Floating rate bonds

Post on: 24 Апрель, 2015 No Comment

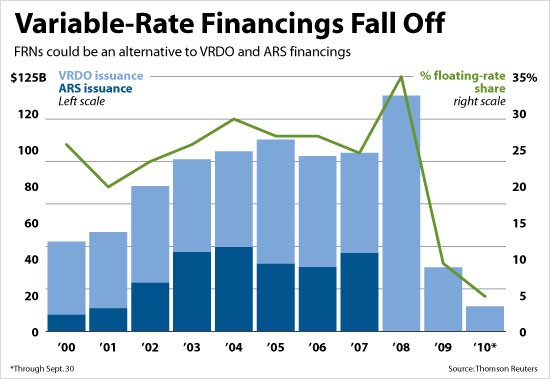

Floating rate bonds (also known as floating rate notes or floaters ) are securities which offer interest rates that periodically reset to changes in a representative interest rate index. These securities were created during the volatile bond markets of the 1970’s. Floating rate bonds are issued in both the U.S. and international debt markets. At the close of 2010, the US floating bond market was valued at $500 billion. The financial sector is the largest issuer of floating rate debt in the U.S market (see Fig.1.)

Contents

Structure

Floating rate bonds possess the following features:

- Base index. The interest rate of a floating rate bond is determined by a floating reference rate, such as the prime rate, the fed funds rate, the LIBOR (London Interbank Offered Rate) or other benchmark interest rate. [1]

- Yield spreads. Yields are usually defined at a certain spread over or under the referenced benchmark index, such as the t-bill rate plus 40 basis points, or the prime rate minus 240 basis points. [1]

- Reset periods. The reset period determines how often the interest rate will be adjusted. The reset rate may be reset daily, weekly, monthly, quarterly, semiannually or annually, depending on the terms of the bond or the characteristics of the benchmark index. [1]

- Day count periods. Floating rate bonds count the number of days in an interest payment period by utilizing either a 30/360 convention (assumes 30 day months for a 360 day yearly period), an actual/360 convention (assumes the actual days of each month for 360 day year), or an actual/actual convention (using the actual days in both days and a year). The convention used will be defined by the bond issuer. [1]

- Payment periods. Interest payments on floaters may be made monthly, quarterly, semiannually or annually. [1]

- Maturity. Floating rate bonds can be issued at any maturity. [1]

Performance characteristics and risks

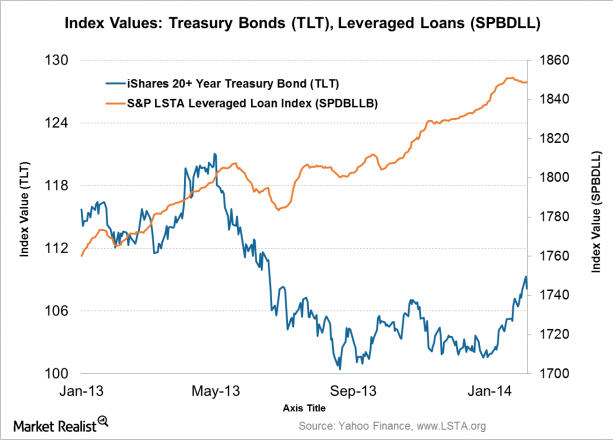

According to a Vanguard Research white paper, A primer on floating rate bond funds. [2] floating rate bonds are subject to three major risk factors. These include interest rate risk, credit risk, and liquidity risk. The paper also examines the correlation of returns with other asset classes; the correlation of returns with inflation; the performance of floating rate bonds during periods of rising interest rates; and the portfolio effects of including floating rate bonds in investment portfolios. The paper measures floating rate bond returns using the Credit Suisse Leveraged Loan Index.

Interest rate risk

Due to the interest rate reset structure of floating rate bonds, the sensitivity of the bonds to interest rate changes is low. Morningstar reports that the average duration of floating rate bond funds is 0.45 years. [2] Floating rate bonds with longer reset periods may be more vulnerable to interest rate and price volatility. [1]

Floating rate bonds are also subject to spread duration [3] Basically, spread duration approximately measures the change in a floating rate bond’s price with changes in credit spreads. The price movement will be approximated by multiplying the change in the yield spread times the spread duration. Thus if a floating rate bond has a spread duration of 2.0 and the credit spread widens by 100 basis points, the bond’s price will decline by approximately 200 basis points. In May 2011 the duration of the Barclays Capital U.S. Floating Rate (US FRN) Note <5 Years Index was 0.14; the spread duration was 1.8. [4]

Default risk

Floating rate bonds are usually issued by companies that are below investment grade status. The average credit quality of floating rate bond funds is BB — B. Default rates over the 1997 — 2010 period reflect the higher credit risk:

Default Rates:

- Investment grade bonds 0.1%

- Senior floating rate loans 3.8%

- Speculative bonds 4.9%

However most floating rate bonds have senior claims in a company’s capital structure, meaning they have the first claims on corporate assets during default. Over the 1997 — 2010 period floating rate bonds had recovery rates of 70.3% during defaults as compared to 35.03% recovery rates for all subordinated debt. [2]

Liquidity risk

Floating rate bonds are unlisted securities. The market is small compared to the broad bond market, and not as liquid. For example, during the 2008 financial crisis, liquidity dried up in the floating rate market, resulting in declines in bond prices and negative total returns. [2]