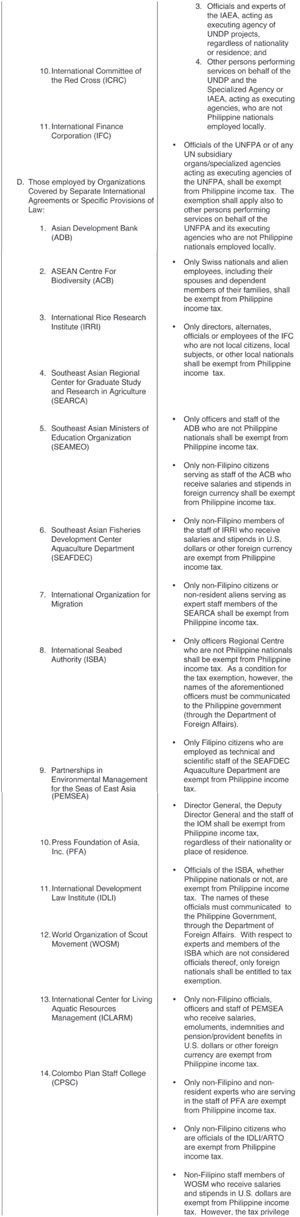

Foreign Governments and Certain Other Foreign Organizations

Post on: 16 Март, 2015 No Comment

Foreign Governments

U.S. investment income earned by a foreign government is not included in the gross income of the foreign government and is not subject to U.S. withholding tax. U.S. investment income means income from investments in the United States in stocks, bonds, or other domestic securities, financial instruments held in the execution of governmental financial or monetary policy, and interest on money deposited by a foreign government in banks in the United States.

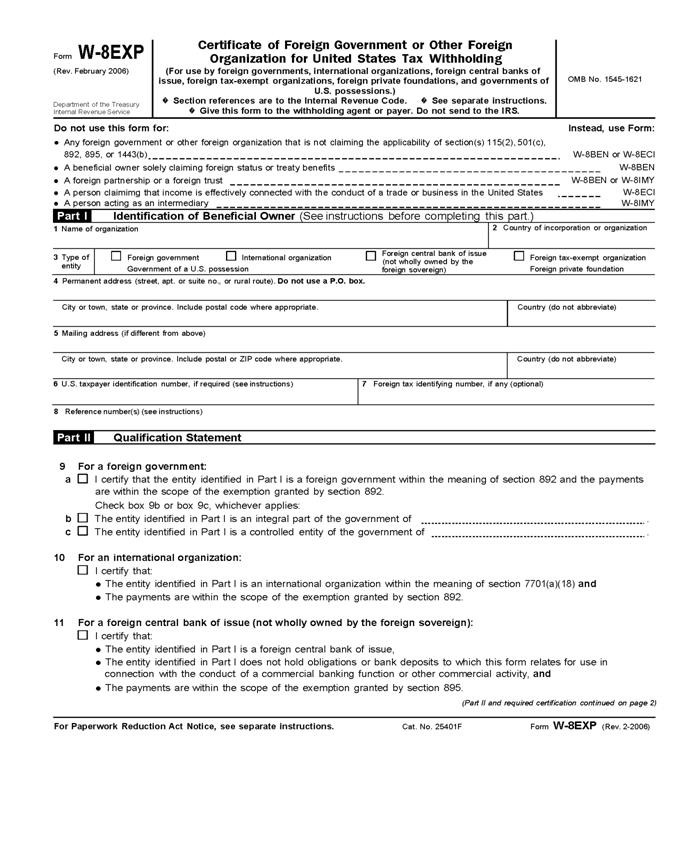

A foreign government must provide a Form W-8EXP (Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding) or, in the case of a payment made outside the United States to an offshore account, documentary evidence to obtain this exemption. Investment income that is paid to a foreign government is subject to reporting on Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding).

Income (including investment income) received by a foreign government from the conduct of a commercial activity or from sources other than those stated above, is subject to nonresident alien (NRA) withholding. In addition, income received from a controlled commercial entity (including gain from the disposition of any interest in a controlled commercial entity) and income received by a controlled commercial entity is subject to NRA Withholding .

If the foreign government is a partner in a partnership carrying on a trade or business in the United States, the effectively connected income (ECI) allocable to the foreign government may be considered derived from a commercial activity. For more information regarding foreign governments receiving income from the conduct of a commercial activity and income as a partner in partnerships carrying on a trade or business in the U.S. refer to Proposed Treasury Regulations REG–146537–06 (IRB 2011-48, Page 813) (PDF).

If the ECI from the partnership is considered derived from a commercial activity, the ECI allocable to the partners is subject to withholding under Internal Revenue Code (IRC) section 1446. Refer to Partnership Withholding .

A government of a U.S. possession is exempt from U.S. tax on all U.S. source income. This income is not subject to NRA withholding. These governments should use Form W-8EXP to get this exemption.

International Organizations

International organizations are exempt from U.S. tax on all U.S. source income. This income is not subject to NRA withholding. International organizations are not required to provide a Form W-8 or documentary evidence to receive the exemption if the name of the payee is one that is designated as an international organization by executive order.

Foreign Tax Exempt Organizations

A foreign organization that is a tax exempt organization is not subject to a withholding tax on amounts that are income unrelated to business taxable income. However, if a foreign organization is a foreign private foundation, it is subject to a 4% withholding tax on all U.S. source investment income.

For a foreign tax-exempt organization to claim an exemption from withholding because of its tax exempt status, or to claim withholding at a 4% rate, it must provide you with a Form W-8EXP (Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding). However, if a foreign organization is claiming an exemption from withholding under an income tax treaty, or the income is unrelated business taxable income, the organization must provide a Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding) or Form W-8ECI (Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States). Income paid to foreign tax-exempt organizations are subject to reporting on Form 1042-S .

References/Related Topics

Note: This page contains one or more references to the Internal Revenue Code (IRC), Treasury Regulations, court cases, or other official tax guidance. References to these legal authorities are included for the convenience of those who would like to read the technical reference material. To access the applicable IRC sections, Treasury Regulations, or other official tax guidance, visit the Tax Code, Regulations, and Official Guidance page. To access any Tax Court case opinions issued after September 24, 1995, visit the Opinions Search page of the United States Tax Court.

Page Last Reviewed or Updated: 07-Jul-2014