in the long term as spikes caused by scheduled economic releases are ironed out.

Carry trades

As a currencys yield spread relative to its counterpart increases in its favor, more and more investors will purchase that currency in order to benefit from the higher return. Based on the supply-demand principle, the higher demand for this currency would imply that its value will appreciate against its trading peers. One of the main fixed-income instruments used for determining in which currency to invest are the long-term government bonds, particularly the 10-year ones.

For example, if the New Zealand 10-year government bond yield is 4.5%, while the 10-year US government bond yield is 1.5%, then New Zealand has a 3% bond spread yield in its favor, or 300 basis points. If New Zealand was to raise interest rates, which would boost yields as well to, say 5%, this would additionally heighten demand for the New Zealand dollar and it would be expected to appreciate against the US dollar.

The best way to frequently utilize this trading strategy and keep track on everything is by entering the data required in spreadsheet software. You need to have different columns for the base currencys interest rate, the quote currencys interest rate, the interest rate differential (calculated by subtracting them) and the responding currency pair. When you do that for a large enough period of time, you will notice the correlation between the elements.