Foreigners shift focus to Turkish insurance sector 21 March 2007

Post on: 16 Март, 2015 No Comment

Foreign interest in Turkey has mostly focused on Turkeys’ banking industry in the last five years, but it is now shifting toward insurance and other financial service firms.

Many analysts believe that this will increase product diversification and the price of insurance premiums.

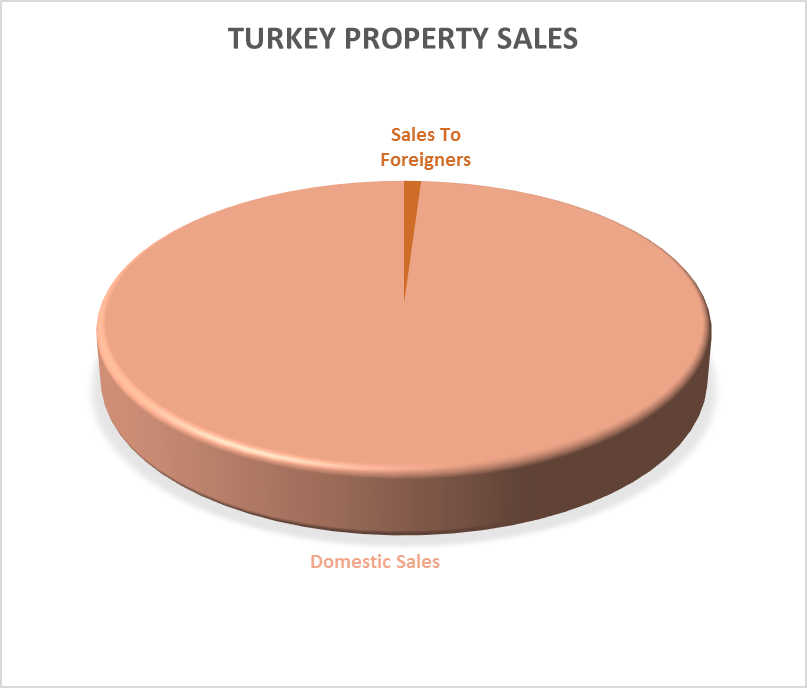

The foreign share in the insurance sector has already exceeded 70 percent, and two recent developments exemplify the mobility in the industry. Following Spanish Mapfre’s recent takeover of Genel Sigorta, Austria’s TBIH Financial Services Group purchased 58.2 percent of the Doğan Group’s Ray Sigorta for $81.48 million Monday. According to the written statement sent to the İstanbul Stock Exchange by the Doğan Holding, the group will continue to own a 20-percent share in Ray Sigorta.

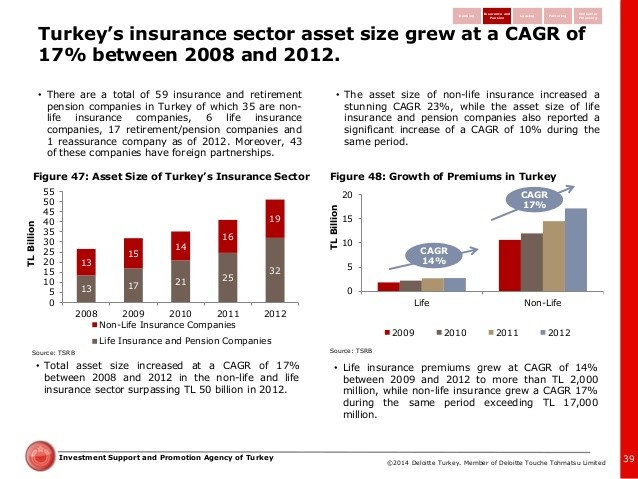

Analysts within the sector believe that foreign insurance giants, which entered Turkish markets in 2006 and paid more than $500 million for mergers and acquisitions, strengthened the financial infrastructure of the companies within the sector. Claiming that the Turkish insurance sector was still in its infancy, analysts note that mergers and acquisitions will keep continuing in the short and middle terms.

Turkey’s insurance industry is seen by many as a rising star, especially due to expectations of more stability after elections, which will bring interest rates down. Analysts say that Turkey’s young population and its market structure open to development are very attractive for foreign investors. Seventeen companies in the sector currently either have a foreign partner or are completely foreign owned. The market has reached its saturation point in the West already. In Turkey, however, insurance companies will earn much from crops on farmland, goats in the mountains and cats on the streets, said an official from an insurance company.

Recep Ko+�ak, general manger of Işık Sigorta, said foreign companies are comparing Turkey’s premium production rates, young population and basic macroeconomic indicators with those of developed nations. Noting that selling new insurance certificates has been extremely hard in Europe, Ko+�ak said: Every aspect of life in Europe is surrounded by obligatory insurance. Turkey, on the other hand, is a developing country. It seems as a new and highly profitable market. According to Ko+�ak, who emphasized that big developments will emerge in liability insurance, the number of certificates covering harm to third parties by other persons or institutions will see a big increase. For example, an insurance certificate will be created to cover the harm that somebody’s cat could cause on others.

Although the sector is introduced with new products every day, individual insurance is still in its infancy, Ko+�ak said. He also claimed that traditional agriculture insurance has not met with warm welcome from the customers at the beginning, but following the state’s support up to 50 percent of the premium interest has risen.

Ertuğrul Bul, general manager of TEB Sigorta, said the sector is growing two and a half times faster than Turkey’s GDP and has the strongest infrastructure after banking sector. But despite the country’s rapidly growing economy, the premium production in Turkey’s insurance sector is 10 times lower than EU countries, Bul noted. There is a huge opportunity and a bill for a new mortgage system that recently passed in parliament and will come into effect by 2008 will provide the sector with a boom in the long run. Parallel to the boost in the construction sector, banks will incline toward insurance more to hedge the risks of themselves and their customers.